Nvidia reported after the close - they had, yet again, another jaw-dropping quarter. Here are the numbers . . .

Let's review the story of the past six months.

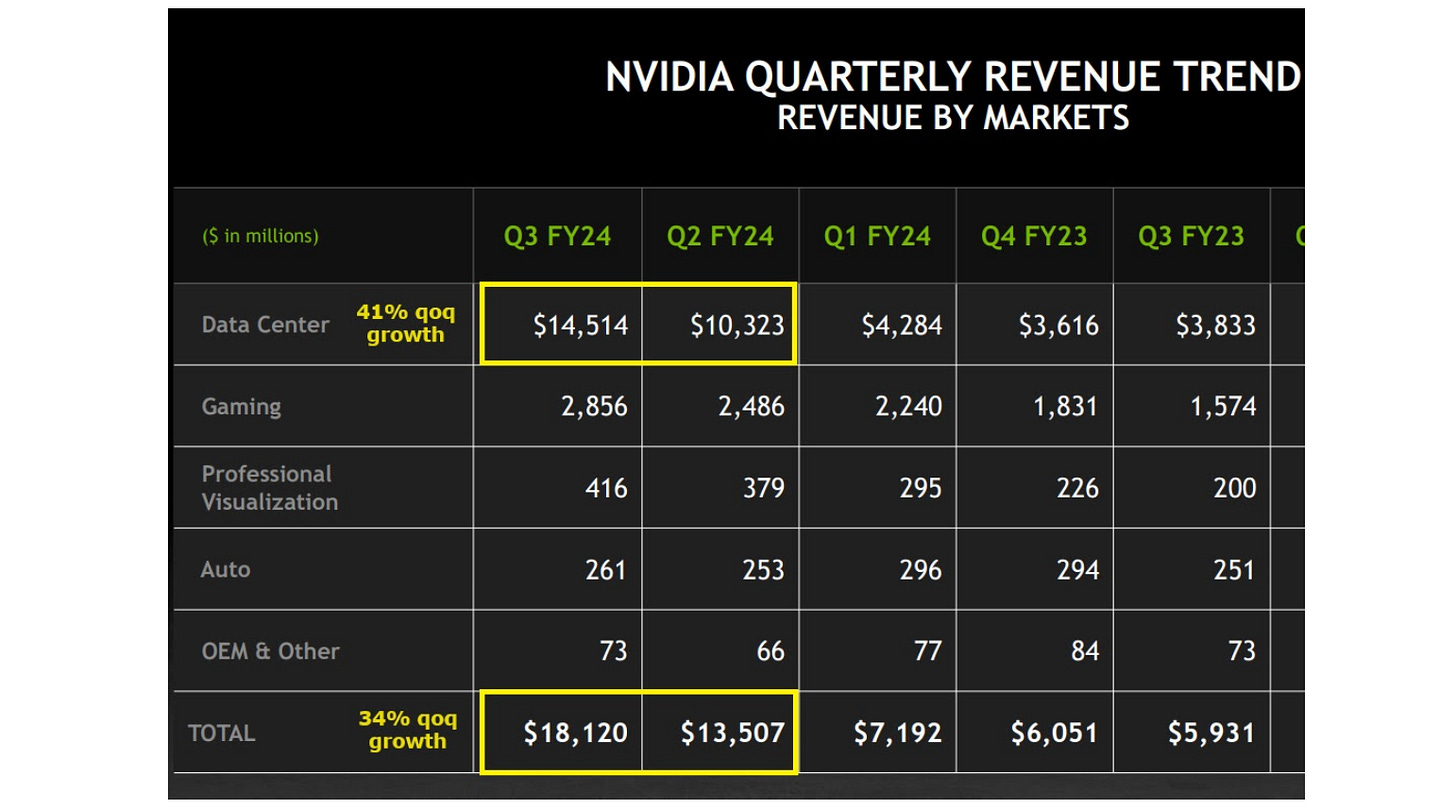

It was in late May that Nvidia shocked the world with a $7 billion quarter, and upgraded guidance for Q2 to $11.5 billion (just one quarter ahead). That guidance was a stunner.

Importantly, the Founder/CEO of Nvidia, Jensen Huang, compared the "ChatGPT moment" (the November launch of ChatGPT) to the "iPhone moment." With that, he declared the early stages of a trillion-dollar "retooling" of the world's data centers. He said demand was steep, they were well supplied, and that the second half would be better than the first.

In Q2, they didn't do $11.5 billion in revenue, they did $13.5 billion.

They guided to $16 billion for Q3. They just reported $18.1 billion.

Next quarter, they are expecting $20 billion in revenue. Keep in mind, this is on 74% gross margin, and around 50% net income margin.

With this performance, the stock is up over 60% since the May report. However, with this growth, the stock has gotten cheaper and cheaper, from a valuation standpoint;Going into the May report (Q1), it was trading for 32 times annualized Q4 2023 sales. Now it's trading 17 times annualized Q3 2024 sales (the most recent quarter).

At yesterday's close, it's trading around 30 times earnings (Q3 annualized net income).

That's in-line with the valuation on the tech giants. But keep in mind, Nvidia is at a much higher growth stage (a triple-digit year-over-year rate). The stock is cheap.

For those that have been calling the boom in AI stocks unsustainable, they are underestimating, if not misunderstanding the significance of this technology revolution. It's productivity enhancing, and a formula for a boom-time era in economic growth.

The generative AI impact will mean bigger companies, in a bigger economy - this will grow the size of the economic and stock market pie.

This is exactly what Jensen Huang discussed, "every company, every industry, every country" will go through this computing transition. He sees "significant total addressable market expansion." And we're still at the beginning stages.

How do you position your investment process to leverage this technology? From idea generation to due diligence, use Gryning AI powered analysis and insights for every investment decision.

Pick the insights that suit you and we’ll double your membership period.