Weekly Market Signals

Performance of six trading strategies (more information); Tactical asset allocation, mean reversion, cross-sectional momentum, and equity long-short with weekly and monthly updating.

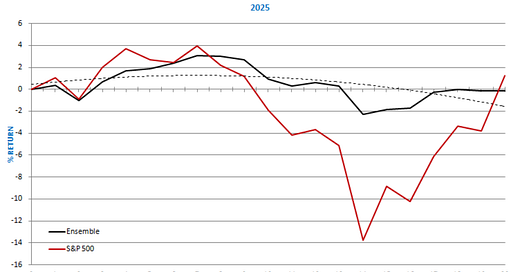

Performance of the six strategy ensemble and benchmarks

Mission accomplished

The stock market (S&P 500 index) has gained 23.23% from the low of April 7, 2025. In six weeks, the index went from a 15.2% loss for the year to a gain of 1.3%. A 4-standard deviation gain of this magnitude has only occurred previously three times, near the 1974, 2009, and 2020 bottoms. The main driver of this market rebound was the “disorderly retreat” of the administration in the tariff war, which was followed by an announcement supporting a few industries through investments by Middle Eastern countries.

Because strategy ensembles typically aim for a low beta, they are unable to track these types of market movements. Due to a strong short-covering rally and rebound in stocks, the Dow-30 long-short hedge has given up all of its earlier gains during the year and is now in the red. However, this strategy played a key role in “smoothing” returns during a period of turmoil in the markets and thus fulfilled its purpose.

Profit-taking in gold this week hit ETF cross-sectional momentum, yet this strategy still outperforms the S&P 500 index. Sector cross-sectional momentum gained 4.2% this week, and that counterbalanced the losses in ETF cross-sectional momentum and Dow-30 long-short. The net result was a flat performance for the ensemble this week versus a large gain for the S&P 500. However, the ensemble has performed as expected.

We like to remind our readers and followers that our reports are transparent about signals and positions, and there is no ambiguity, although there may be differences in performance calculations due to slippage and other trading friction effects. We report all entries and exits in advance for the first trading day of the following week or month. We do not make vague claims about entries and exits depending on whether the price action was favourable or not. We do not try to guess the market; we follow strategies. Trying to guess the market may offer high short-term gains occasionally, but the long-term expectation is negative, and experienced market professionals know this well.

Daily Mean Reversion is one of the strategies that is available as part of the “One Solution, Multiple Benefits” ten (10) strategy rule pack (more information).

Daily Mean Reversion

The mean-reversion strategy uses our algorithm to generate long-only signals for two ETFs and now with S&P 100 stocks in the daily timeframe. The updates are typically available by 7:00 a.m. (ET) on weekdays.

Daily Mean Reversion | Performance with SPY and QQQ (ytd)

* 50% SPY ETF and 50% QQQ ETF

Historical Performance Ending 01/03/2000-12/31/2024

SPY and QQQ ETFs (50% allocation to each ETF, $0.01/share commission)

The following pairs can also be used in place of SPY and QQQ:

SSO and QLD for 2x leverage.

SPXL and TQQQ for 3x leverage.

ES and NQ futures.

Win rate is 69.1%, 1,389 trades, average holding period is 4.8 days, exposure is 41.4%. Performance is indicative only and depends on execution, slippage, and commissions.

SPY: The mean waiting time between signals has been 6.5 days, and 3 standard deviations are at 23.2 days.

QQQ: The mean waiting time between signals has been 4 days, and 3 standard deviations are 14.3 days.

Daily Mean Reversion | Performance with S&P 100 stocks since March 24, 2025

Summary Table | Ten Strategy Pack

The strategies we have developed are based on the following two principles: simplicity and economic value.

Simplicity reduces the probability of overfitting and data-mining bias. Economic value is necessary in the form of reasonable alpha and risk-adjusted returns.

The strategies are suitable for traders with basic knowledge of programming and testing rules on backtesting platforms. We provide the rules only. We do not provide any code.

Limited Time | Dynamic Three

The Dynamic-3 bundle includes the rules of the following strategies: MRMOM, ETFMR, and ETFMO. These long-only strategies operate in the daily timeframe (OHLC).

The rules we provide are sufficient for programming the strategies on a trading platform. The strategies are not data-mined and have simple rules.

The special price of the Dynamic-3 bundle is £2000 ( BUY ), but this offer is only available for a limited time and will end without notice. This offer is valid for retail customers and traders.

The MRMOM strategy generates signals for GLD, QQQ, SPY, and TLT ETFs.

The ETFMR strategy generates signals for SPY and QQQ ETFs.

The ETFMO strategy generates signals for a leveraged ETF that operates independently of the equity markets. This simple strategy trades only a few days during each month and is uncorrelated to the stock market.

Delivery: The trading rules are in the form of “private content” sent out via email seven days after paying for a subscription to the strategies.

Terms: We make no refunds on any purchase, and all sales are final. No refunds are given for cancellations or under any circumstances, and there is no exception.

Strategy code: We provide the rules in plain English. The customer will need to convert those rules to code before testing them on a backtesting platform.