Let's revisit our discussion on real rates.

We've talked about the trend of falling inflation, the continuation of which would put pressure on the Fed to cut rates aggressively next year, or subject the economy to the consequences of higher and higher (more and more restrictive) real interest rates (i.e. the difference between the Fed Funds Rate and the inflation rates).

Of course, rising real rates would create even tighter financial conditions - by overtightening the Fed could find itself following the mistake of 2021 (pouring fuel on the inflationary fire) with the opposite mistake in 2024 (inducing recession, if not a deflationary bust).

What happens in a deflationary bust, after you've blown out trillions of dollars in fiscal spending, ballooning the government debt to record levels in the process?

You don't get the intended outcome, which is a nominal growth boom to (hopefully) more than offset the surge in debt. Instead, you become Japan, which has spent four decades trying to emerge from the deflationary spiral. Deflation is much harder to beat than inflation.

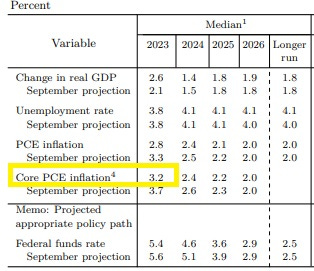

So, the Fed cannot make a mistake this time. In the current case, they cannot be too slow to remove pressure on the economic brake pedal. The consequences would be catastrophic. That said, they did indeed eliminate the December hike they projected back in September. Moreover, they have projected three rate cuts next year. Sounds good, right? The markets liked it. But this (highlighted in yellow) was the most important number in the Fed projections …

Remember, Jerome Powell leaked the November core PCE (due to be published December 22). At 3.1%, that's a fall from the previous 3.5% year-over-year rate. That's a quickening of disinflation and as you can see in the image above, they have it settling at 3.2% for year end 2023 (which would be the December data, due to be reported in January).

What does it all mean?

It means inflation is moving faster than the Fed and that means that policy is getting more restrictive.

In fact, with the available data prior to the Fed meeting, the current real rate was 1.8%. After the Fed disclosed its well informed estimate, it's now 2.2%. That's forty basis points tighter. If we go into the 2024 projection, even as the Fed has projected cuts, the fall in the inflation projection leaves us with a steady 2.2% real rate through 2024.

That's firmer downward pressure on the economy, and inflation.

Bottom line: The Fed will have to move faster and more aggressively. The interest rate market is pricing that in - with expectations for a Fed Funds rate below 4% by the end of next year.

The 10-year yield has already anticipated the easing, now back below 4%, and probably finding support into this trendline.

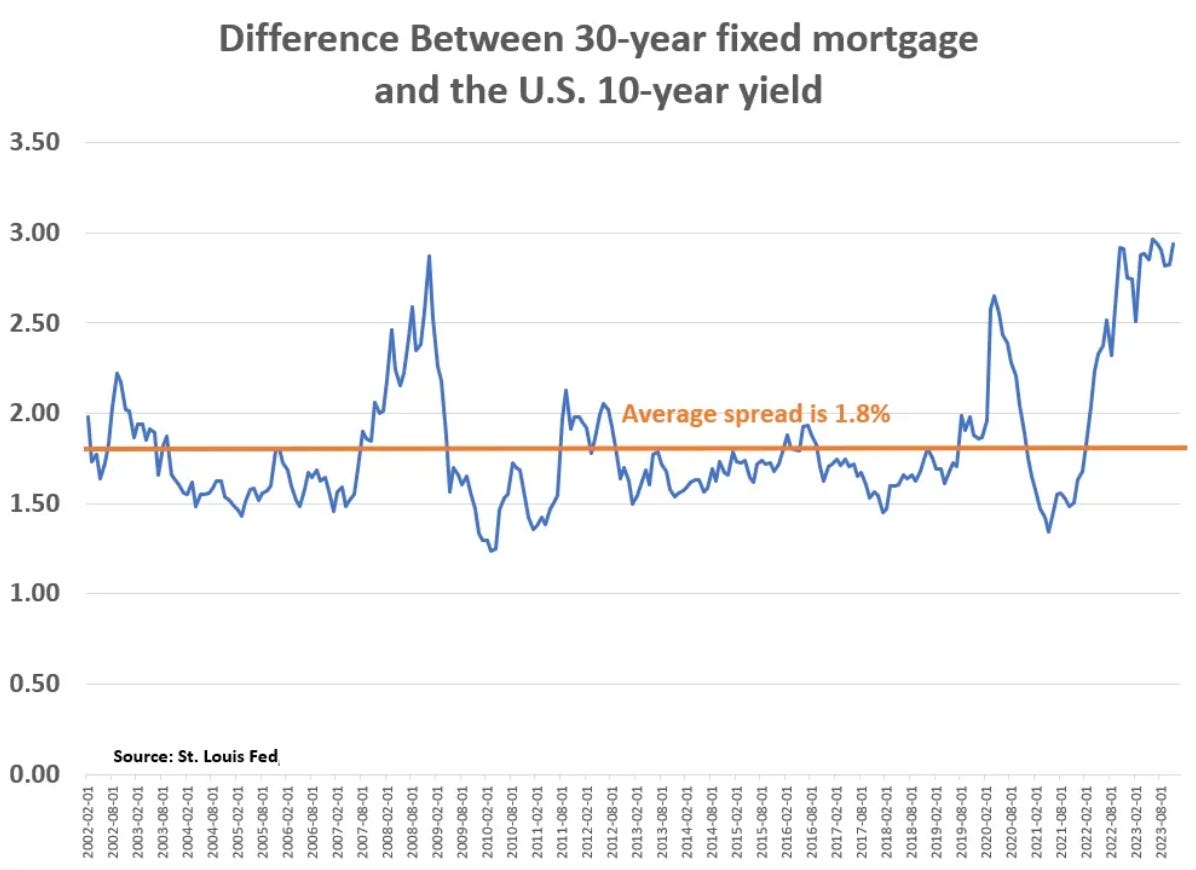

What does this move in the 10-year mean for mortgage rates?

Below is the historical spread between the 30-year fixed mortgage rate and the 10-year yield - it's already at the extreme of the range. Returning to the average spread of this 20-year history (1.8%), assuming the 10-year settles around 4%, we should see mortgage rates falling to the high 5% area.

I wish you a wonderful weekend.