Weekly Market Signals

Performance of six trading strategies; Tactical asset allocation, mean reversion, cross-sectional momentum, and equity long-short with weekly and monthly updating.

Performance of the six strategy ensemble and benchmarks

Comments

This week the ensemble performance fell 0.4% versus a loss of 1.5% for the S&P 500 index. The year-to-date performance of the ensemble remains positive. The main contributors this week were ETF cross-sectional momentum and Dow-30 long-short.

The performance in the first quarter of this year shows how strategy ensembles have the potential to minimise losses during periods of high market uncertainty. Often, the trade-off is underperformance during a strong equity bull market. Some passive index investors may never realise the long-term performance of the equity markets because they panic during falling markets and sell.

The lower but less volatile-on-average performance of a strategy ensemble may offer protection and even outperformance over the long term. There are no guarantees in the markets, and an ensemble is just one way to minimise risks and maximise reward.

Daily Mean Reversion and the Futures Trend Following are two of the strategies that are available as part of the “One Solution, Multiple Benefits” ten (10) strategy rule pack (more information).

Daily Mean Reversion

Daily Mean Reversion | Performance with SPY and QQQ

The following pairs can also be used in place of SPY and QQQ:

SSO and QLD for 2x leverage.

SPXL and TQQQ for 3x leverage.

ES and NQ futures.

Win rate is 69.1%, 1,389 trades, average holding period is 4.8 days, exposure is 41.4%. Performance is indicative only and depends on execution, slippage, and commissions.

SPY: The mean waiting time between signals has been 6.5 days, and 3 standard deviations are at 23.2 days.

QQQ: The mean waiting time between signals has been 4 days, and 3 standard deviations are 14.3 days.

We have added long-only mean-reversion signals for a small subset of S&P 100 stocks. There will be a testing period of three months before we decide whether we will continue offering the stock mean-reversion signals.

Historical Performance Ending 01/03/2000-12/31/2024

SPY and QQQ ETFs (50% allocation to each ETF, $0.01/share commission)

Futures Trend Following

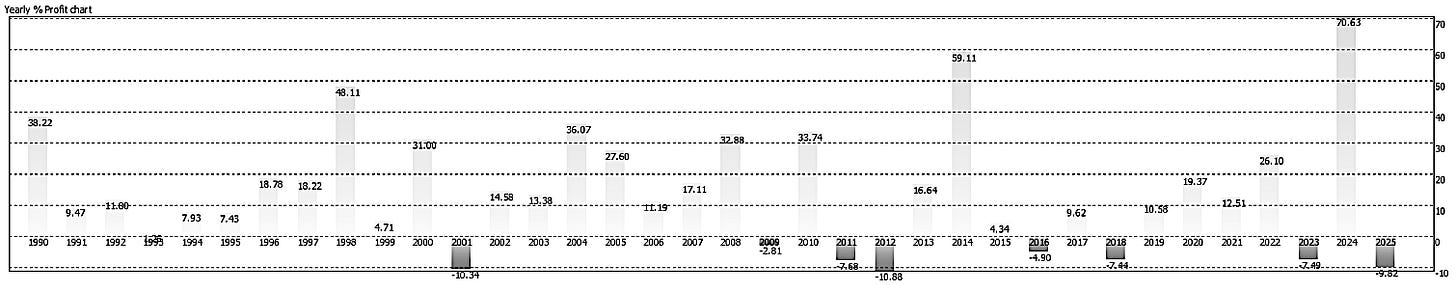

Updated (weekly) after the close of Friday, March 28, 2025 (backtest)

The strategy is down 9.8% year-to-date.

The drawdown from equity highs is 14.2%.

There are 14 open positions, 9 long and 5 short.

Details of the strategy used:

Timeframe: Daily

Strategy Type: trend-following based on breakouts, exit long, and reverse to short with stop-loss.

Maximum positions: 23, long or short.

Position size: Based on stop-loss and maximum risk per position.

Trade entry: All trades are executed at the opening of the next bar.

Stop-losses: All stop-losses are executed intraday.

Summary Table | Ten Strategy Pack

If you would like to purchase the rules of the Ten Strategy Pack, click on the button below.

Next Day Model

NDM and NDMVix are machine learning algorithms (statistical models) based on alternative data – dark pool data and options dealer gamma exposure (DIX, GEX and VIX Futures) – with the goal to predict the direction of the next day move in the S&P 500 index; futures or ETF’s.

Last week, our Next Day Model Vix (NDMVix) was right 4/5 days for a net +176 points in SPX. The two models are available as a standalone annual subscription.