Mid-Next Year

US stocks closed sharply higher on the first trading day of the week, tracking the rise for Treasury securities as markets pared back concerns that a fresh trade war could hamper the corporate outlook.

The S&P 500 gained 2% while the Dow jumped 1.8% and the Nasdaq 100 advanced 2.4%.

In the meantime, long-dated Treasuries enjoyed some respite as Japan signaled it may pull back on long-curve issuance, aiding credit-sensitive stocks in the US.

Tesla surged 6.5% after CEO Elon Musk said he would refocus on his companies and ease political involvement.

Additionally, Nvidia added 3% to set the pace for chipmakers ahead of its earnings this week.

We get Nvidia earnings.

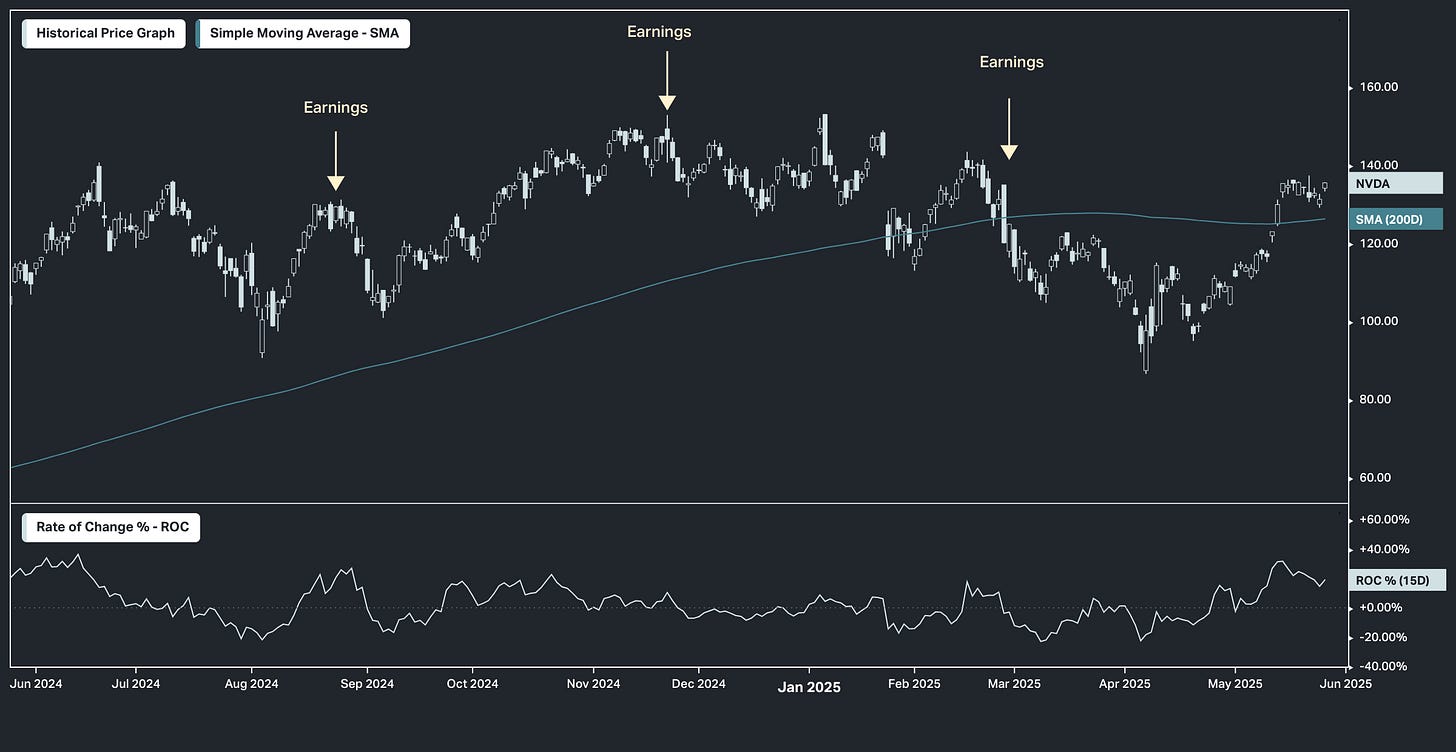

And we'll go in with the stock trading around the same levels as its January earnings event. But as you can see, it returns to these levels after a 35 percent drawdown, which took almost three months to recover.

And in this chart you can see the post-earnings declines, which have become the pattern of the past few earnings events.

The February earnings event came with a big one - an 11% decline.

Why?

As we've discussed along the way, Nvidia data center revenue has been telling a very clear story. There's a supply issue.

The growth in data center revenue has been on a rhythm of about $4 billion a quarter since the second half of 2023. This means the trajectory Nvidia's revenue growth rate continues to be down.

However, the backlog of demand for Nvidia's most advanced chips is only getting bigger and bigger.

Just a few weeks ago the Trump administration was said to be considering allowing Nvidia to sell a million chips to the UAE. That would be a $30 billion deal. For context, Nvidia probably did $40 billion in data center revenue last quarter.

Add to that, the American tech giants are already lined up with hundreds of billions of dollars committed to buy as many chips as Nvidia can supply them. So, halting and reversing Nvidia's declining growth rate depends entirely on bringing new global manufacturing capacity online.

It's underway - in the U.S.

But when will it come online? It sounds like mid-next year, at the earliest.

Until then, the path for Nvidia trend revenue growth would fall below 50% (chart below).

But with 56% net income margins, the stock would get cheaper and cheaper along the way. The forward PE (on an annual revenue run rate) would be in the mid-20s by mid-next year on the current $3.3 trillion valuation.

For the commodity traders amongst you, please find below the free weekly Commodity Chartbook.