The big jobs report comes in today.

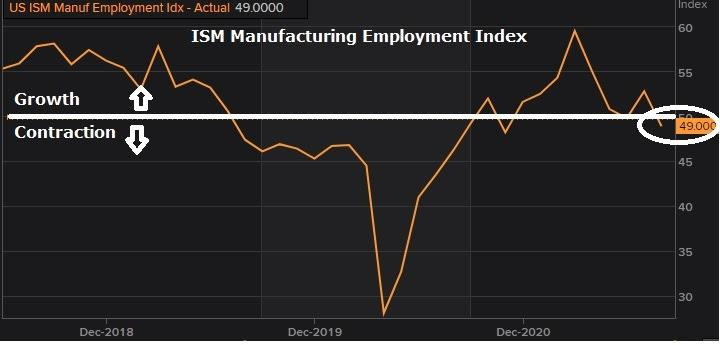

As we discussed yesterday, things set up for a disappointing number. We have clues from the ADP data that we could see not only a weaker than expected nonfarm payroll number, but also a downward revision to last month's number. Supportive of that, the employment component of the recent ISM Manufacturing report dipped back into contractionary territory for the first time since November.

And as we discussed earlier last month, the consumer sentiment reading from the University of Michigan hit a 10-year low in July.

So these are meaningful signals to acknowledge.

The question is: Will a weak number today be enough to shake the boom in asset prices, particularly stocks? Likely.

But as the dust settles, the realisation should set in that weak jobs data only gives the Fed cover to stay "easier for longer." That's positive for stocks.

Conversely, a strong jobs number means recovery is stronger. That too is positive for stocks.

With all of this said, today’s report on August employment means very little in the bigger picture. We all know that employment has been encumbered by policy disincentives, and those disincentives have ended for half of the country (U.S.), as of this month. So the employment situation should only improve from here (from September on), and that will strengthen an already hot economic growth (but also underpin inflation).