“No asset class or investment has the birthright of a high return. An asset is only attractive if it’s priced right.”

Welcome to 2024, there’s good* reason to think 2024 should be a pretty good year . . .

* Gryning will expand to provide Long form Macro Views with actionable trade idea’s, alongside an Anti-Constrained Portfolio - outright, alpha seeking, with a view to market beating, trade idea’s. Stay tuned!

2023 - The Year of AI and the Magnificent Seven…and the Rebound

The stock market had a strong recovery in 2023 (+24.6%) after declining (-18.2%) in 2022. Including dividends, the S&P 500 is now +3.5% over the past two years.

These returns are due mainly to the performance of a very small group of tech stocks known as the Magnificent Seven: Apple (AAPL), Alphabet/Google(GOOG), Amazon (AMZN), Meta Platforms (META, formerly Facebook/FB), Microsoft (MSFT), Nvidia (NVDA) and Tesla (TSLA). This group contributed roughly 60% to the S&P 500’s gains in 2023.

The bond market also bounced this year +6% after its worst year ever (-13%) and its first back-to-back negative years (2021-22). 2023 was headed for the third record negative year through October but rallied into positive territory with the 10-year treasury falling from 4.99% to 3.89%.

Looking at the individual stocks in the S&P 500, 10 companies had gains in excess of 100%. Most of these stocks were clobbered in 2022, and a handful have not only recouped their 2022 losses but surged ahead: PHM, RCL, NVDA, PANW, and AVGO.

Putle Homes (PHM) was the biggest winner among this group (above) over the past two years but +85.3% does make the 2 Year Top Ten (it came in at #14) where FICO takes the cake at +169% and Marathon Petroleum (MPC) +141% at #2:

The biggest losers in 2023 were: SEDG, ENPH, FMC, MRNA, DG, PFE, EL, PAYC, ETSY, and AES (range: -30% to -65%).

The End of The Easy Money Era

The easy money era that prevailed from 2009-2021 is over. Some argue we will not see a prolonged zero interest rate policy (ZIRP) nor the sustained use of quantitative easing (QE) as monetary policy tools during the next recession. The Fed has hiked the Fed Funds rate to 5.25% - 5.50% from 0% - 0.25% over the past two years. This is the fastest pace ever. The Fed is reducing its balance sheet and the money supply is pulling back and likely to be on trend by end of 2024.

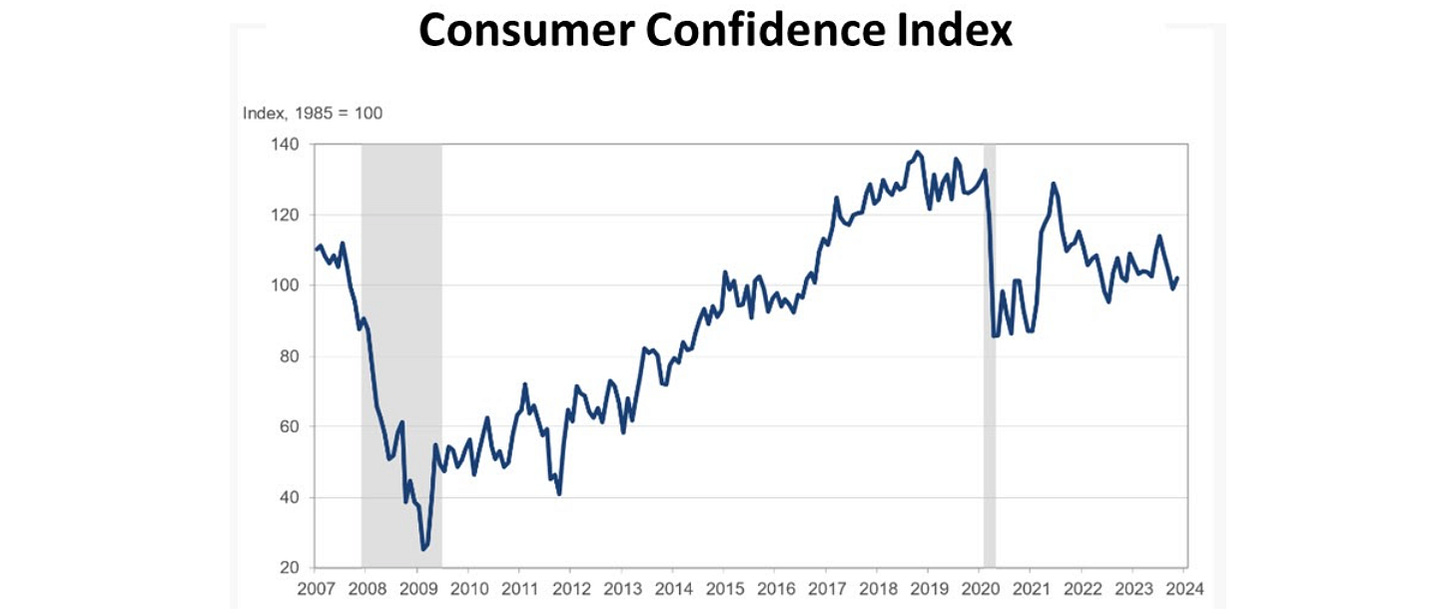

Low Consumer Confidence and Sentiment

Despite the bounce in stocks, higher net worth, and low unemployment, consumer confidence and sentiment are low. Confidence is off the lows but remains significantly below pre-pandemic highs. Factors include persistently high inflation, negative real rates, wavering trust in institutions, record-level debt, and geopolitical conflicts.

A chart of University of Michigan Consumer Sentiment over the past 15 years is also weak, actually weaker.

With interest rates higher and home prices higher, the cost of owning a home has effectively doubled. Housing affordability is at the lowest level in four decades.

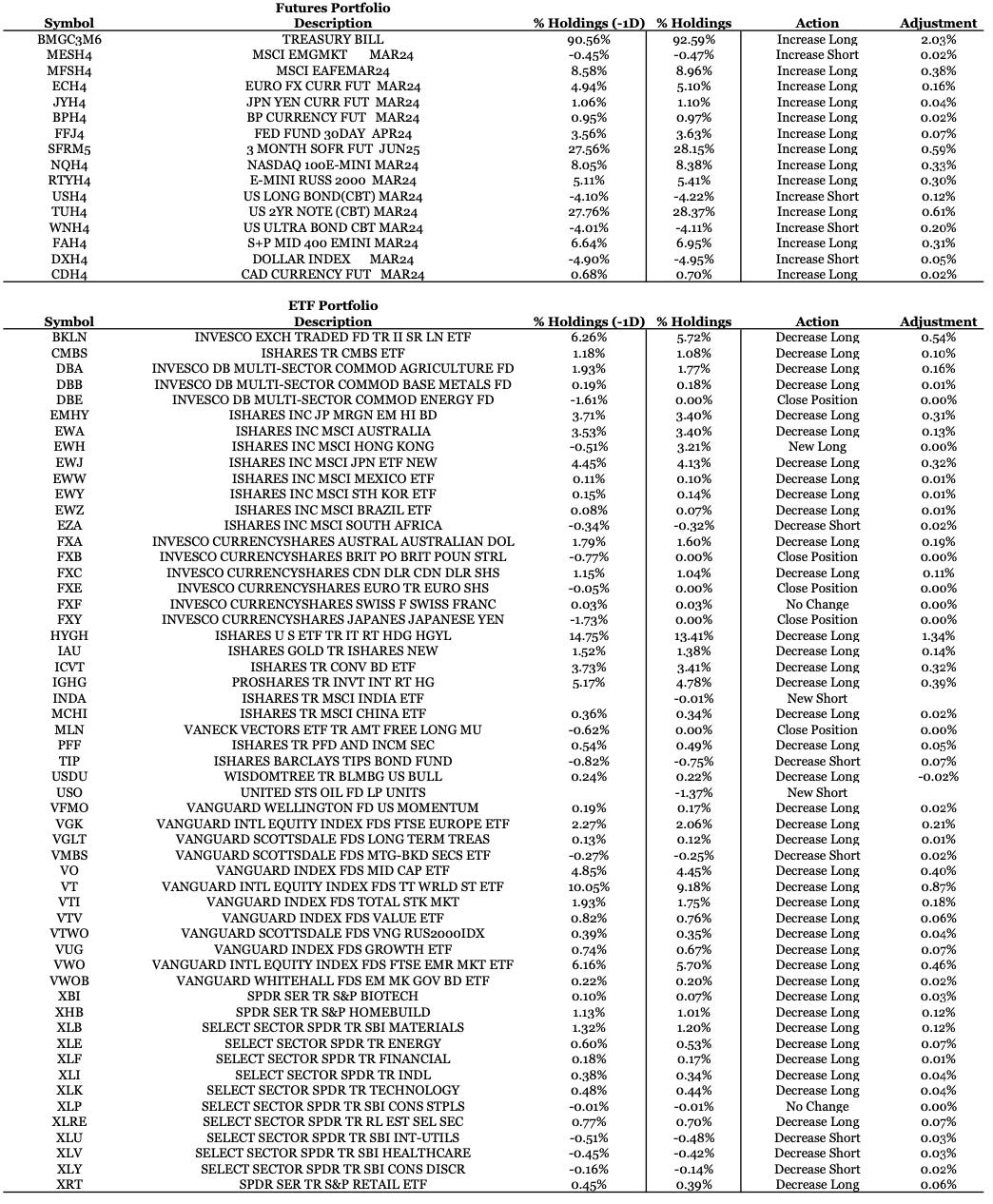

Guided Portfolio’s: