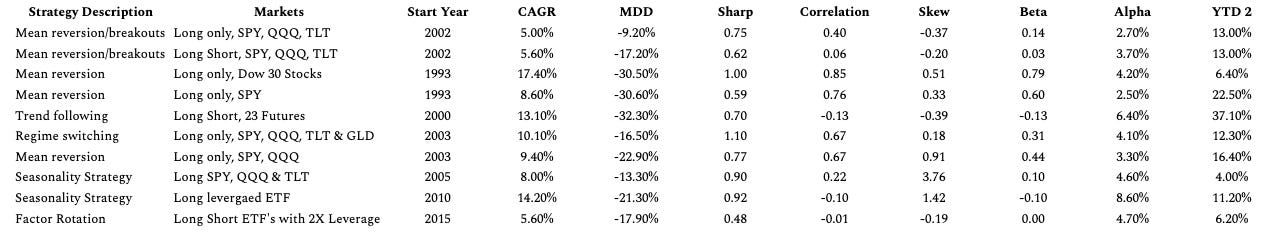

Performance of six trading strategies; Tactical asset allocation, mean reversion, cross-sectional momentum, and equity long-short with weekly and monthly updating.

Performance of the six strategy ensemble and benchmarks

In 2024, the strategy ensemble gained 12% with a 3.4% maximum drawdown. The four asset allocation models are updated on a monthly basis.

Dynamic Momentum strategy: 2024 return 24.9%, maximum drawdown -4%

Hybrid Asset Allocaion strategy: 2024 return 16.7%, maximum drawdown -2.1%

Membership: Quarterly

Membership: Annual (25% off)

Daily Mean Reversion and the Futures Trend Following are two of the strategies that are available as part of the “One Solution, Multiple Benefits” 10 strategy rule pack. For more information, click here, or buy now by clicking below.

Purchase Strategies

Daily Mean Reversion | Performance with SPY and QQQ

The following pairs can also be used in place of SPY and QQQ:

Performance with SPXL and TQQQ

* Start date: June 27, 2023. The allocation to the signals of the two ETFs is 50% of closed equity. Performance is indicative only and depends on execution, slippage, and commissions.

Daily Equity Performance (SPY and QQQ): 06/27/2023 – 01/17/2025 (updated weekly)

Win rate is 69.1%, 1,389 trades, average holding period is 4.8 days, exposure is 41.4%. Performance is indicative only and depends on execution, slippage, and commissions.

SPY: The mean waiting time between signals has been 6.5 days, and 3-standard deviations are at 23.2 days.

QQQ: The mean waiting time between signals has been 4 days, and the three-standard deviations are 14.3 days.

Strategy Spotlight | Furures Trend Following | Performance 2024

Purchase Strategies

Disclaimer

All sales and memberships will commence seven (7) days after confirmation has been received, with the processing time added to the end of the membership period to ensure a full time allocation.

Disclaimer: The premium content is offered for informational purposes only and none of the information in it constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The author of the premium content is not a financial adviser; he is not advising, and he will not advise you personally concerning the nature, potential, value, or suitability of any particular security, portfolio of securities, transaction, investment strategy, or other matter. To the extent any of the information contained in the premium content may be deemed to be investment advice, such information is impersonal and not tailored to the investment needs of any specific person.

Any trading signals or trading systems are provided for informational purposes only and do not constitute investment advice or actionable content. We do not warrant the accuracy, completeness, fitness, or timeliness for any particular purposes of the trading signals or trading systems. Under no circumstances, trading signals should be treated as financial advice. Trading involves substantial risks, including possible loss of principal and other losses. If investment or other professional advice is required, the services of a licensed professional should be consulted. The subscription to market signals does not include disclosure of any strategy rules.

From time to time, the author of the premium content may hold positions or other interests in securities mentioned in the service posts and may trade for their account based on the information presented. The author of the premium content may also take positions inconsistent with the views expressed in the service posts.