We have had a couple of back-to-back quarters of negative real GDP growth. This is typically the layman’s definition of recession - market strategists and economists have said we are not in recession because corporate earnings are growing.

With 90% of the S&P 500 companies having reported second quarter earnings, the overall earnings growth rate of the S&P 500 is 6.7%. On the surface, this does appear to be a positive.

It turns out that when we remove the very positive year-over-year earnings growth of the energy sector (up 299%), the rest of the S&P 500 had a year-over-year decline in earnings of -3.7%. Negative earnings growth of the S&P 500 ex-energy reinforces the argument that the economy is currently in a recession.

A strong labor market is often cited as evidence the economy is expanding and inflationary pressures remain strong. When we look at current employment statistics from online job listings, we see job openings have declined by about 40% in recent months. The Goldman Sachs index of hiring expectations has moderated sharply since March.

Employment is a lagging indicator for recessions. A recent survey of business executives by Price Waterhouse Coopers (PwC) indicated that 47% of companies are considering or plan to reduce their company’s overall headcount - typical of recessionary times, we often see the labor market begin to contract when the recession has already begun.

Anemic earnings and a slowing labor market suggest inflation will decline sooner and by more than currently expected. If this proves to be the case, the Fed should raise rates less than expected which is supportive of higher P/E multiples and less of a dampener on economic growth. Bad news now is good news for the stock market.

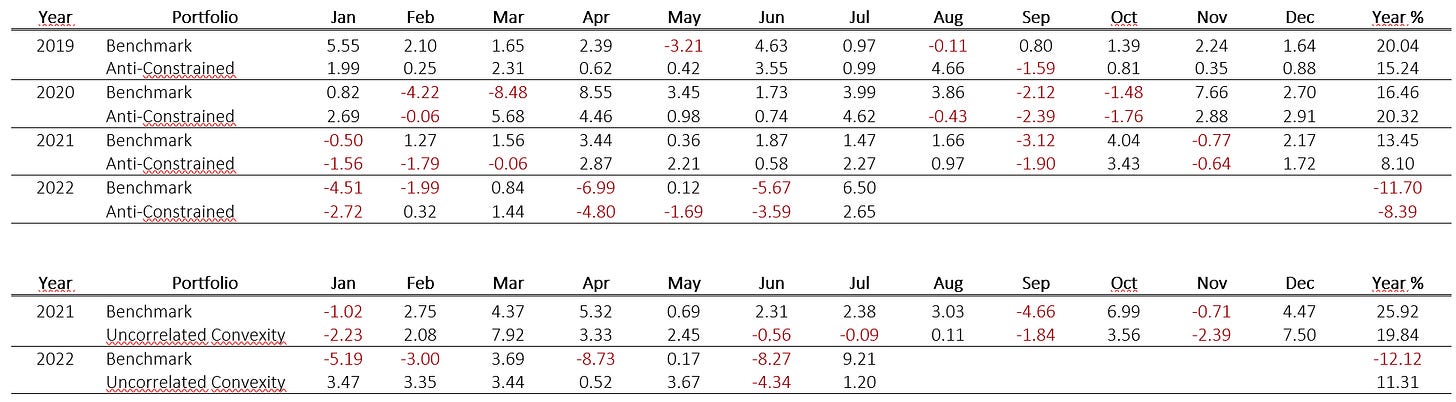

Managing Risk is the core aspect in how I navigate the markets. Below I show how my two core portfolio’s have performed, with draw-down control.

What does your money mean to you? Click below - give yourself the best chance to outperform the market.