Weekly Market Signals

Performance of SIX trading strategies (more information); Tactical asset allocation, mean reversion, cross-sectional momentum, and equity long-short with weekly and monthly updating.

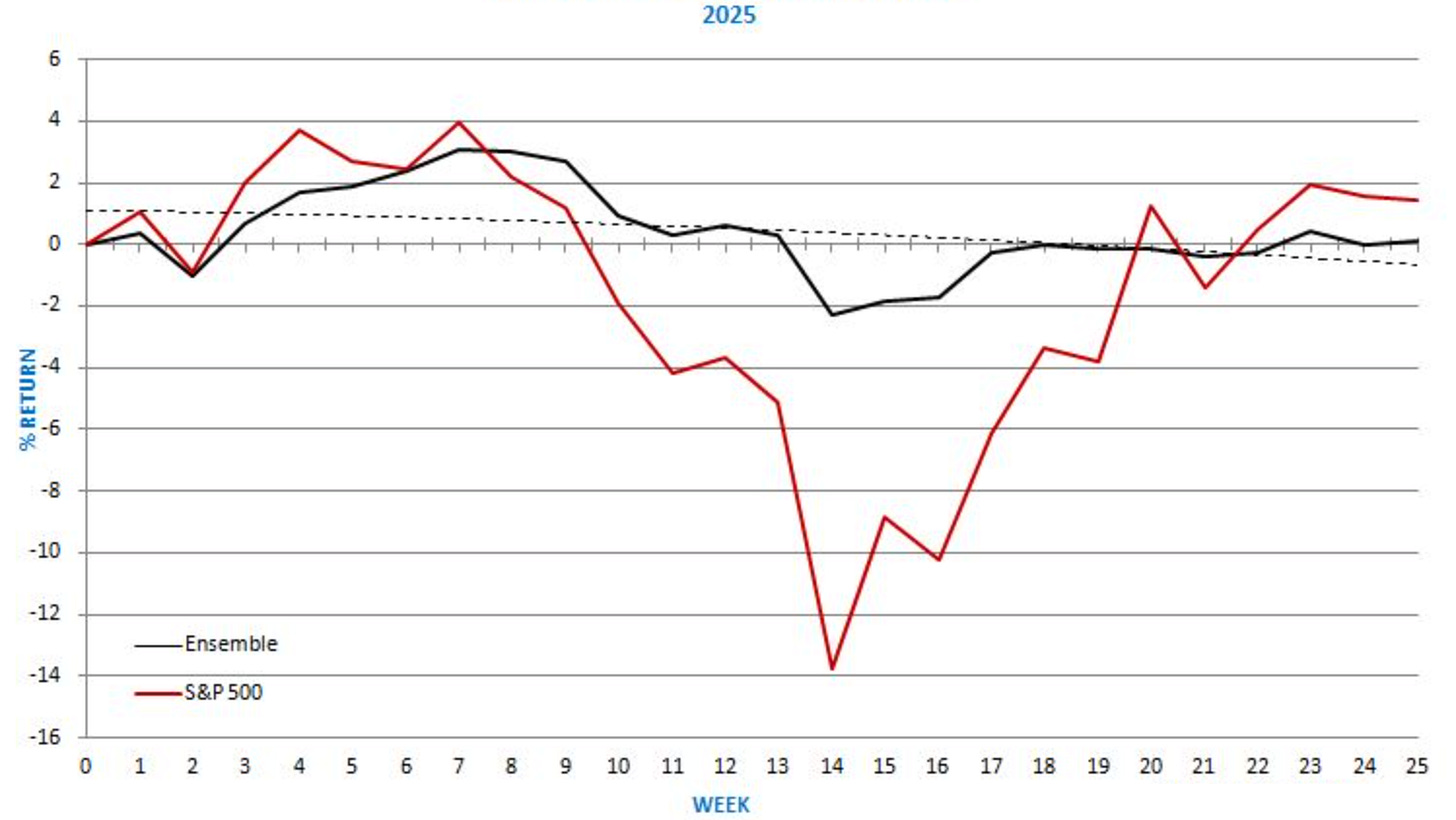

Performance of the six strategy ensemble and benchmarks

Comments

Rational assessments of the possible outcomes of the war and tariffs have driven market action but also wishful thinking. Although historically similar conflicts have ended with a rally in equity prices due to favourable resolutions, there is always a small element of surprise due to known but also unknown risks. We expect that the ensemble will provide superior risk-adjusted returns even in the event of a surprise, and this is one of its main purposes.

This week, the changes in strategy performance were small. Dow-30 long-short and mean-reversion offered above-market returns. The net result was a small gain for the ensemble overall. Year-to-date, the ensemble has fulfilled its main purpose well.

The SPY ETF mean-reversion strategy has underperformed since 2022, and we are considering replacing it next year with a strategy that improves diversification. We do not replace strategies often but only when it becomes necessary. For instance, the issuer’s termination of numerous commodity ETFs resulted in the discontinuation of the ETF trend-following strategy. The sector rotation strategy replaced the commodity ETF strategy.

Subscribe below to access the positions and performance of the individual strategies alongside the signal summary for this week.

Daily Mean Reversion is one of the strategies that is available as part of the “One Solution, Multiple Benefits” ten (10) strategy rule pack (more information).

Daily Mean Reversion

The mean-reversion strategy uses our algorithm to generate long-only signals for two ETFs and now with S&P 100 stocks in the daily timeframe. The updates are typically available by 7:00 a.m. (ET) on weekdays.

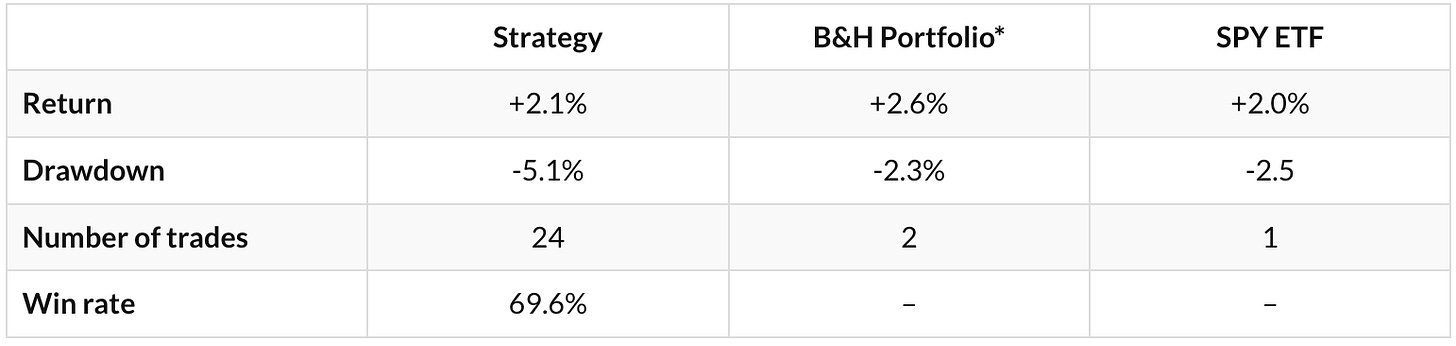

Daily Mean Reversion | Performance with SPY and QQQ (ytd)

* 50% SPY ETF and 50% QQQ ETF

Daily Mean Reversion | Performance with S&P 100 stocks since March 24, 2025

Summary Table | Ten Strategy Pack

The strategies we have developed are based on the following two principles: simplicity and economic value.

Simplicity reduces the probability of overfitting and data-mining bias. Economic value is necessary in the form of reasonable alpha and risk-adjusted returns.

The rules of 10 strategies are available for sale in a bundle. The rules we provide are sufficient for programming the strategies on a trading platform. The strategies are not data-mined and have simple rules.

Delivery: The trading rules are in the form of “private content” sent out via email seven days after payment.

Terms: We make no refunds on any purchase, and all sales are final. No refunds are given for cancellations or under any circumstances, and there is no exception.

Strategy code: We provide the rules in plain English. The customer will need to convert those rules to code before testing them on a backtesting platform.