Oil

Macro Perspectives

Let's talk about the recent decline in the price of oil - after trading above $95 a barrel last Thursday, it's now in the low $80s again.

This is a big reversal, countering what has been a 40% rise in crude oil prices since late June. Is this a signal of exhaustion in economic momentum?

Let's take a look . . .

First, if we look back at just the past eighteen months, from the date the Fed started the tightening campaign, you can see in the graphic below, the magnitude of this move in oil is not unusual.

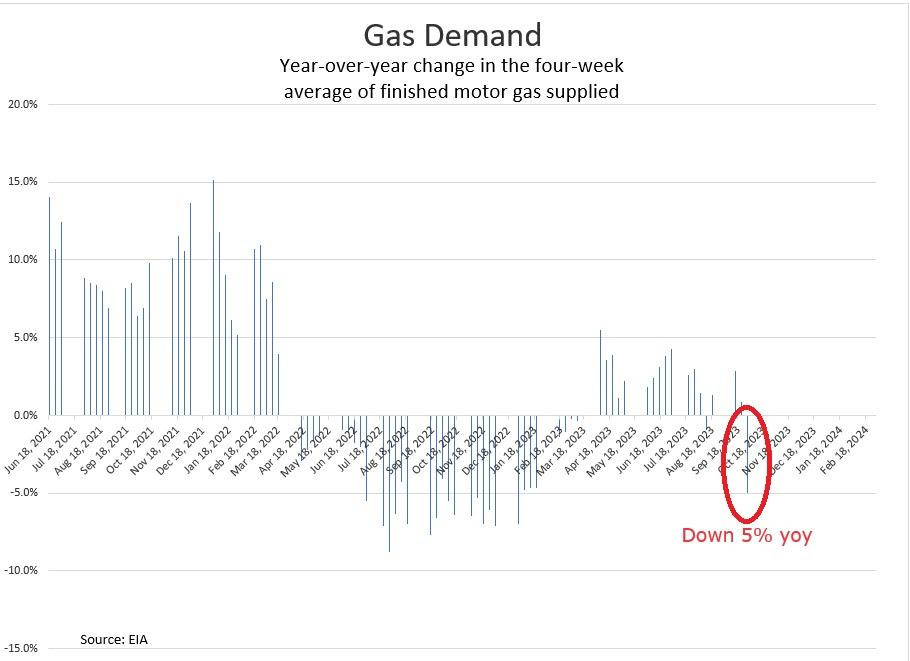

That said, the biggest decline in oil prices, of this past week, was this week (Wednesday), and it came following the government's weekly petroleum report that suggested a surprising decline in U.S. gas consumption/demand.

For the last week of September, the report showed a decline (chart above) of 5% compared to the same period last year. The second half of last year, also had large year-over-year declines, and that coincided with a move in crude oil prices from $110 to $70 (chart below).

But as we know, we can attribute plenty of this decline to the Biden administration's drawdown of the Strategic Petroleum Reserves (SPR, chart below).

The difference this time: The SPR card has been played. Now it's time to restock and the Western world's war on oil has put OPEC and Russia in the driver's seat. Not surprisingly, they have been, and will continue to hold production down.

With that, the inventory (supply) picture doesn't fit with the demand data, within this EIA report. Inventories have been and continue to shrink.

As for demand, if we look at driving activity, the total vehicle miles traveled is back near pre-pandemic levels. Is it electric vehicles that might be weighing on gasoline demand? EVs still represent less than 1% of the cars on the road.

This decline in oil prices looks like a gift to buy the dip.