On Friday;

Stocks had a good day.

Commodities had a big day (aligning with a big move lower in the dollar).

And the U.S. yield curve steepened - generally associated with a more optimistic view on the economy.

What happened?

My view: Part China. Part midterm elections looming.

China: President Xi is now a couple of weeks into his unprecedented third term. And overnight, at China's International Import Expo, his opening ceremony address was entitled: "Working Together for a Bright Future of Openness and Prosperity."

He said China remains committed to "opening up to the outside world." This is big news (near term), especially if it implies that Xi will begin prioritizing economic growth over covid prevention.

The speech was full of language suggesting China wanted to play nice in the world for "mutual benefit," working with "all countries" to share the opportunities from "deepened cooperation."

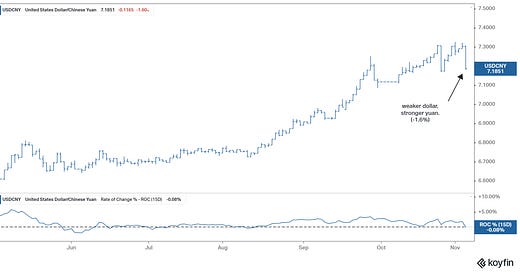

It's global growth positive. And as a signal, Xi (the PBOC) strengthened the yuan on the day (which they control).

A stronger yuan is counter to their economic interest (and policy), where they like to manipulate a weak currency to drive exports. So, again, a stronger yuan on the day was intended to signal alignment with Xi's speech.

U.S. Midterms: Remember, post-midterm elections, regardless of the outcome, are historically good for stocks.

Bancorp did a study on this: Looking back to 1962, stocks (S&P 500) in the 12-months following a midterm election had an average return of 16%.

That's double the long-term average return.

And over these fifteen data points observed (over 60 years), ALL had positive stock market performance for the twelve-month period following the midterm election.

The Gryning Times | Portfolio Update

The results above show the passive - rebalanced monthly - for the Anti-Constrained & Uncorrelated Convexity portfolios. I do not include results from the actively managed portfolio’s, nor those from the ad-hoc Alpha & Beta trade idea’s.

If you want to know more, or alternatively gain access to the above portfolio’s, click below.