Just when you thought the political landscape couldn't get crazier, it has, with the opening of a Supreme Court Justice seat.

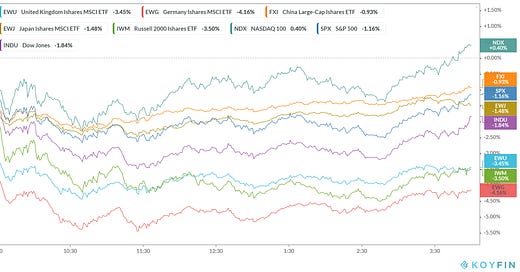

Markets were broadly lower yesterday (global stocks and commodities) on the idea that more fiscal aid is NOT coming, because of the (even uglier) partisan war that will now transpire over a new Justice nomination and confirmation.

I've discussed that another package wasn't coming anyway - the democrats lost their leverage last month, when Trump used executive order to extend the federal unemployment subsidy. That federal unemployment check was the bargaining chip that the democrats were relying on, to force republicans to submit to nationwide mail-in voting legislation, "because people shouldn't have to risk their lives (i.e. risk getting Covid) to vote." When Trump stripped the unemployment check out of the negotiations, the deal was dead - the dems lost their path to mail-in voting.

With this in mind, for markets, does the uptick in political chaos mean there is more risk in markets today, than there was last week. No.

Even if that were not true, knowing that the Fed is in full backstop mode (and will be there for a long time), the dip in broad stocks should be bought.

Stocks are important to promoting confidence, stability and wealth. If stocks were to get messy (i.e. a quick and "disorderly" decline), we know exactly what the Fed would do - they would outright buy stocks.

In fact, they will do anything and everything to preserve stability and to preserve the recovery - and to protect the trillions of dollars that have been spent to manufacture that recovery.

As a proxy on broader stocks, and broader risk appetite, this is probably an important chart to watch in the coming day(s).

A sustained break here would project a move to the 96.20 and late July gap area - that would be giving back all of the gains of big tech's (including Apple's) monster Q2 earnings, where it was revealed just how stacked the lockdown economy deck was in favor of the big tech monopolies.

Housekeeping News: As we come into a pivotal part of the year, in an effort to better grasp market sentiment, risk appetite and sector rotations, I will be releasing our Volatility Model signals on the broader market, covering; XLB, XLE, XLF, XLP, XLU, XLV, AAPL, BAC, GE, JPM, MSFT, WMT, SPX, QQQ and IWM.

Overtime I may add into the watchlist and am happy to try to accomodate any requests, although for sake of “clean” data and reliability of the model, the focus will stricktly be on US equity.

Lastly, to the subscribers and those that follow me on twitter, I appreciate and thank you for our interaction.