Multiples

Wall Street regained ground on Thursday afternoon, after falling nearly 1% the day before, boosted by tech stocks.

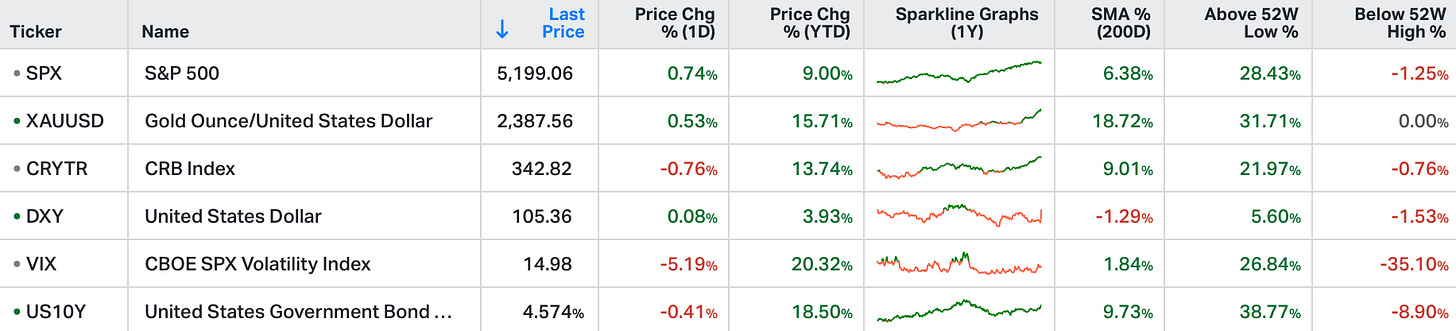

The S&P 500 was up 0.7%, the Nasdaq added 1.4% while the Dow was trading marginally higher.

The PPI data released today offered some relief as prices rose slightly less than anticipated, although all metrics for headline and core consumer prices released yesterday came above forecasts, supporting the Federal Reserve's belief that further evidence of inflation moving steadily towards the 2% target is necessary.

Broadcom, Apple, Nvidia, Nike, Atlassian and Datadog were up more than 3%.

On the other hand, UnitedHealth, Chevron, Boeing, and Verizon were weighing on the Dow.

After the inflation report, we talked about the overreaction in markets.

With a slightly hotter March CPI report, the rhetoric from the investment community surrounding the inflation picture, and the Fed's rate cut prospects, was irrational.

This is a market that's gone from pricing in as many as seven quarter-point rate cuts this year, to five, to three. By the end of yesterday the Wall Street Journal said it was "now a matter of IF," the Fed will cut this year.

Of course, that mentality led to sell-offs the previous day across stocks, and bonds.

That said, only twenty-four hours later the European Central Bank concluded its meeting on monetary policy - they (newly) introduced the possibility of rate cuts in the policy statement (likely June). Moreover, in the press conference Christine Lagarde (ECB President) admitted that there were members that wanted to cut rates today.

This is of particular significance, when evaluating the Fed path, because global central banks have been overtly coordinating policy - so closely, that they repeat the same language. The latest shared mantra has been the need for more "confidence" in the disinflation trend. So, if there was concern that the stall in the U.S. disinflation trend was a signal that another inflation shock was coming, the ECB positioning should offer some sanity.

With the above in mind, the previous move in the Nasdaq was completely reversed yesterday. It was a rare dip to buy in the AI theme, and the investment community showed little patience when presented with the opportunity to buy at lower prices.

On that note, while interest rates and geopolitical noise continue to get most of the media attention, the technology revolution is moving at a sprinter's pace.

This week, Google hosted its annual cloud conference - it was all about AI and Google's (Alphabet's) developing AI ecosystem, and maintaining dominance in the age of generative AI.

Google unveiled its "most powerful, scalable and flexible AI accelerator" chip.

Intel hosted its Vision 2024 conference. It featured a new AI chip called Gaudi 3, which is said to be capable of training large language models 50% faster than Nvidia's H100 chip, and 40% more power efficient.

Apple announced an AI chip this week, to be in the new Mac PCs (an AI personal computer).

Amazon's CEO, Andy Jassy, published his 2023 Letter to Shareholders. He said, "generative AI may be the largest technological transformation since the cloud, and perhaps since the internet." And they have AI chips.

So, everyone has AI chips. And that's good. If Jensen Huang is right (Founder/CEO of Nvidia), the cost to "retool" the world's data centers to accelerated computing has already climbed from $1 trillion to $2 trillion (over the next five years). Given that Nvidia is supplying 90% of it (at the moment), and they've done under $50 billion in data center revenue over the past year, this global computing power transformation has a long way to go.

There's a lot of demand to fulfil, and it's still very early. The $39 billion worth of Chips Act grants started deployment just three weeks ago - we should expect multiples of that amount, in private investments, that will follow the government money.