The Fed has clearly communicated to us that they will begin exiting emergency level policies, likely at the next meeting in November. As we've discussed, a change in the direction of monetary policy (from the easing to tightening direction) is generally bad for stocks.

So, how did markets react? Stocks are up...

In this case, even after the Fed tapers and even after the Fed starts raising rates (from zero), there is and will be plenty of tailwinds for stocks - policy will remain stimulative for quite some time. So, with yesterday’s pop in stocks, is the recent correction over? Many on Wall Street would like to believe so, and have probably proclaimed it to be over. My view: probably not.

Let's take a look at some reasons why we may see a little more pain for stocks.

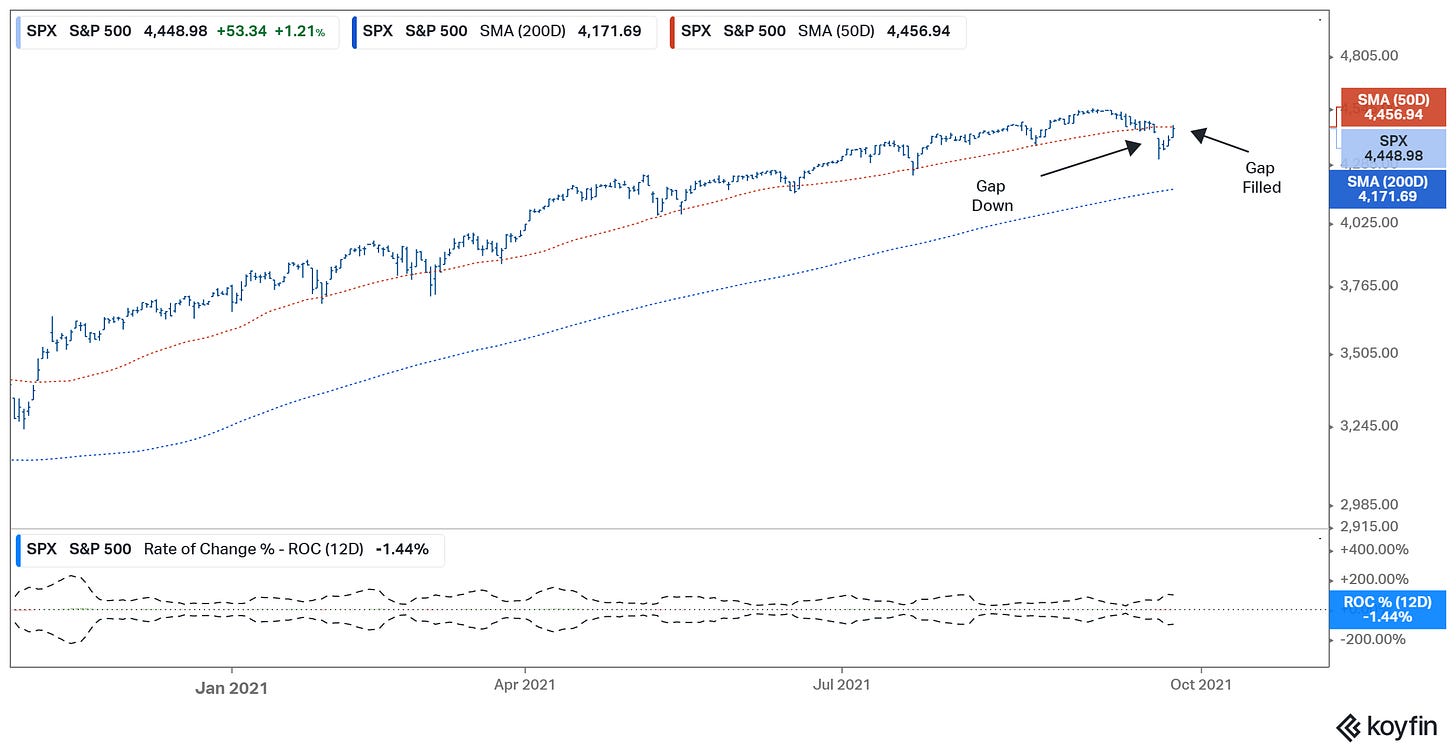

Remember, we looked at this chart on Tuesday, when the price traded below the 50 Day moving average. This trend, from election day, represents the anticipation of a Biden presidency that would bring about continued easy money and an unimaginably big fiscal spend.

Also notable in this chart, for those that appreciate technical analysis, you can see the gap down in stocks on the Sunday night open of the futures market. That gap was filled yesterday. This "filling of the gap" is a technical pattern that tends to resolve in the direction of the break (i.e. lower).

Now, in addition to higher stocks, we also had a strong surge in yields. That's to be expected, given the Fed's change of direction on monetary policy, and, importantly, as you can see in the chart, the benchmark interest rate market broke out of its two month range.

But on a day where rates are moving higher, with the expectations that the U.S. will lead the major developed world in a rate hiking cycle, the dollar should have boomed. That didn't happen, the dollar traded down all day.

What else traded lower? Copper. This is another red flag for the resumption of the rise in stocks (at this stage). The Fed's plans to exit emergency level policies is a signal of confidence in the recovery and the sustainability of the recovery. What metal tends to reflect the view on the health of the economy? Copper.

Bottom line: Despite the big surge in stocks, it wasn't a “risk-on” day across global markets. Given the event risks looming at the moment, these are probably clues to pay attention to.