US equities closed higher on Friday, marking a fourth consecutive session of gains.

The S&P 500 rose 0.7%, the Nasdaq gained 1.1%, and the Dow added 20 points.

Alphabet shares climbed 1.5% after beating earnings estimates, announcing its first-ever dividend, and revealing a $70 billion stock buyback plan.

Tesla surged 9.8% after new self-driving car rules were unveiled.

This weeks Commodity Chartbook from GRYNING | Trader (available to members every Monday)

The starting point for headline news last week was highly negative.

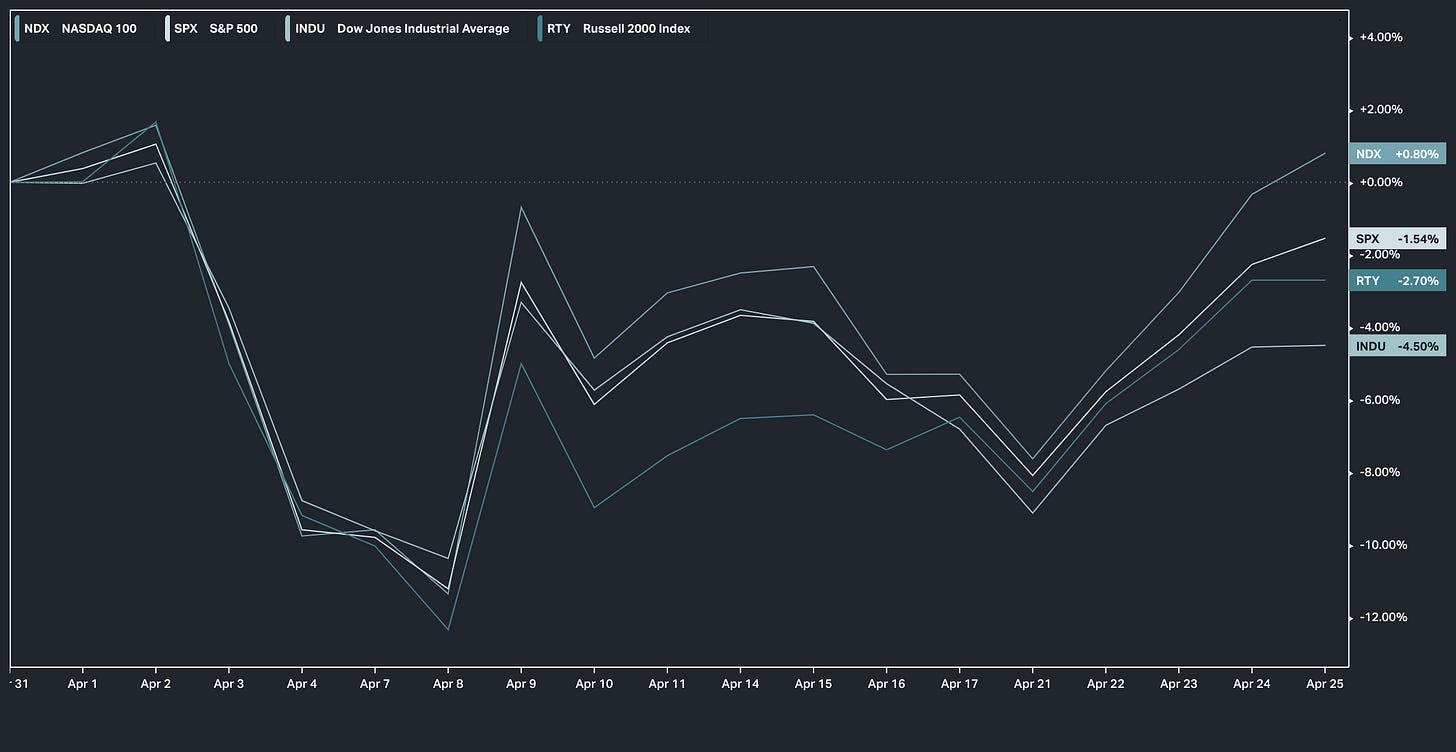

The S&P 500 fell 10.5% over April 3-4, which is one of the worst 2-day stretches in modern history (75 years); Motley Fool, 4/20/2025

The S&P 500 had the worst performance since inauguration day for any new president dating to 1928; Bespoke Investment Group, 4/22/2025

The Dow Jones Industrial Average is set to have its worst April since 1932; WSJ, 4/22/2025

“Powell’s (Federal Reserve Chairman) termination cannot come fast enough!”; Donald Trump, 4/17/2025

On Tuesday and Wednesday, the news flow pivoted to the positive.

Donald Trump said he has “no intention” of firing Jerome Powell before his term at the Federal Reserve expires; Donald Trump 4/23/2025

Trump says China tariffs will “come down substantially” suggesting a U-turn in policy; CNN, 4/23/2025

White House is “closing in” general agreements with Japan and India; Politico, 4/23/2025

Treasury Secretary Bessent expects tariff standoff with China to de-escalate; Bloomberg, 4/23/2025

Treasury Secretary Bessent noted in a speech at the Institute of International Finance that more than 100 countries have approached the U.S. wanting to help "rebalance global trade.” Bessent, 4/22/2025

The percentage of “bulls” in the American Association of Individual Investors (AAII) declined by 60% since the start of the year. Bearish sentiment at the beginning of April was 61.9%—the third highest since 1987. Bearish sentiment in March 2009 and October 1990 were only worse at 70.3% and 67.0%, respectively.

We have just barely lifted off from max bearishness in the past week. The latest reading is 55.6% and the bullish sentiment is 21.8%. A bullish turn in the headlines with a backdrop of intense negative sentiment can create a significant market rally.

Month-to-date, the S&P 500 was down by about 1.5%. This is substantially better than April 08 and now does not rank in the top ten worst April’s since 1950.

As investors, we face the same problem every day: how do we allocate capital to earn a good risk-adjusted return? Despite the regularity with which we must answer the question, every time we sit down to answer it, we must do so in a completely different political-economic context. This is true regardless of investment style or focus.

A subscription to The GRYNING Times aims to reduce the opportunity and very real information costs of maintaining situational awareness within the liquid capital markets universe. Become a member to get the Monthly Global Trend Report, Weekly Commodities Chartbook – both attached above – and daily Trend Reports with potential Trade Idea’s.