We are a week away from the Fed's first meeting of the year, and as it stands, they will be contemplating a 10-year yield that has gone from 1.45% to 1.90% since they last met (a month ago!).

It has translated into a sliding stock market: Rates up, lower valuations on the high growth (especially no EPS) stocks.

The Nasdaq index, full of the much-loved "companies of the future," is down 8% to open the year.

The question is, what would make the Fed baulk on the guidance it's given to exit emergency policies? It's a question that markets have been conditioned to ask. After all, we've seen an about-face more than once from the Fed, in the years emerging from the financial crisis. Lower stocks has equated to a Fed response (a lifeline).

Consider this: They began rate liftoff in December of 2015, with the guidance of four rate hikes through 2016 - only to pause, and return back to damage control just a month after the first hike.

Will it happen this time? The short answer, no.

As we discussed yesterday, the policy error from the Fed emerging from the financial crisis, was acting too soon. The policy error now, acting too late, too slow.

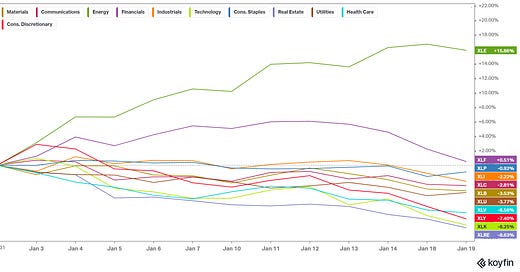

We can see the difference in these two environments through the sector performance in this recent decline in stocks. In a sea of red (from the sector level), financials and energy are green on the year. Energy is up, as a result of undersupply in a hot economy with hot demand. Financials are up, as a supplier of credit, winning from a hot economy and prospects of more profitable lending.

Bottom line, post-financial crisis is not an analog for post-pandemic.

Of course, an easy differentiator is the $5 trillion in new, excess liquidity added to the system over the past two years. That has slowly turned the tide in what has been a long bear market in commodities, into a young secular bull market in commodities.

With that, let's revisit this chart we've looked at many times in my Macro Perspectives notes...the commodities/stocks ratio.

As you can see, commodities are coming out of a roughly 12-year period of significant underperformance, relative to stocks. In fact, commodities haven't been this cheap, relative to stocks, in 50 years.