We may have hit peak Fed lunacy! Voting Fed member, Jim Bullard, suggested that the Fed Funds rate could need to go as high as 7%, in order to beat inflation.

Keep in mind, the nonpartisan Committee for a Responsible Federal Budget projects for every 100 basis point rise in the U.S. 10-year yield, the U.S. government adds $285 billion annually in interest costs. This adds, materially, to a record, and already unsustainable government debt load.

Of course, the government doesn't have the money. They will borrow it. From whom? Mostly, it will be the Fed that will have to be the buyer of last resort.

When nations finance their own deficit, and therefore expand the government debt bomb (via the Fed or any other central bank), you get more inflation, not less, as traditional holders and buyers exit, and/or just reject it as an investment.

Don't worry, as we've already seen, well before that level (of 7%) would be reached, the global financial system would implode (sovereign debt defaults, currency devaluations and other vulnerabilities within the system would be revealed).

And we don't need to pontificate about outcomes, it's already happened - at just half of the level on the Fed Funds rate that Bullard theorised yesterday.

Conversely, what looks far more likely than a 7% Fed Funds rate? A swing from record inflation, back to deflationary pressures.

By early December, when we see the November inflation report, I suspect we will see a negative monthly inflation number (i.e. a price decline in the month);

Used car prices peaked earlier this year.

Food prices, globally, peaked in February.

The median house price peaked in May.

Rents have fallen for two straight months.

Oil prices peaked in June.

These prices have all been consistently falling since peak levels. There's a difference between deceleration in the rise of prices (i.e. cooling inflation), and a decline in prices (deflation).

The Fed is inducing deflation..

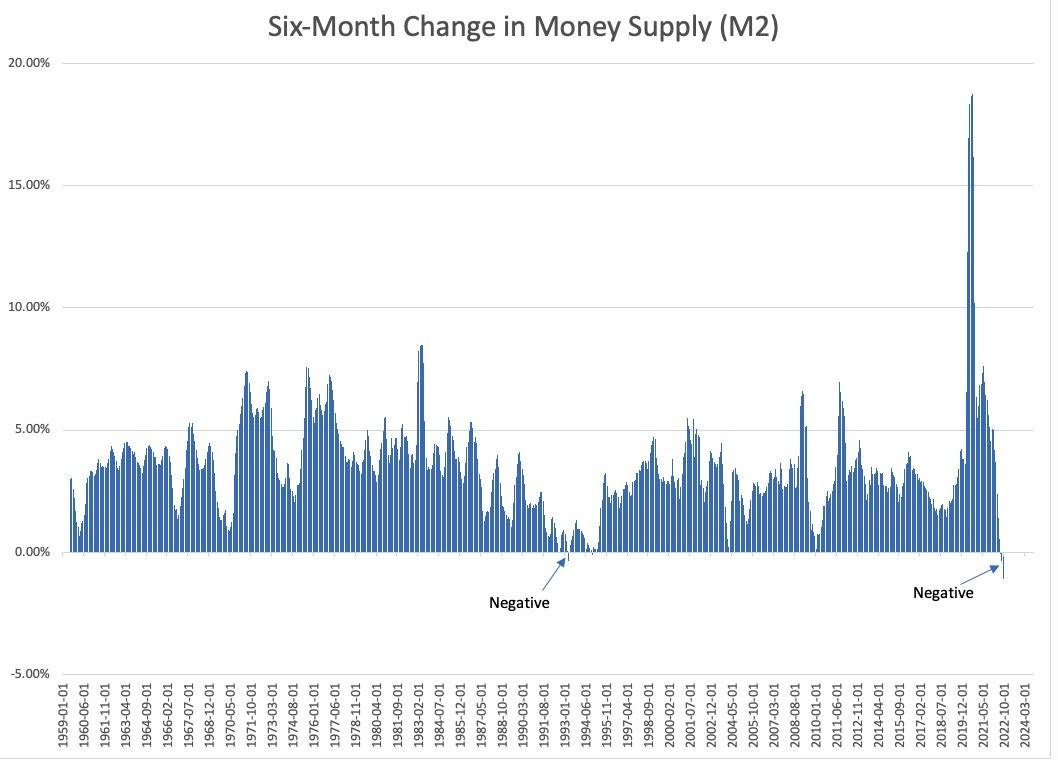

With this in mind, let's take a look at this chart of "six-month change" in money supply...

Money supply is declining, and at the fastest rate on record, going back over 60 years of history. Moreover, as you can see in the chart, a negative six-month change in money supply is highly unusual. It's only happened twice prior to this recent episode ('92 and '93).

Deflation is typically associated with a contraction in the supply of money and credit (the former is happening, the latter not yet).

PS: If you, or anyone you know, are looking for an agnostic read on the financial markets, with actionable insights given the once over by a hedge fund strategy, please share this or alternatively, join The Gryning Times.