Palantir - Its Early...

US stocks closed lower Monday, unable to shake losses as investors weighed strong economic data against trade tensions and the upcoming Fed meeting.

The S&P 500 and Nasdaq slipped 0.6% and 0.7% respectively, with the former snapping nine-day win streaks, while the Dow lost 98 points.

Still, uncertainty persisted after Trump said he has no plans to speak with China’s President Xi, keeping investors cautious.

Energy sector led the decline, followed by consumer discretionary and tech.

Among stocks, Netflix and Paramount each dropped over 1.5%, Berkshire Hathaway slid 5% on news Warren Buffett will step down in 2026, and ON Semiconductor sank 8.3% after issuing a mixed outlook.

We talked last week about earnings of six of the seven AI kings. The seventh, Nvidia comes later this month.

It was two years ago in Nvidia's May earnings call that Jensen Huang shocked the world, declaring "the beginning of a major technology era." He told us there was a "rebirth of the computer industry" underway, where "AI has reinvented computing from the ground up."

He told us there was a "retooling" going on across the economy, the beginning of a 10-year transition of the world's $1 trillion data center, to accelerated computing.

He had the numbers to back it up. They grew revenues by 19% that quarter, from just the prior quarter (!), with the outlook to grow over the next quarter by 52% (shockingly huge).

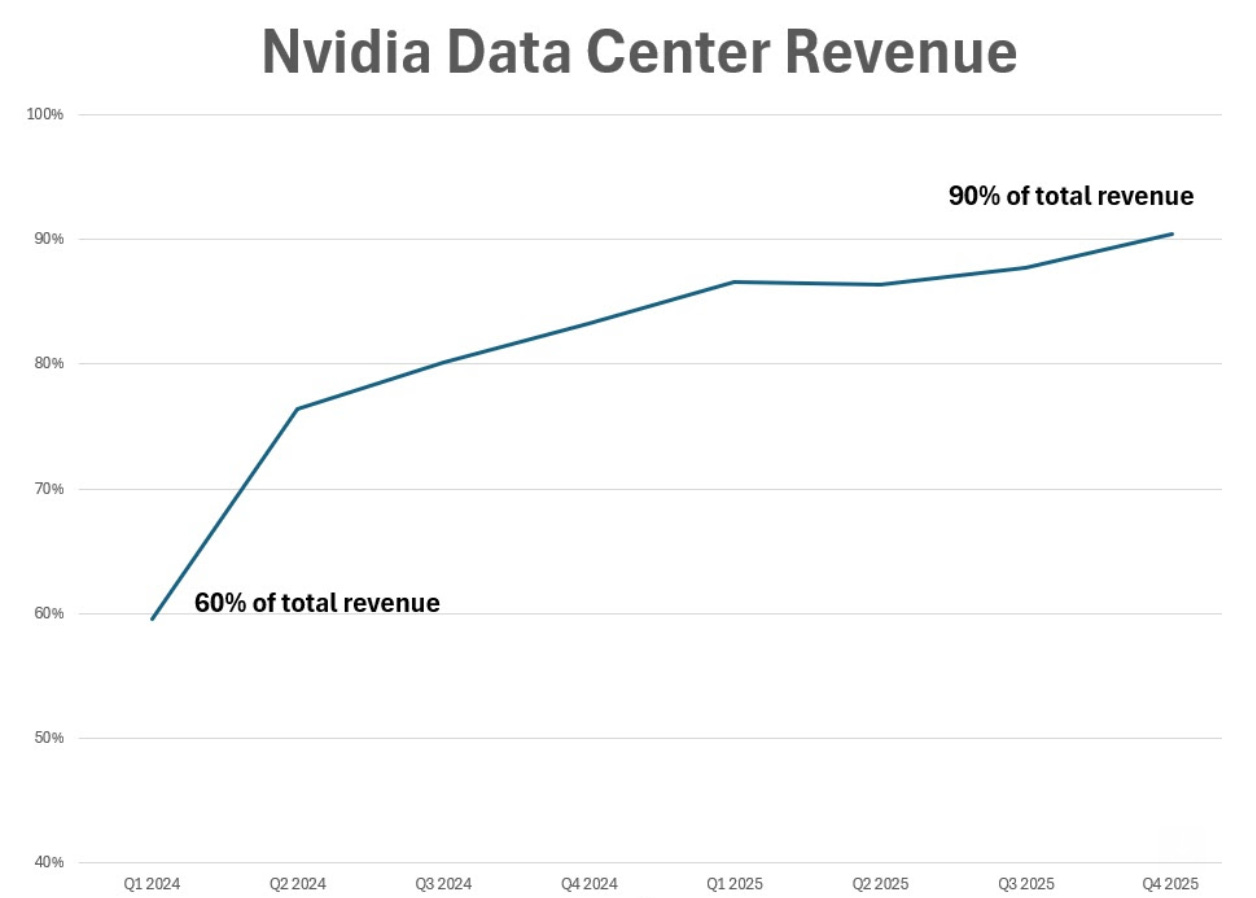

As you can see in the chart, this was the beginning of Nvidia transforming itself into an AI company (growing data center business from 60% of the entire Nvidia business, to now nearly the entire Nvidia business).

With that said, as we've discussed here in my daily notes, while the AI infrastructure boom in demand continues, the Nvidia growth rate is constrained by supply.

Meanwhile, there is another company that is beginning to put up Nvidia like growth numbers after finding a transformational AI strategy within its existing business. It's Palantir.

And it's all about this chart ...

They reported yesterday afternoon - growing U.S. commercial revenue by 19% from the prior quarter, and guiding around 70% year-over-year growth for 2025. That's a doubling of the growth rate for this time last year - so growth is accelerating.

Palantir's new commercial business called the Artificial Intelligence Platform (AIP) has only been in existence for two years, and is just now taking hold, as (mainly U.S.) companies are scrambling to figure out how to integrate generative AI into their businesses.

Palantir has become the dominant player in solving that problem - putting enterprise customers through a short boot camp, which results in a product, and they're into production within weeks.

That translates into multi-million dollar contracts for Palantir. For this stage of the technology revolution (deploying genAI across enterprises), it's very early.

Please find below this week’s 87 page Commodity Chartbook - sent out to members on Monday morning, alongside four bond trade idea’s as picked up by our Global Trend Model. You can access our Monthly, Weekly & Daily reports alongside Trade Idea’s by clicking on the button below.

Global Trend Report Trade Idea(s)

A number of bond ETFs have weekly trend ‘pressure’ points - these points mark the end of trendless periods - according to our model, ahead of the May 6-7 Fed meeting. The model anticipates a significant change in these markets, with an up or down trend to emerge and last several months. If you are directionally agnostic, straddles are likely to perform. On the other hand, since stocks are trending higher, a downward bias in bonds may prove to be fruitful.

The table above is used to track recent Trade Idea’s as flagged by our Global Trend Report. The previously highlighted equity positions (here) are up 36.19% since we alerted members. Become a member to access the Monthly, Weekly, Daily Reports and Trade Idea’s.