Navigating Regime Change

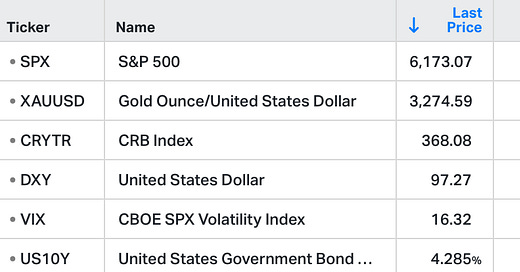

US stocks closed at record highs on Friday driven by optimism over pending trade agreements and rising expectations for interest rate cuts.

The S&P 500 gained 0.5%, closing above its February peak, while the Nasdaq 100 also advanced 0.5% to a new high.

Earlier in the day, markets surged on encouraging news of trade progress with key partners, including a framework agreement with China.

Although Trump’s unexpected remarks on Canada briefly dented sentiment, they failed to derail the broader rally.

The market’s strong rebound from April lows has been driven by easing inflation pressures and resilient corporate earnings.

Three Things

Tariff Counterfactuals

The stock market has returned to where it was before the whole tariff fiasco happened. And now I am seeing people say “see, the tariff worries were all overblown!” The effective tariff rate has now dropped to a rate that is still high, but nothing remotely close to the embargo style levels we had in mid-April. And the markets have rightly bounced back. But that doesn’t mean there was no damage done.

When we assess the impact here, we have to look at it in relative trade terms. For instance, the US Dollar has fallen 6.5% since the beginning of the year when more and more protectionist measures were implemented. Some people might say a falling Dollar is a good thing, but I don’t see it that way. You would never look at a collapsing currency in a place like Argentina and say “oh look, they’re more competitive now!” They technically are, but their currency collapsed because they have hyperinflation and their economy is less competitive on a relative basis. Likewise, it’s been a good thing that the USD was rising for so long because it’s a coincident indicator that the USA is doing better in relative terms. We want the currency to rise because it’s a symbol that there’s strong demand for the currency and that the market doing better on relative terms.

This is most evident in relative stock prices this year. While the US stock market is back to where it was before the whole tariff thing started, foreign stocks are now up 19% year to date. This is a sign that the markets expect the rest of the world to become more competitive in relative terms. This doesn’t mean the US is doing badly. It means it’s not doing as well as we otherwise would be. Which is exactly why economists call tariffs the “invisible tax”. Your economy might do just fine in absolute terms, but you don’t see that you’re doing worse in relative terms in large part because you don’t see the counterfactual outcome.

Investment Strategy - Navigating Regime Change

The page below is from our Global Trend Report, where we connect the jigsaw puzzle of how asset prices, markets & economies are inter-related.

If you’re looking for expert macro-economic research alongside an actionable trading strategy, become a member below.

Why isn’t the Fed cutting rates?

JD Vance asked a good question on Twitter:

“I’d love to hear an argument for why Powell cut rates 50 points right before an election but can’t do it now with inflation lower.”

Trump is very eager to cut rates to stimulate growth. And I don’t disagree with him. I think inflation has come back essentially to target and that the labor market is showing enough fragility that you could easily get rates down to 3.5% or so and feel okay about how loose policy is. And let’s not forget that housing, despite prices being somewhat robust, has been in the doldrums for years now. Most importantly, with inflation at 2.1% on headline PCE and 2.5% on core, I think the Fed can pretty much declare victory. Sure, it’s not exactly at their 2% target, but it’s below the historical average and close enough to target.

But is this the slam dunk argument that it was a year ago when they cut 50? When the Fed cut 0.5% last September, the inflation rate was also 2.1%, but the rate of inflation had been on a one-way trend from 7.2% down to 2.1%. There had been almost no signs of a change in the downward trend and so it was pretty clear that a 5%+ rate was too restrictive relative to 2.1% inflation. And so they cut 1% over the course of the next few quarters and now the Fed Funds Rate is 4.1%. But the problem now is that inflation expectations and inflation itself have been mostly sideways for the last few quarters. Then of course we got the big tariff scare. And although the Fed said it wasn’t likely to cause sustained inflation - after all, 4.1% is restrictive, but it’s not nearly as restrictive as 5.1%.

The bottom line is, I am not especially worried about inflation at present. And I generally agree with the White House that the Fed should be cutting further. But I can also, somewhat, understand the Fed’s position that it’s okay to wait and see. After all, it’s not like the economy is cratering or anything. They feel there’s no need to be overly zealous in either direction. So there are clearly two sides of the argument here, even though I’m firmly in the fed is lagging camp and a moderate pace of further cuts is overdue.

PS: We at GRYNING do 4 things; we highlighted the Global Trend Report in the note above, we recently published the free alpha report for July → Seasonal | July's Trifecta , and later on today we will publish the latest update on our Quantitative Strategies (Market Signals | 23 June 25).

You really should join us…