One More Time

On Friday, the S&P 500 closed mostly flat, while the Nasdaq gained 0.1%.

The Dow, however, dropped 86 points, extending its losing streak to seven sessions, marking its longest stretch since 2020.

Broadcom surged 24.4%, hitting a $1 trillion market cap after reporting a 220% increase in AI-related revenue, exceeding expectations.

This boost lifted semiconductor stocks, including Marvell (+10.8%) and Taiwan Semiconductor (+5%) which booked strong gains.

The broader market showed mixed performance, with concerns over the Federal Reserve’s upcoming policy decision and economic conditions limiting further gains.

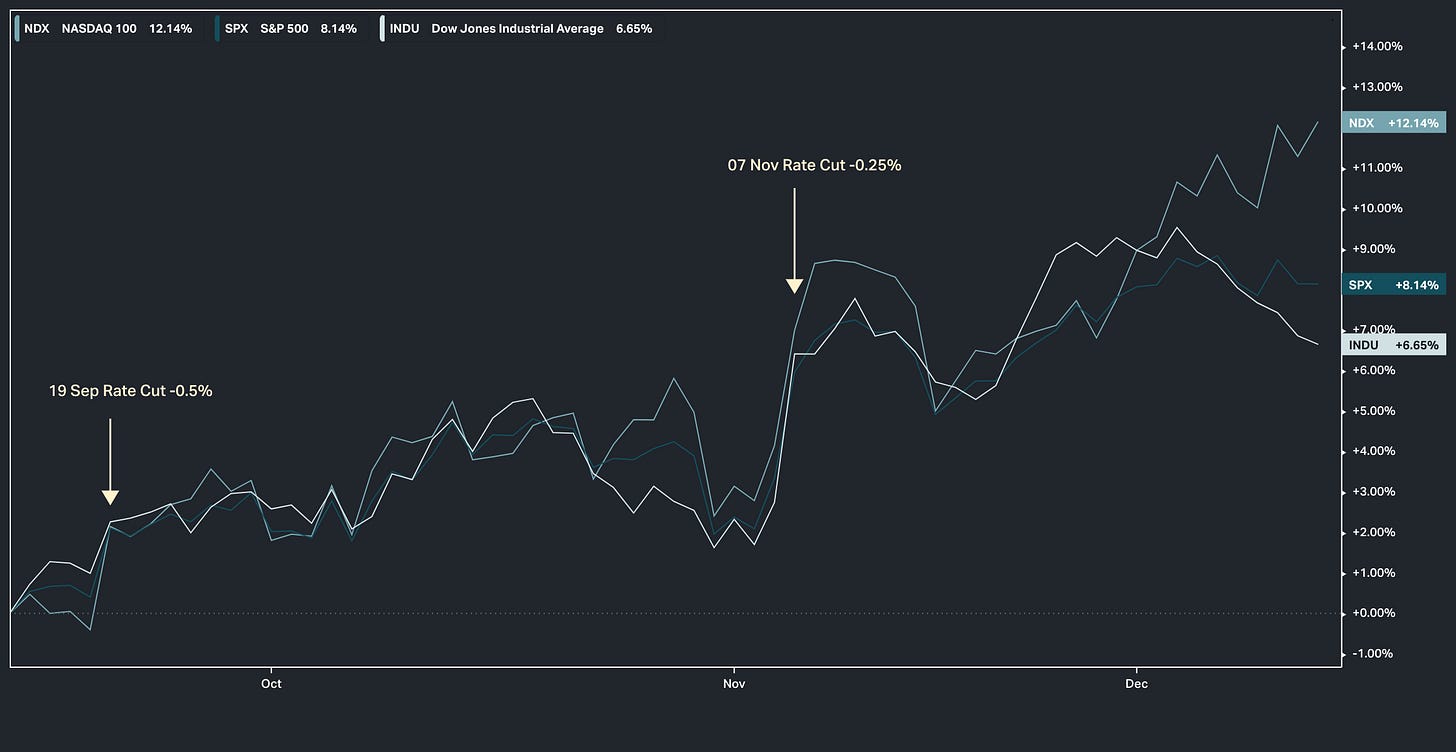

On September 19, 2024, the Federal Reserve lowered the Fed Funds interest rate for the first time in four years by 0.5%. On November 7, 2024, the Fed lowered the rate by 0.25%. On December 18, the expectation is the Fed will lower the rate one more time by 0.25% for a total 2024 rate reduction of 1%.

The Consumer Product Index (CPI – measure of inflation) was up 0.3% month-over-month in November. The year-over-year rate is up 2.7%. This was as expected. Under the surface, the shelter index (rent and owners’ equivalent rent), which had been keeping inflation readings high, showed the smallest increase since mid-2021. Investors believe the slowdown in shelter inflation will factor favourably in future CPI reports.

On the CPI report issued last week, the Fed futures market jumped to a 98% probability that the Federal Reserve will cut the Fed Funds rate by 0.25% this week. All else being equal, a lowered interest rate should be supportive of a Santa Claus rally (a seasonal trading pattern in the final five days of the year and the first two days of the new year).

There is currently $9 trillion of assets in money market funds in the U.S. During 2024, money market funds had $992 billion of inflows, the best inflow year on record. With volatility low and the stock market rising, it is possible some of the money market money moves into the stock market.

Since 1928, the average return of the S&P 500 from December 15 through December 31 is 2.04%. For a granular look, curtesy of Gryning Research, here are the top 10 performing S&P stocks on a 6-month horizon during past FED rate-cutting cycles: