With the debt ceiling drama taking an intermission - senate passed a short-term increase to the debt limit, House to vote on it next - and the anticipation of the strong jobs report coming today, global markets (and the global risk picture) closed yesterday broadly positive.

The employment recovery has looked very good (at a 5.2% unemployment rate) - getting closer to the long-term average unemployment rate. Add to that, the unemployed in half of U.S. states have now lost additional federal unemployment pay, and should be moving back into the workforce - likely to be represented in the data we'll see today. That means we should see a good report/ lower unemployment.

Additionally, as discussed previously, not only has the headline inflation rate been running well north of the Fed's target level, but the wage component in these jobs reports has been running hot. We don't need to see it in a government report - we can see it all around us - employers are short of labor, and employees are commanding a higher wage, and getting it.

Throughout the post-financial crisis era, when the Fed was trying to produce some inflationary pressures (to avert the deflation threat), what was the one piece that wasn't materialising for them? Wage growth.

So while the supply chain disruptions will, at some point, abate. Higher wages will stick - that's a tailwind for inflation.

Higher energy prices are driven by a structural supply shortage (not bottlenecks). That's sticky - that's a tailwind for inflation.

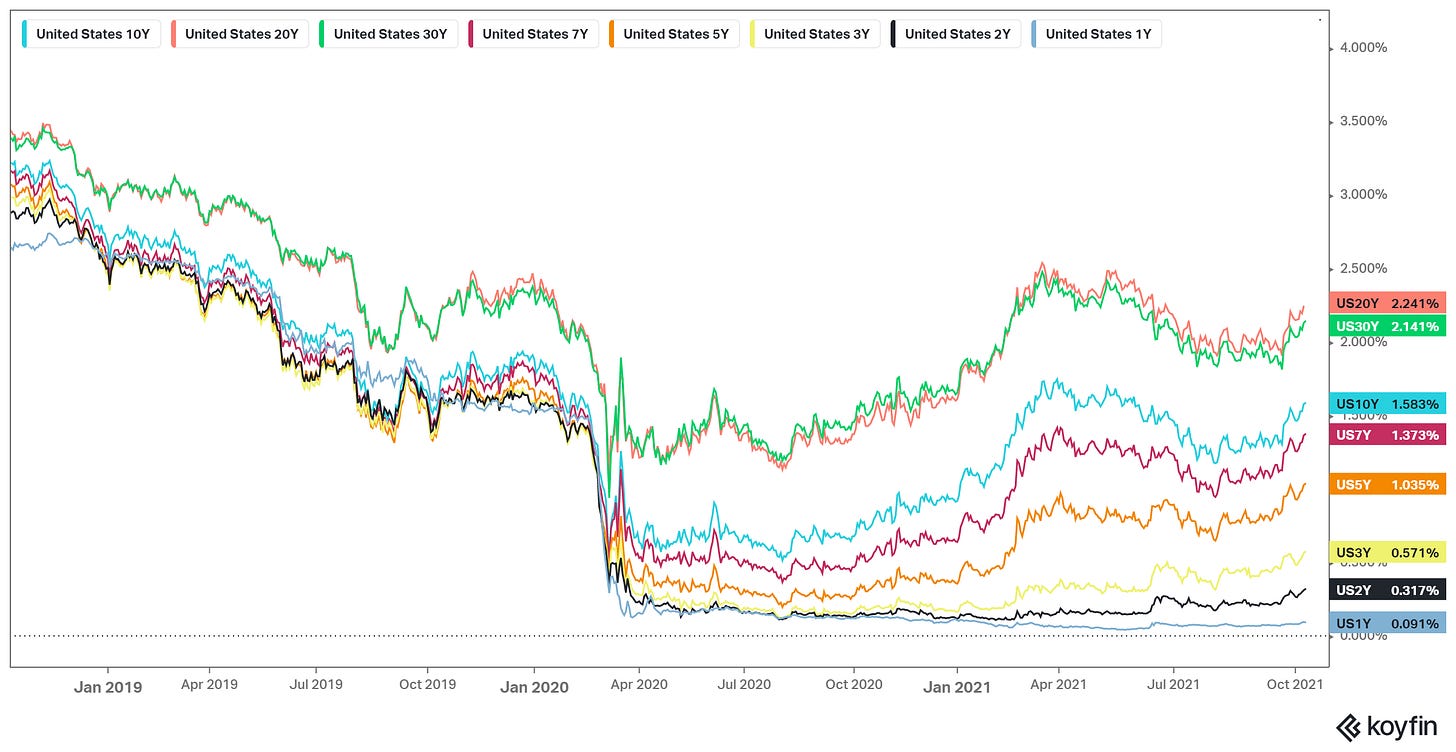

With the above in mind, the Fed’s dual mandate of price stability and full employment clearly doesn’t justify emergency level policies. So, a strong report today will further validate the Fed's plan to officially change-the-direction of monetary policy at their November 3rd meeting.

All of this said, if we look forward by a month or two, the question is: how will the Fed react if/when the unemployment starts to move back up, due to vaccine mandates? They may not taper for long.