The midterm elections were a year ago.

We talked about the midterm election analogue - going back to 1962, there has never been a 12-month period, following a midterm election, in which stocks were down. The average one-year return, following the fifteen midterm-elections of the past sixty years, was +16% (about double the long-term average return of the S&P 500).

That record still stands. As of yesterday's close, stocks delivered a 16% total return over the past twelve months.

Now, the expected outcome going into last year's midterm election was, at the very least, a divided Congress. After the fiscal insanity of the previous two years, gridlock on Capitol Hill would be welcomed.

We did indeed get a divided Congress. But instead of fiscal restraint, we've had more fiscal insanity. This past summer, the Republican-led House agreed to suspend the debt ceiling through 2025, giving the Treasury license to issue unlimited debt for the next two years (through the end of the Biden first term).

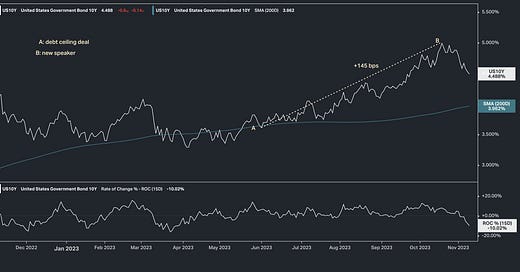

The interest rate market did this . . .

Now, however, we have change - a new Republican Speaker of the House.

The early indications suggest that this leadership will bring action against the excesses of the past two years, which came from the aligned government.

The recent slide in rates is probably no coincidence.

Research that is trusted by traders, pm’s & top firms to surface broader, deeper and more differentiated insights at speed.

Cut through the noise and get straight to the signals - become a member below.