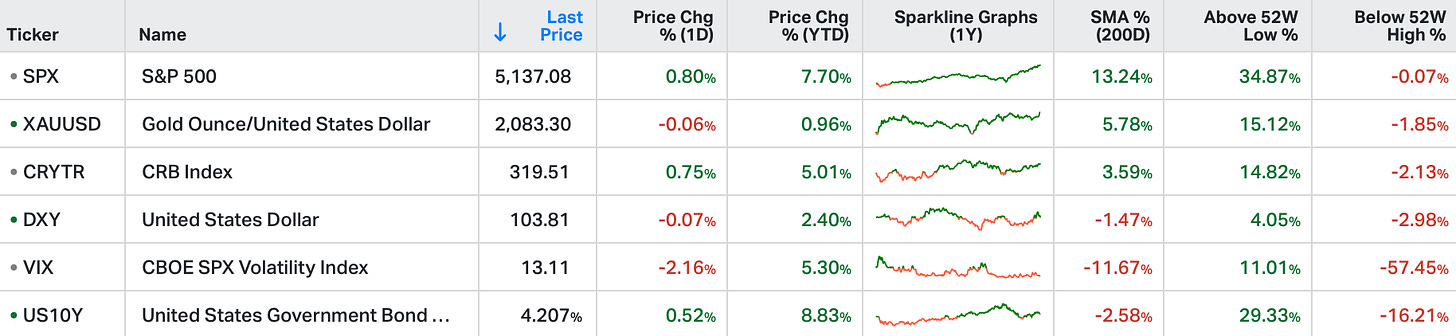

The S&P 500 and Nasdaq reached new record highs on Friday, driven by a tech rally as concerns lessened regarding the Federal Reserve delaying interest rate cuts.

The latest ISM data revealed that factory activity contracted more than anticipated in February, and the Michigan consumer sentiment was sharply revised downward.

On the corporate front, New York Community Bancorp shares plummeted by 25.89% due to identified material weaknesses in loan risk control.

In contrast, Nvidia gained over 4%, while Apple lost about 0.6% after being removed from Goldman Sachs' conviction list.

The S&P 500 posted a 0.97% weekly gain, and the Nasdaq was up 1.74%, marking their seventh positive week out of the last eight.

Stocks traded to new record highs (again) last week.

Nine months ago Wall Street was calling AI a bubble. Today they're capitulating to the reality that it's a new industrial revolution…and it's early.

It was just November of 2022 that OpenAI launched ChatGPT. Nvidia's founder/CEO, Jensen Huang, called it the "ChatGPT moment." As he said, that moment crystallised how to transition from the technology of large language models to a product and service.

That was the starting line - it reset the outlook for the economy and for markets.

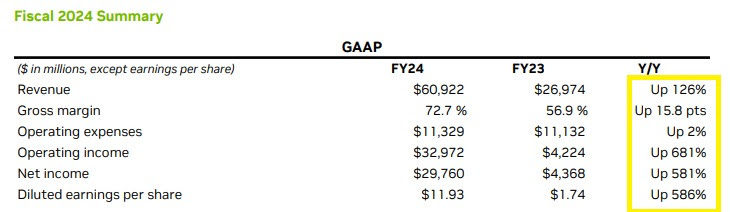

Six months later, Nvidia reported it's first full quarter of earnings, in a world that had been reset with this outlook. As the dominant supplier of the chips necessary to power generative AI, the demand for Nvidia chips had exploded. Jensen Huang began educating the world on the "rebirth of computing," and he had the numbers to prove it.

On that day (my May 24 note here), I said "Nvidia may be challenging Microsoft and Apple as the biggest company in the world very soon (joining the multi-trillion dollar market cap club).

As you can see below, the shocking multi-billion dollar quarterly growth that started nine months ago for Nvidia, has only become more shocking. And Nvidia is now a $2 trillion company.

For perspective on the durability/credibility of this growth, keep in mind the biggest, most powerful technology companies in the world (Meta, Google, Amazon, Microsoft) are not only making record-level investments in building AI infrastructure, but they are completely transforming their companies to focus on generative AI.

So, as we've discussed here in my daily notes, with the events of the past year, it's clear that we are in the early stages of a new industrial revolution.

And that statement should be the answer to the question: Is it too late?

It's not too late. For those that have been calling the boom in AI stocks unsustainable, they are underestimating, if not misunderstanding, the significance of this technology revolution. It's productivity enhancing, and a formula for a boom-time era in economic growth.

As we've discussed throughout the past year, the generative AI impact will mean bigger companies, in a bigger economy - a bigger pie.

It's already happening. Just in the past month, we have our first $3 trillion company, in Microsoft. And while Nvidia is now worth $2 trillion, the price you pay for the stock today, relative to its earnings, is CHEAPER than it was back in May of last year - when they shocked the world declaring "a rebirth of the computer industry."

With that, as I said in my Feb 05 note (here) the best time to get invested in this technology revolution was November 30, 2022 (when ChatGPT launched), the next best time is today.

Remember, the CEO/Founder Jensen Huang has said "every company, every industry, every country" will go through this computing transition. He sees "significant total addressable market expansion." That's the pie growing.

Already he sees the cost to "retool" the world's data centers to accelerated computing climbing from $1 trillion to $2 trillion within the next five years. Given that Nvidia is supplying about 90% of it (at the moment), and they've done under $50 billion in data center revenue over the past year, this global data center transformation has a long way to go. It's very early.

So, what comes next?

Huang has said the future of this accelerated computing will power the "next big reinvention," where "the digital world meets the physical world." Nvidia's Omniverse technology will power it, and it will reshape $100 trillion worth of global industry.

On that note, last month Apple debuted the Apple Vision Pro. Here's how they describe the product: "Apple Vision Pro seamlessly blends digital content with your physical space."

The CEO of Siemens, when he presented earlier this year at the Computer and Electronics Show (CES) in Las Vegas, called 2024 a "turning point" where real and digital worlds will converge. He introduced the "Industrial Metaverse." In his words, this is generative AI making reality better and building it faster and more efficiently, by using the virtual world.

And the virtual world is all about the "digital twin."

The digital twin allows builders/developers/engineers to see the products perform (as a digital twin), have fully immersive interaction with the product, before and while building it.

They can imagine it, design it, visualise it, simulate conditions for it (test it), monitor it - and all of this data becomes actionable insights via generative AI. So, they can improve it, before building it.

This is the next wave of generative AI. It's coming as trillions of dollars of infrastructure-related government spending is being deployed. This convergence of technological advancement and government funding sets up for a manufacturing boom. And it’s going to be at record speed.

With all of the above in mind, as you know, we've been working on identifying and thoughtfully building a portfolio of companies on the leading edge of this transformation, in my AI-Innovation Portfolio.

We now have 15 stocks in the portfolio, since we launched in June of last year.

We started with a focus on AI infrastructure stocks. These are the "picks and shovels" of this technology revolution. We've since added massive SaaS companies that will deliver the capabilities of generative AI to companies around the world.

Ahead of the most recent Nvidia earnings, we made another addition to the portfolio -- the cheapest of the giants leading the technology revolution, and they own perhaps the most valuable data on the planet.

As for the industrial metaverse, we also recently added a pioneering infrastructure engineering software firm that's been leading this metaverse technology since 2016. It's founder led, with double-digit growth, high profitability, and high gross margins (already). And this company is actively shaping the digital transformation that will drive the infrastructure/building boom.

Again, it's still early in this technology revolution. There are tremendous investment opportunities, in an era that has already brought us the multi-trillion dollar companies. More are coming.

If you aren't yet a member, and you'd like to join us and get all of the details on these stocks and the rest of our portfolio, you can do so following the instructions below.

The next wave will be the tremendous potential for new businesses to form around generative AI, and for old businesses to adopt and realise the benefits of generative AI.

Here's how you can join me...

The AI-Innovation Portfolio is about allocating to HIGH-GROWTH.

For £600 per quarter (£200 per month), you'll gain exclusive access to my in-depth research, expert analysis, and timely investment recommendations focused on the generative AI revolution - all email delivered to your inbox.

You can join me by clicking on the link below, get signed up, and then keep an eye out for Welcome and Getting Started emails from me.