The election results in France on Sunday provided continuity for the globally coordinated social and environmental agenda. That was good for the stability of the European Union, and the euro - and it should have been positive for broad market stability.

But, then we had this other big issue looming as we headed into the weekend: China.

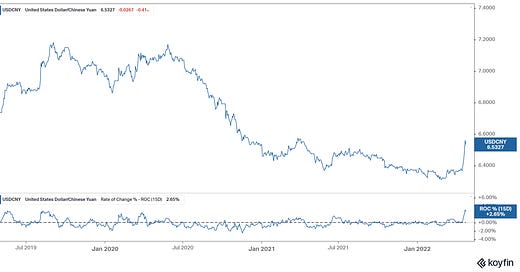

China has been devaluing the yuan (their currency) in a way that looks very similar to August of 2015, and they made the biggest adjustment (weakening the yuan) Sunday night. Additionally, the central bank in China cut the reserve requirement ratio, to encourage lending and borrowing.

So, the developed market world (led by the Fed) is tightening money, and China is easing.

Why?

Because the Chinese government is locking down their economy again. It started late last month, has worked its way through Shanghai, and now it looks like they will lock down Beijing.

We are seeing similar imagery to what was being circulated through global media/social media back in January and February of 2020. It was propaganda, and it worked to spread fear throughout the world. Like last time, we are seeing (again) images of authorities in hazmat suits "disinfecting" the streets, and (this time) barriers erected around residents to keep them in.

The promoted policy being enforced by the Chinese Communist Party is "zero covid.” Let's hope the political leaders in the developed world don't attempt to follow China's lead again on this one (i.e. "zero covid").

However, as we discussed last month, when the lockdowns re-started in China, the market behavior suggested that investors believe there is political appetite for more lockdowns (in the Western world).

At the depths of the decline to yesterday, the stocks that were UP were stocks that thrive in a lockdown: Zoom ended up finishing the day up 2.2%, DoorDash was up 3.4%, Roku was up 4.1%, and Docusign finished up 4.3%.