Weekly Market Signals

Performance of SIX trading strategies (more information); Tactical asset allocation, mean reversion, cross-sectional momentum, and equity long-short with weekly and monthly updating.

Performance of the six strategy ensemble and benchmarks

The S&P 500 index gained 1.9% in the holiday-shortened week but did not recover a 2.6% loss from the previous week. After a 2% gain on Tuesday, May 27, 2025, the stock market moved sideways and, on the weekly chart, formed an “inside bar.”

Despite calls for a sustained rise in equities due to deficit spending and tax cuts, risks of a large correction remain elevated due to multiple risk factors, including but not limited to rising long-end yields and geopolitics. Many analysts continue to maintain a mindset from the post-pandemic and even post-GFC era, despite a significant shift in risk drivers.

Those who understand that the equity markets can rise in the long term but may also experience an “uncle point” and significant losses along the way employ strategies to lower beta exposure while recognising that this approach may negatively impact performance in the short to medium term. A well-designed strategy ensemble is one way of damping volatility and dealing with elevated market risk. The primary objective of a strategy ensemble is to preserve capital and maintain low beta, thereby providing “peace of mind.”

The most recent update for the FOUR asset allocation models can be found here.

Daily Mean Reversion is one of the strategies that is available as part of the “One Solution, Multiple Benefits” ten (10) strategy rule pack (more information).

Daily Mean Reversion

The mean-reversion strategy uses our algorithm to generate long-only signals for two ETFs and now with S&P 100 stocks in the daily timeframe. The updates are typically available by 7:00 a.m. (ET) on weekdays.

Daily Mean Reversion | Performance with SPY and QQQ (ytd)

* 50% SPY ETF and 50% QQQ ETF

Historical Performance Ending 01/03/2000-12/31/2024

SPY and QQQ ETFs (50% allocation to each ETF, $0.01/share commission)

The following pairs can also be used in place of SPY and QQQ:

SSO and QLD for 2x leverage.

SPXL and TQQQ for 3x leverage.

ES and NQ futures.

Win rate is 69.1%, 1,389 trades, average holding period is 4.8 days, exposure is 41.4%. Performance is indicative only and depends on execution, slippage, and commissions.

SPY: The mean waiting time between signals has been 6.5 days, and 3 standard deviations are at 23.2 days.

QQQ: The mean waiting time between signals has been 4 days, and 3 standard deviations are 14.3 days.

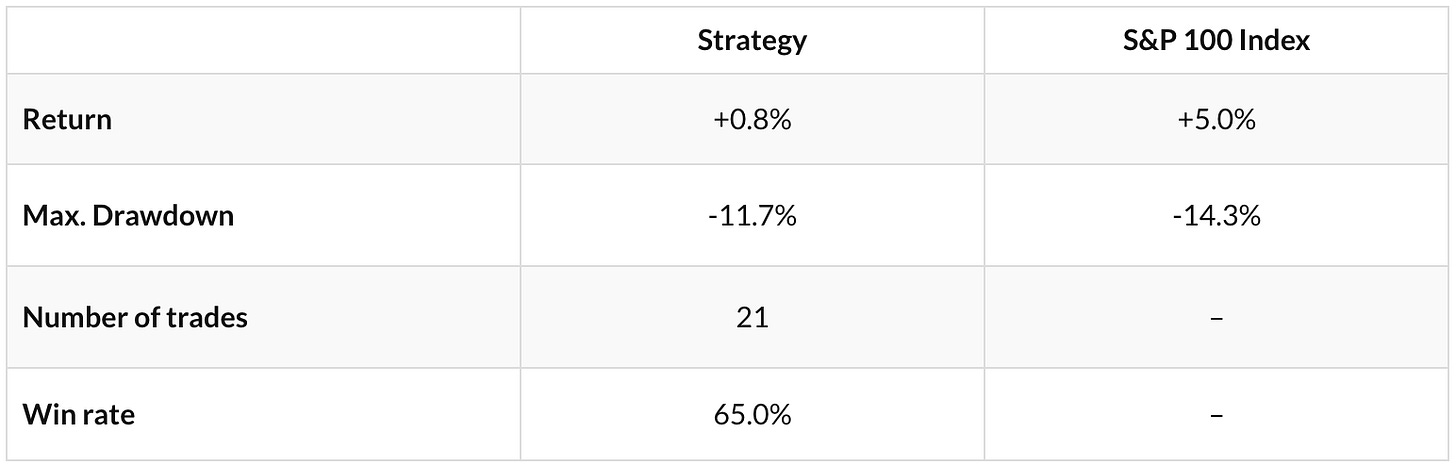

Daily Mean Reversion | Performance with S&P 100 stocks since March 24, 2025

Summary Table | Ten Strategy Pack

The strategies we have developed are based on the following two principles: simplicity and economic value.

Simplicity reduces the probability of overfitting and data-mining bias. Economic value is necessary in the form of reasonable alpha and risk-adjusted returns.

The rules of 10 strategies are available for sale in a bundle. The rules we provide are sufficient for programming the strategies on a trading platform. The strategies are not data-mined and have simple rules.

Delivery: The trading rules are in the form of “private content” sent out via email seven days after payment.

Terms: We make no refunds on any purchase, and all sales are final. No refunds are given for cancellations or under any circumstances, and there is no exception.

Strategy code: We provide the rules in plain English. The customer will need to convert those rules to code before testing them on a backtesting platform.