Weekly Market Signals

Performance of six trading strategies; Tactical asset allocation, mean reversion, cross-sectional momentum, and equity long-short with weekly and monthly updating.

Performance of the six strategy ensemble and benchmarks

In 2024, the strategy ensemble gained 12% with a 3.4% maximum drawdown.

Performance of the four asset allocation models

Hybrid asset allocation (HAA) employs two strategies: asset cross-sectional momentum and strategic allocation. The asset cross-sectional momentum strategy and the strategic allocation strategy generate signals in the monthly timeframe.

The Dynamic Momentum Strategy trades the SPY ETF with a proprietary timing algorithm. The objective is to avoid market corrections and maximise the Sharpe ratio.

Cross-sectional momentum: +3.8% ytd return, 0.0% ytd drawdown

Strategic asset allocation: +2.1% ytd return, 0.0% ytd drawdown

HAA (50-50): +3.0% ytd return, 0.0% ytd drawdown

Dynamic momentum: +2.7% ytd return, 0.0% ytd drawdown

2024 performance:

Cross-sectional momentum: +16.7 return, -1.9% drawdown

Strategic asset allocation: +17.8% return, -2.2% drawdown

HAA (50-50): +17.3% return, -2.1% drawdown

Dynamic momentum: +24.87% return, -3.9% drawdown

Below is a performance comparison table for HAA from January 2020 to January 2025 (in the monthly timeframe).

According to historical backtests, our strategy ensemble and asset allocation models have the potential to reduce risk while improving performance based on risk-adjusted returns. The high win rate, reduced market exposure, and high Sharpe and skew ratios can help decrease the probability of experiencing a significant loss.

You can access the 6 strategy ensamble with 4 asset allocation models as a standalone quarterly service or as part of a hugely discounted service offering all Gryning strategies and information content (more information).

Next Day Model

NDM and NDMVix are machine learning algorithms (statistical models) based on alternative data – dark pool data and options dealer gamma exposure (DIX, GEX and VIX Futures) – with the goal to predict the direction of the next day move in the S&P 500 index (SPX).

Investing by Design is an all-in-one strategy and information package that gives you robust foundations for your trading business.

Daily Mean Reversion and the Futures Trend Following are two of the strategies that are available as part of the “One Solution, Multiple Benefits” 10 strategy rule pack.

Daily Mean Reversion

Daily Mean Reversion | Performance with SPY and QQQ

The following pairs can also be used in place of SPY and QQQ:

SSO and QLD for 2x leverage.

SPXL and TQQQ for 3x leverage.

Performance with SPXL and TQQQ

* Start date: June 27, 2023. The allocation to the signals of the two ETFs is 50% of closed equity. Performance is indicative only and depends on execution, slippage, and commissions.

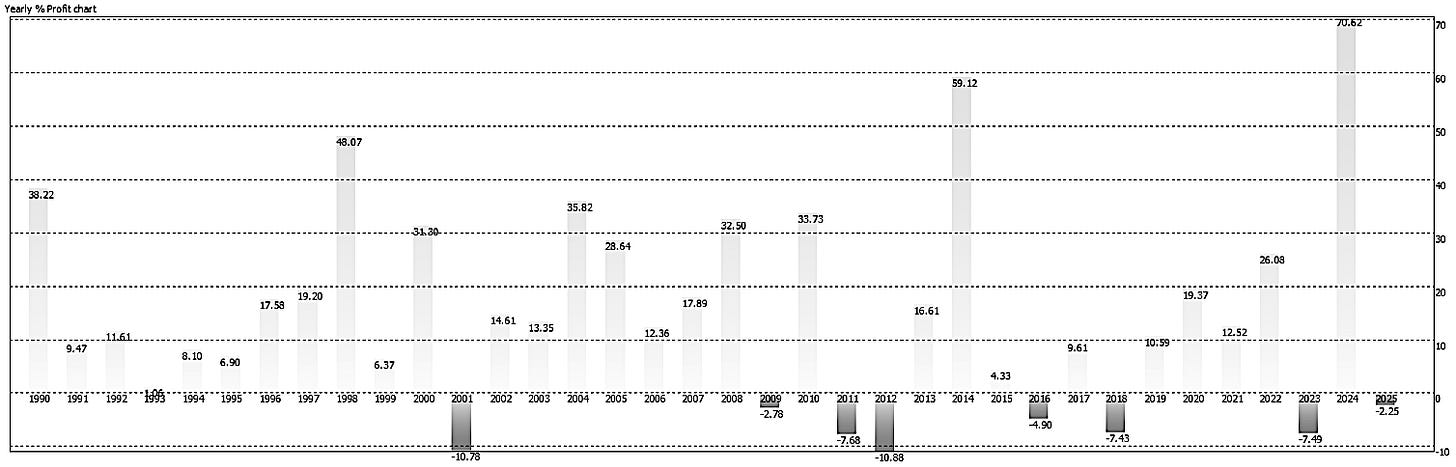

Historical Performance Ending 01/03/2000-12/31/2024

SPY and QQQ ETFs (50% allocation to each ETF, $0.01/share commission)

Win rate is 69.1%, 1,389 trades, average holding period is 4.8 days, exposure is 41.4%. Performance is indicative only and depends on execution, slippage, and commissions.

SPY: The mean waiting time between signals has been 6.5 days, and 3-standard deviations are at 23.2 days.

QQQ: The mean waiting time between signals has been 4 days, and the three-standard deviations are 14.3 days.

Futures Trend Following

Update after the close of Friday, February 14, 2025 (backtest):

The strategy is down 2.3% year-to-date.

The drawdown from equity highs is 7%.

There are 14 open positions, 13 long and 1 short.

Summary Table | Ten Strategy Pack

Rules to the 10 strategies are available for purchase and are also made available as part of the hugely discounted Investing by Design package.

The strategies are suitable for traders with basic knowledge of programming and testing rules on backtesting platforms. We provide the rules only. We do not provide any code.

Delivery: The trading rules are in the form of “secure content” via private email.

Terms: All sales are final, and no refunds will be made on any purchase. No refunds are given for cancellations or under any circumstances, and there is no exception.

Strategy code: We provide the rules in plain English. The customer will need to convert those rules to code before testing them on a backtesting platform.