With NATO leaders in Brussels today, the markets are reacting to a likely escalation in what looks like a Western proxy war with Russia.

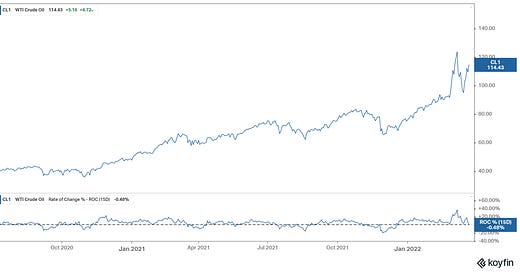

Oil closed at around $114. We should expect to see oil prices much higher (still) - we've been talking about the construct for $100 oil, long before the Russia/Ukraine crisis.

Here's an excerpt from my note a year ago ...

The globally coordinated ’Clean Energy Revolution’ promotes higher oil prices, not lower. That's the structural driver for oil prices. Funding for new exploration has been choked off - foreign oil producers (particularly from bad acting countries) will be in the driver’s seat. That movement is underway and these producers will command/demand higher prices, especially in a less competitive, lower supply world.

As we discussed this dynamic back in February, I said 'get ready for $4 plus gas.' With the monetary and fiscal backdrop that has evolved, and the inflationary pressures already bubbling up, it will probably be more like $6 gas.

It will be self-fulfilling, and yet it will become the justification for the move to "clean energy" (just as high gas prices were in the Obama era).

Fast forward to today, and add in further supply disruption (in Russian sanctions), plus what will likely be a wartime surge in demand for oil, and we will very likely see a spiral higher in oil prices.

Now, in a normal world, high prices stimulate more investment in oil exploration and drilling - it won't happen this time, at least under the current global and domestic regime. They want substitution ("clean").

That brings me to another probable outcome we've discussed for quite some time here in my daily notes: Price Controls. But as we've also discussed, a subsidy would only sustain the demand dynamic for oil. Apply that to a world that is undersupplied and underinvested in new supply, and the price of oil would continue to rise.

With that, what could be added to such a White House game plan? Rationing…