We talked about the "AI effect" on the stock market yesterday. With the booming stock performance of the tech giants this year, where AI powers are heavily concentrated, there were building expectations that the earnings report by Nvidia in the afternoon might undershoot.

That was not the case. In fact, it was the opposite. This Nvidia report might be the big wake-up call on the massive technological transformation underway (and in just the early stages).

After the bell, Nvidia reported a huge earnings and revenue beat, with an even bigger upgrade in guidance (gaining 24.22% after hours);

They grew revenues at 19% since last quarter (Q1).

They think they will grow revenues for Q2 by 33% - driven by "a steep increase in demand" related to generative AI and large language models.

Again, that's quarter-over-quarter growth.

A key question in the earnings call: Can they continue that kind of growth?

The answer: "We have visibility (on demand) that is probably extended out a few quarters ... Yes. We are expecting a substantial increase in second half compared to first half."

Additionally, they say they have secured "substantially higher supply for the second half of the year," to meet surging demand.

For perspective: Nvidia is the leader in producing graphic processing units (GPUs) which enable the move from "general purpose computing" (powered by CPUs) to "accelerated computing" (powered by GPUs).

On the earnings call, they say the world's $1 trillion worth of global data center infrastructure is based on CPUs - and there is aggressive demand to "re-tool" (across industries) to accelerated computing.

Keep in mind, before yesterday's report, Nvidia was the seventh most valuable company in the world ($770 billion market cap). With this explosion in growth, Nvidia may be challenging Microsoft and Apple as the biggest company in the world very soon (joining the multi-trillion dollar market cap club).

As I said yesterday . . .

Just as the 1920s were defined by innovation (the automobile and widespread access to electricity), we have the formula here for another "roaring 20s."

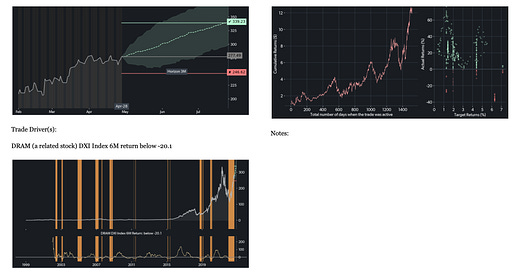

The Trade Sheet below was sent out to members on Mon 01 May’23.

NVDA 0.00%↑ closed yesterday at 305.38, and was up 24.6% (75.22) after hours to blow through the target listed, likely to open around 380.00.

If you, or anyone you know, are looking for actionable trading idea’s backed by data and quantitative analysis, click on the link below.