NVDA: Resolve Lower

US stocks failed to recover on Monday following last week’s sharp losses, the S&P 500 fell 0.5% and the Nasdaq slid 1.2%m while with the Dow added 33 points.

Weakness in tech dragged the Nasdaq lower, as Palantir plunged 10.5% and Microsoft fell 1% amid concerns over reduced data center spending.

Attention turns to earnings reports from Home Depot, Lowe’s, and Nvidia, with the latter seen as a major market mover given its leadership in artificial intelligence.

Traders are also watching Friday’s release of the personal consumption expenditures (PCE) index, the Fed’s preferred inflation gauge, which could shape expectations for rate cuts.

Despite recent volatility, investors are weighing whether the Fed’s stance on rates will provide a floor for the market in the months ahead.

Nvidia reports tomorrow.

We head into this report with some perceived gaps having been exposed in the Nvidia armour in the past month. The "DeepSeek moment" revealed that the large language models can be improved upon, advancing the capabilities of generative AI, without requiring more computing capacity. So, maybe AI leadership isn't determined by who gets access to the most Nvidia GPUs?

If that were the case, the hyperscalers (Amazon, Meta, Google, Tesla, Apple) would have flinched.

We heard from them all earlier this month. They didn't flinch.

Instead, they are all pressing the accelerator. If we combine the planned capex spending for 2025, guided by Microsoft, Meta, Google, Tesla, Apple and Amazon — it's over $300 billion. It's huge growth in spend from 2024 — about $100 billion more.

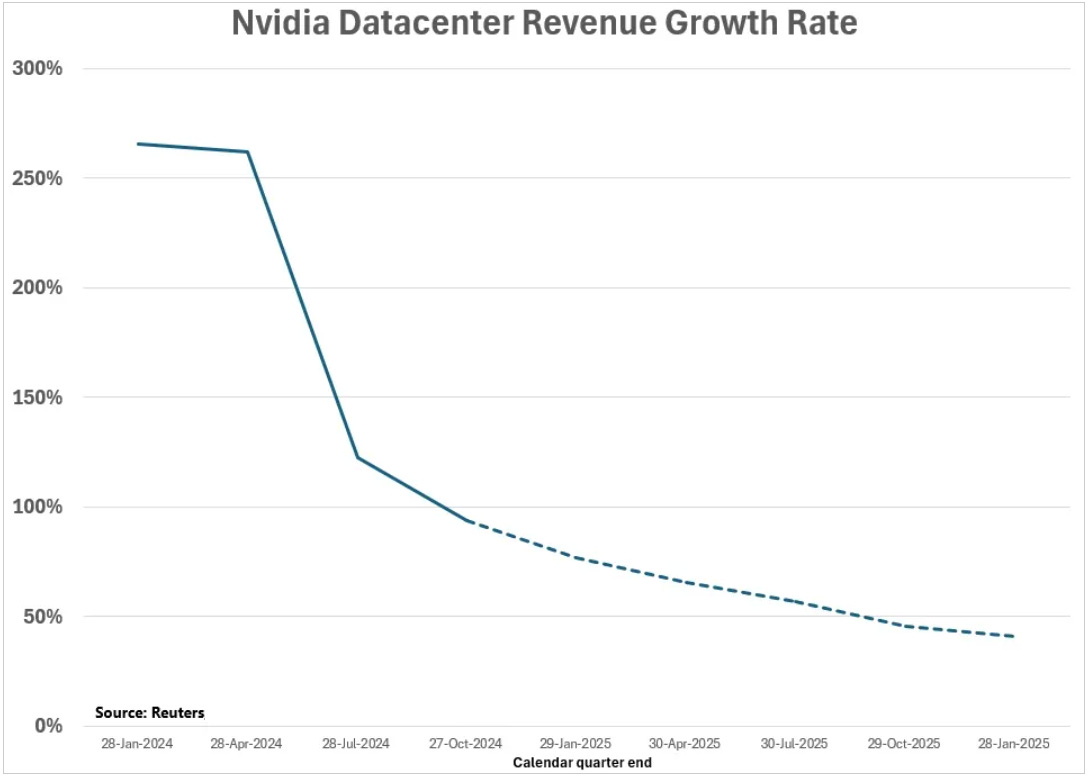

But as we've discussed for many quarters now, it's not a demand issue for Nvidia; it's a supply issue. And the clues have been in the Nvidia datacenter revenue growth. It's a $4 billion drumbeat. You can see it here (quarter-to-quarter change within the green box) …

If they maintain the $4 billion quarterly growth through 2025, and deliver everything to the American hyperscalers, they still fall short of demand by $100 billion.

Stable new revenue dollars every quarter means the growth rate trajectory for Nvidia is down. At $4 billion a quarter, the year-over-year growth rate falls to under 50% by the second half of 2025.

Now, a little less than 50% growth is still a big number, but the market has already begun to reconsider the valuation.

As you can see in this next chart, the stock put in a top after Q3 earnings last November. The largest company in the world then proceeded to whipsaw in an 8% range that day (a $300 billion valuation swing).

And then a new top was just barely printed early last month after Jensen's keynote at the CES conference in Las Vegas. Then we had this gap lower on the DeepSeek news. The gap has since filled, heading into Wednesday's earnings.

Assuming neither Nvidia nor Taiwan Semiconductor has identified new manufacturing capacity, this chart looks likely to resolve in the direction of this January gap, lower.

That said, the AI revolution is real and well intact. And a correction in the AI-theme would be a welcome buying opportunity.

Macro Summary Table | Germany IFO

The table below is part of the information package members of Investing by Design get, whereby we look at macro-economic data through a quantitative lense. For more information on the quantitative strategies provided, click on the link below.