Weekly Market Signals

Performance of SIX trading strategies (more information); Tactical asset allocation, mean reversion, cross-sectional momentum, and equity long-short with weekly and monthly updating.

Performance of the six strategy ensemble and benchmarks

Comments

After two weeks of sideways action, the S&P 500 index surged 3.4%. The strategies performed well, except for the ETF cross-sectional momentum strategy, which struggled due to a decline in gold and commodity prices.

The Dow-30 long-short strategy made a strong comeback this week with 5 winners - 3 long and 2 short - and a gain of 2.8% for the week. The sector rotation strategy delivered the best performance, with a gain of 3.4%.

Note that on Tuesday, July 1, 2025, we will rebalance the two monthly strategies before the market opens. Additionally, the market will be closed on July 4, 2025, due to the holiday. Enjoy the holiday!

Daily Mean Reversion is one of the strategies that is available as part of the “One Solution, Multiple Benefits” ten (10) strategy rule pack (more information).

Daily Mean Reversion

The mean-reversion strategy uses our algorithm to generate long-only signals for two ETFs and now with S&P 100 stocks in the daily timeframe. The updates are typically available by 7:00 a.m. (ET) on weekdays.

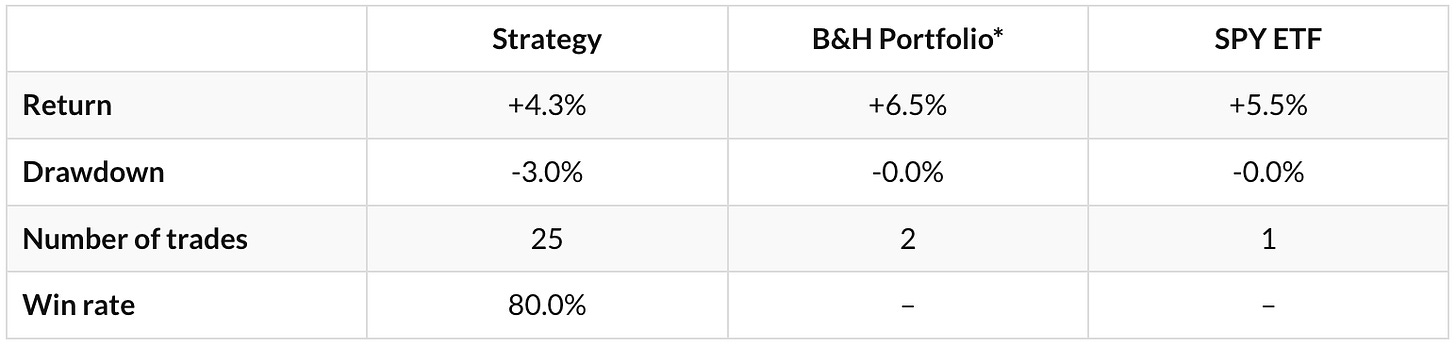

Daily Mean Reversion | Performance with SPY and QQQ (ytd)

* 50% SPY ETF and 50% QQQ ETF

Daily Mean Reversion | Performance with S&P 100 stocks since March 24, 2025

Summary Table | Ten Strategy Pack

The strategies we have developed are based on the following two principles: simplicity and economic value.

Simplicity reduces the probability of overfitting and data-mining bias. Economic value is necessary in the form of reasonable alpha and risk-adjusted returns.

The rules of 10 strategies are available for sale in a bundle. The rules we provide are sufficient for programming the strategies on a trading platform. The strategies are not data-mined and have simple rules.

Market Statistics

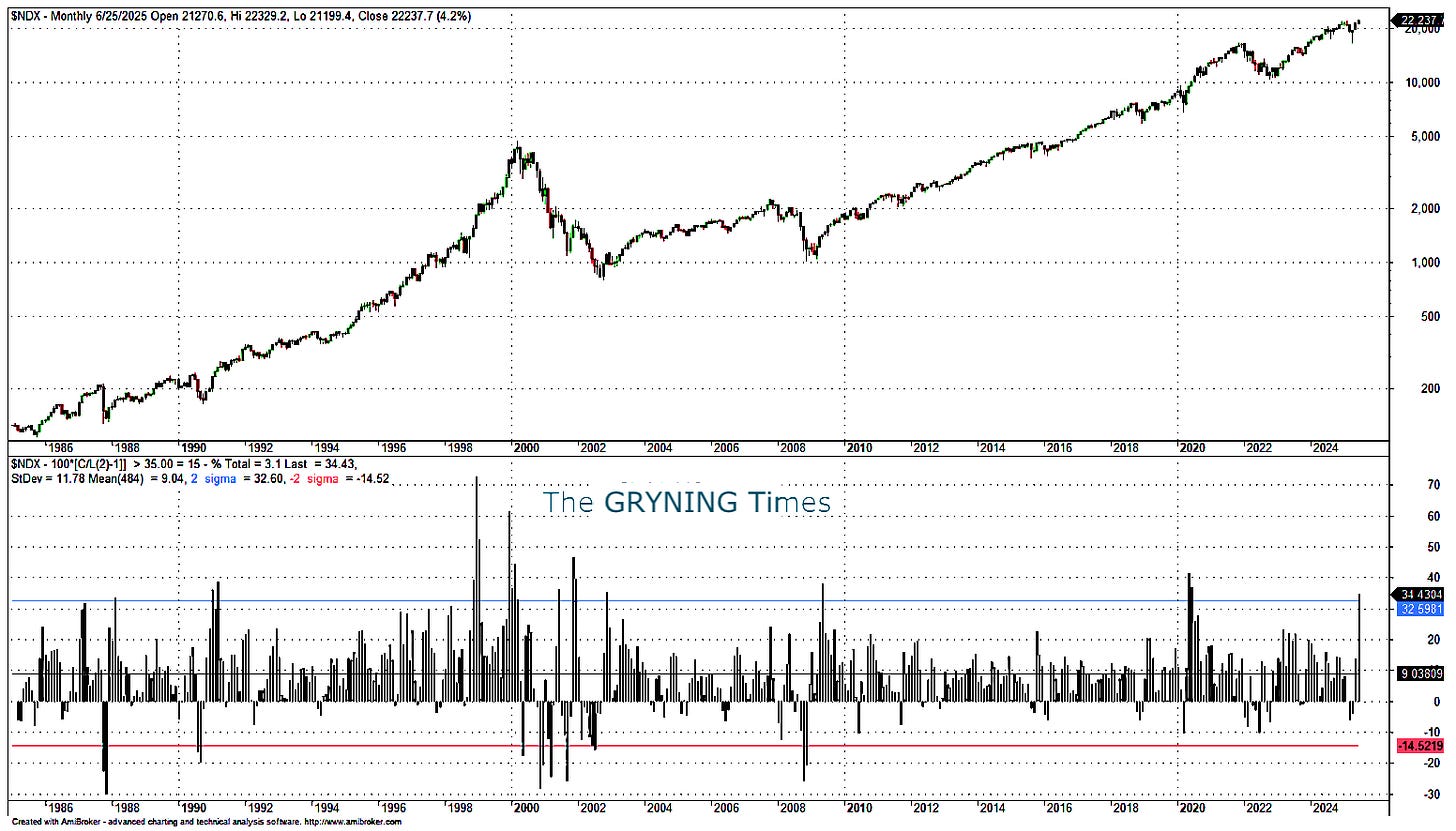

A 34.4% gain for the NASDAQ-100 index from the low of April 7, 2025, to the close of June 25, 2025, is an outlier gain but not improbable or unusual.

The chart shows the histogram of monthly returns from the close of a month to the low of two months ago. Indeed, the latest return is 34.4%. The mean of the sample, 484 in total, is 9.04%, and the standard deviation is 11.78%. Therefore, the move was slightly above two standard deviations.

The excess kurtosis (-3) of the distribution is 3.35, and the skew is 0.53. The chart also confirms that there are several outliers in the right tail, with 15 of them exceeding 35%. The rank of the 34.4% return is approximately 96.9%, indicating that 3.1% of the observations have exceeded this test return.

Delivery: The trading rules are in the form of “private content” sent out via email seven days after payment.

Terms: We make no refunds on any purchase, and all sales are final. No refunds are given for cancellations or under any circumstances, and there is no exception.

Strategy code: We provide the rules in plain English. The customer will need to convert those rules to code before testing them on a backtesting platform.