We should expect a hot jobs report today to continue the steady creep of inflation concerns.

It's the job of Jay Powell and the Fed to manage the expectations of people about price pressures - as Bernanke once said, monetary policy is 98% talk - Powell and company have been doing a lot of talking.

But it's not easy to talk down the price increases that are right in front of our noses everyday. Beyond the supply/demand dynamics that are putting upward pressure on prices, it's perception that can lead to behavior, and behaviors (related to inflation) are what can lead a dangerous spiral. For that reason, the Fed worries about perception.

If you’re buying today, at any price, because you think price will be higher tomorrow, that's a recipe for an inflationary spiral. The current U.S. housing market ( I suspect the same is taking place in Sweden) is a perfect example.

At this stage in the game, I'm not telling you anything you don't know, we all clearly see the move in asset prices.

What hasn't participated, and has been written off as a "has been" trade, is gold. Despite being THE asset that has historically been most favored in times of inflation, gold is actually DOWN year-to-date (down 4%).

Is that a signal that we are wrong about the sustainability of the inflation we're seeing? Unlikely.

It is believed, by many, that gold has been supplanted by cryptocurrency (namely, Bitcoin) - as the new, improved way to hedge against inflation. If that's the case, we are in for some very serious inflation, Bitcoin is up 93% year-to-date.

The people buying bitcoin as an inflation hedge clearly think "this time is different" - that a digital currency will protect their buying power better than gold in a persistently high, if not hyper-inflation scenario. In my years of investing and trading experience, it's often a bad idea to position for "this time is different."

Even so, surely gold should be benefiting from at least some global capital flows on this inflation perception. Remember, it's down year-to-date. Clearly it has been a dislocated asset in this market and economic environment, which creates an opportunity to see that dislocation corrected.

We may have seen the signal for gold to start its big catch-up moveyesterday. Gold broke out of a trading range, trading above $1,800 for the first time since February. This is an important day for anyone that trades gold or gold stocks.

In a world where asset prices are making new highs by the day, you can buy a dip in gold;

Fundamentally, the outlook is strong given the explicit devaluation of cash through unlimited Fed QE and seemingly unlimited deficit spending.

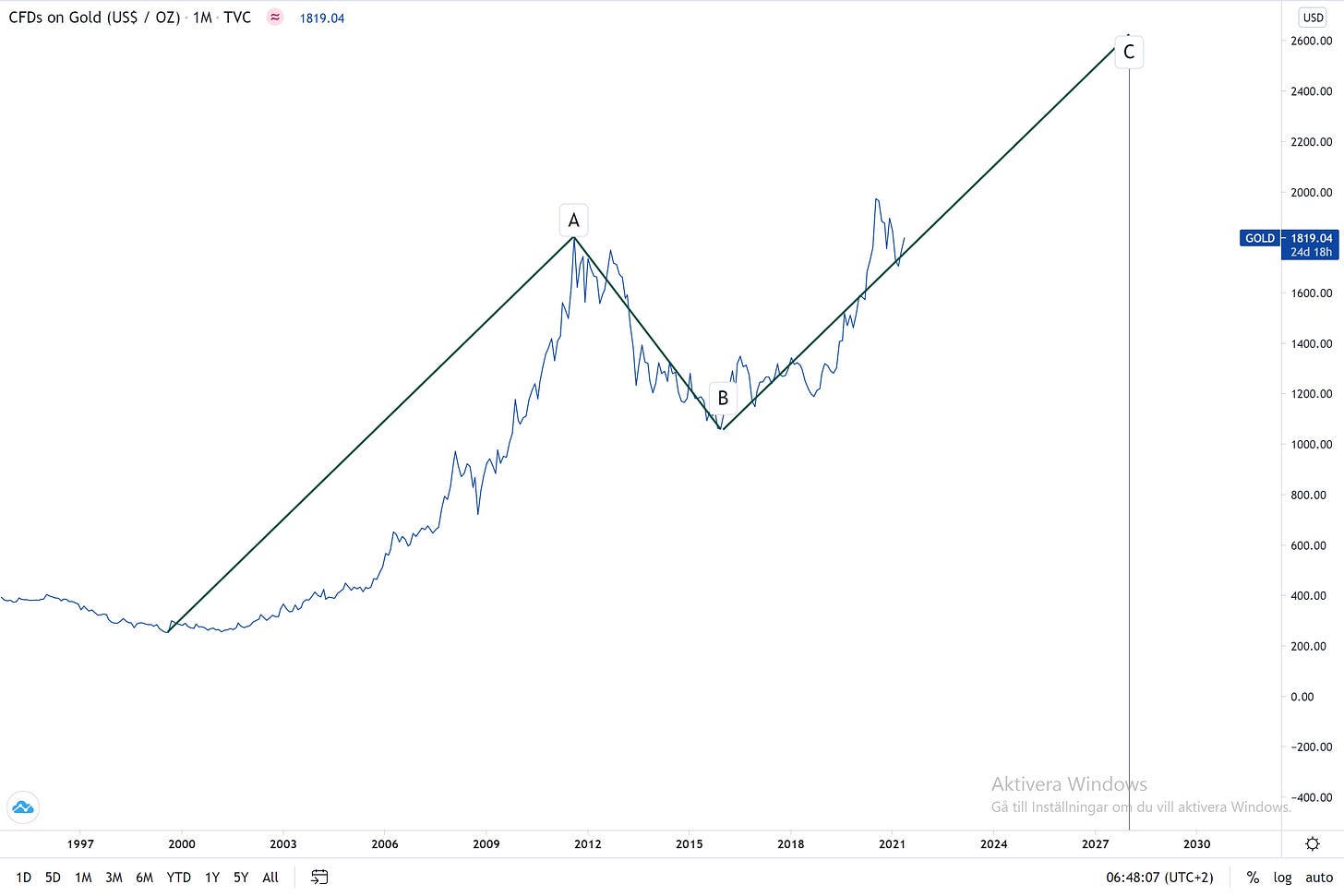

So is the longer-term “technical” outlook...

This is a classic C-wave (from Elliott Wave theory) here in gold, pattern projects a move up to ~$2,700.

How do you play it? Get leveraged exposure to gold through gold miners, or track the price of gold through an ETF, like GLD.