US Stocks continued their rally in the afternoon session, after Fed Chair Jerome Powell signalled that interest rate cuts are imminent.

The S&P 500 rose 1%, the Dow Jones gained over 400 points, and the Nasdaq led with a 1.4% increase.

Workday led the Nasdaq with a surge of over 12%, while semiconductor stocks like Nvidia, Marvell Tech, Arm Holdings and GlobalFoundries each climbed more than 4%.

Tesla also jumped 4.5%, benefiting from the prospect of lower interest rates, which could make electric vehicles more affordable through cheaper financing.

For the week, both the S&P 500 and the Nasdaq gained 0.8%, while the Dow rose by 0.6%.

Gross Domestic Product (GDP) is the total value of goods produced and services provided by a country during a period of time, typically one year. When GDP is diminishing, this is often considered a recession - the common definition of recession is two sequential quarters of negative GDP growth.

In a recession, many companies experience declining sales. If these companies are overburdened with debt, they may be unable to make their debt service payments and file for bankruptcy. For bondholders, this risk is called “credit risk.”

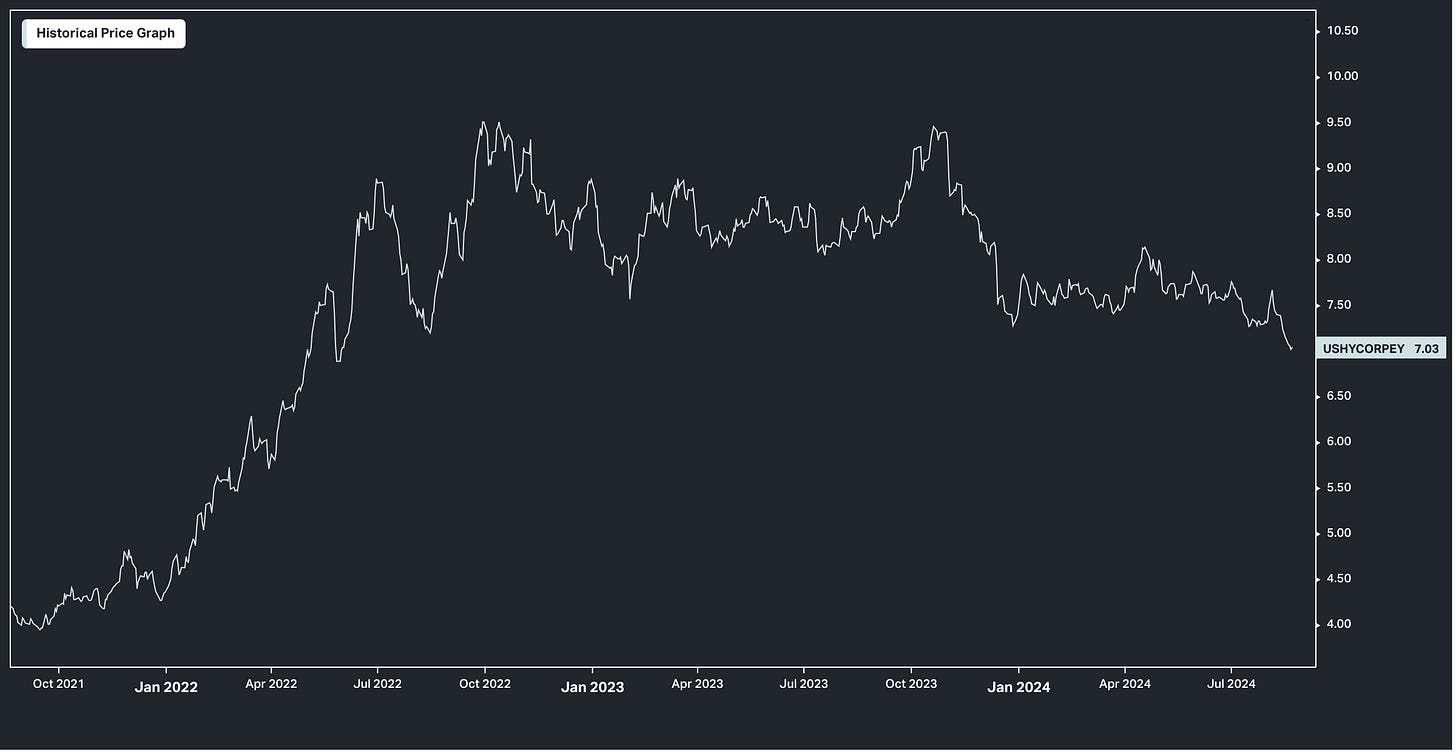

The bond market attempts to price this negative potential outcome (credit risk) in bonds by offering investors higher yields on risky company debt, especially if recession risk is rising. If the risk of recession is declining, risky company debt yields decline and the bond values rise.

Yields on risky company debt (aka: junk bonds, non-investment grade bonds, high-yield debt) have fallen to the lowest level in more than two years.

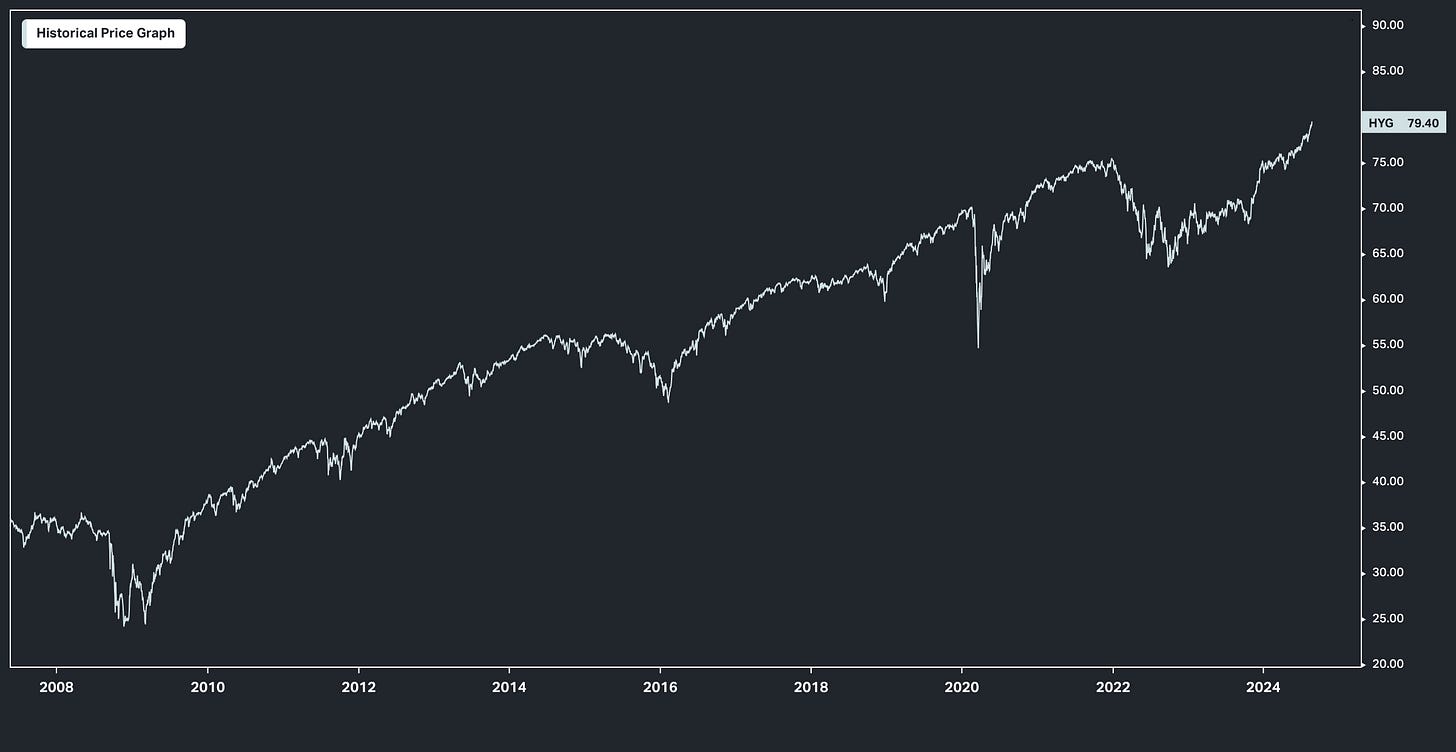

Bond prices move inversely relative to yield. Junk debt valuations are at 12-month highs. The bond market is making it clear that the odds of a recession are low.

Goldman Sachs raised its recession probability for the next 12 months from 15% to 25% three weeks ago. Last week, they pulled their recession probability back to 20%. It would not be a surprise to see them reduce it to 15% in the next couple of weeks.

The ratings agency S&P Global stated that it believes “the speculative-grade (junk, high-yield, non-investment grade) corporate default rate in the U.S. could fall to 3.75% by June 2025." The three factors they point to for this optimistic outlook are;

strong refinancing and repricing activity (especially as the Fed lowers the Fed Funds rate),

resilient earnings,

resilient consumer spending.

No recession and low credit risk through June 2025 makes it likely stocks appreciate over the intermediate term.