Six weeks ago, following the Fed's November meeting, Jerome Powell said there was "significant" tightening in financial conditions in recent months.

The Fed had projected one more rate hike for 2023, but he implied, at that moment, that the rise in bond yields (to 5% on the 10-year Treasury), weakness in stocks and strength in the dollar had already done the Fed's job (i.e. added additional tightening). He signaled the end of the Fed's tightening cycle.

A month later, Jerome Powell was on stage giving prepared remarks at a fireside chat at Spelman College. The S&P 500 had just recorded its best November in over 40 years, 10-year Treasury yields had fallen almost three-quarters of a point and the dollar had weakened by three percent.

The conditions he cited a month prior had all reversed.

But he did nothing to push back against the idea that the tightening cycle was over. He did nothing to push back against a market that was pricing in the next move as a rate cut (and perhaps as early as March).

Fast forward to yesterday, and the financial conditions referenced by Jerome Powell six weeks ago have continued to ease. However, not only did Powell (and his Fed colleagues) show little-to-no concern, he all but explicitly claimed victory on inflation.

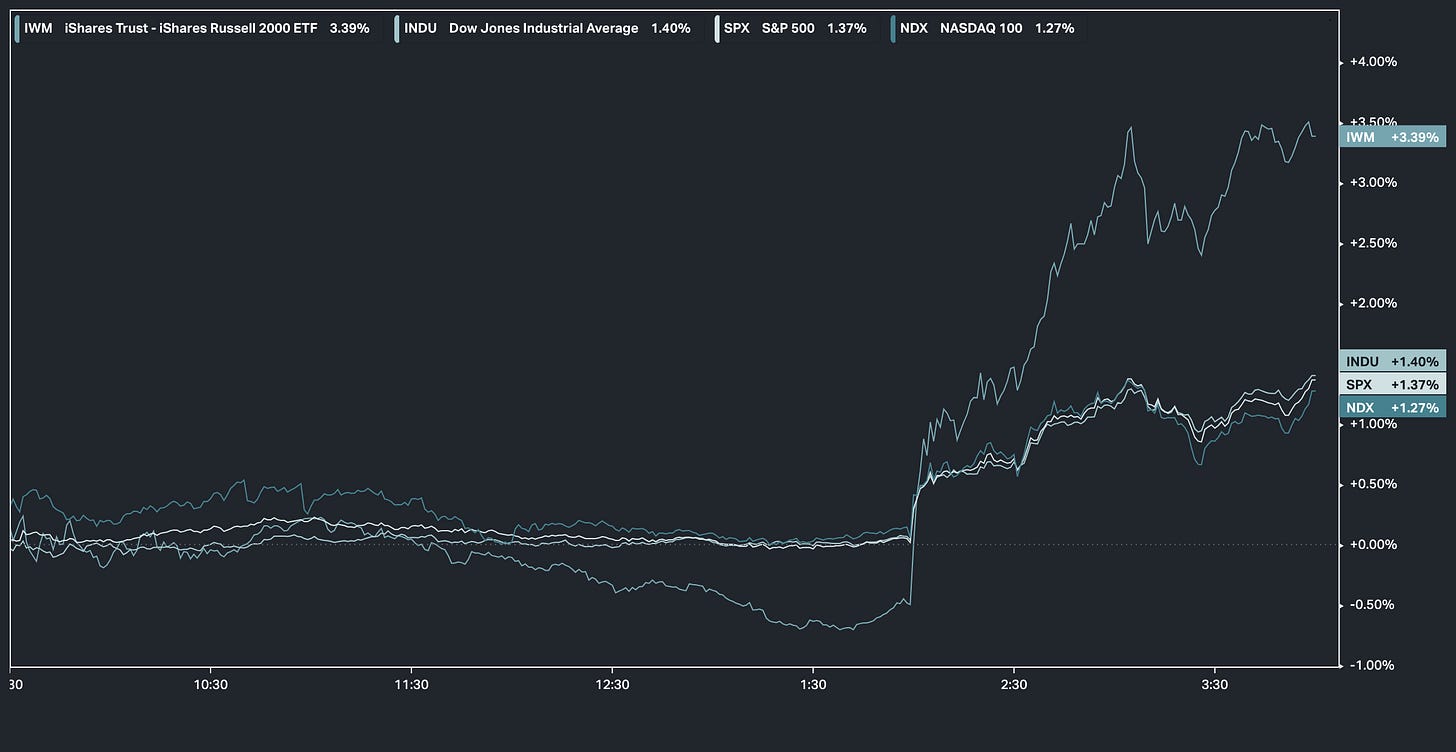

That's a greenlight for stocks . . . and stocks had a big day.

Add to this, there's one major data point for markets between now and year end, and it's the Fed's favored inflation gauge, core PCE. But now we don't have to wait for it. Powell leaked it yesterday afternoon, in his press conference prepared remarks - they expect it to have fallen from 3.5% to 3.1% year-over-year.

So, there should be little resistance against the momentum for stocks into the year end.

With that, we've talked about the opportunity in small caps, which have dramatically lagged the broader market indices. The Russell 2000 was the bigger winner, up 3.5% and it could catch up very quickly.

The S&P 500 is 2% away from the record highs (of about two years ago).

The Nasdaq is 5% away.

The Dow is just 1% away.

The Russell 2000 is 26% away from the all-time highs marked two years ago.

Sharing is Caring. Teams & groups can gain access to AI powered anaylsis at no extra cost, how you form the groups and share the costs is fully up to you;

A single monthly membership allows insights for a group of 3.

A yearly membership - currently at 50% off - allows insights for groups of 6.

* The second option works out at £100 / person for 12 months of AI powered analysis *

Curious to see how our analysis works - the Gold focussed analysis (click here) was sent out on 23 October 2023, the charts below show how the ETF’s listed within have done so far. I’ll let you check out the performance of the single stocks yourself!

The above offer is also available for GRYNING | CAPITAL.