Weekly Market Signals

Performance of SIX trading strategies (more information); Tactical asset allocation, mean reversion, cross-sectional momentum, and equity long-short with weekly and monthly updating.

Performance of the six strategy ensemble and benchmarks

Asset Allocation Models: A Dual Approach to Market Timing

The asset cross-sectional momentum strategy (CSMOM) and the strategic allocation strategy (MOMMF) generate signals in the monthly timeframe. The MOMMF incorporates both tactical and passive elements and undergoes annual rebalancing.

The Dynamic Momentum Strategy (DYNMOM) is a proprietary timing algorithm that trades the SPY ETF. Its objective is to maximise the Sharpe ratio and avoid market corrections. There have been 23 trades since 2005, and the win rate is 91.3%. The average profit/loss has been 9.4% with a market exposure of 66%.

You can access everything the above strategies produce: trade alerts, market updates, and other informational content by clicking on the button below.

Daily Mean Reversion is one of the strategies that is available as part of the “One Solution, Multiple Benefits” ten (10) strategy rule pack (more information).

Daily Mean Reversion

The mean-reversion strategy uses our algorithm to generate long-only signals for two ETFs and now with S&P 100 stocks in the daily timeframe. The updates are typically available by 7:00 a.m. (ET) on weekdays.

Daily Mean Reversion | Performance with SPY and QQQ (ytd)

* 50% SPY ETF and 50% QQQ ETF

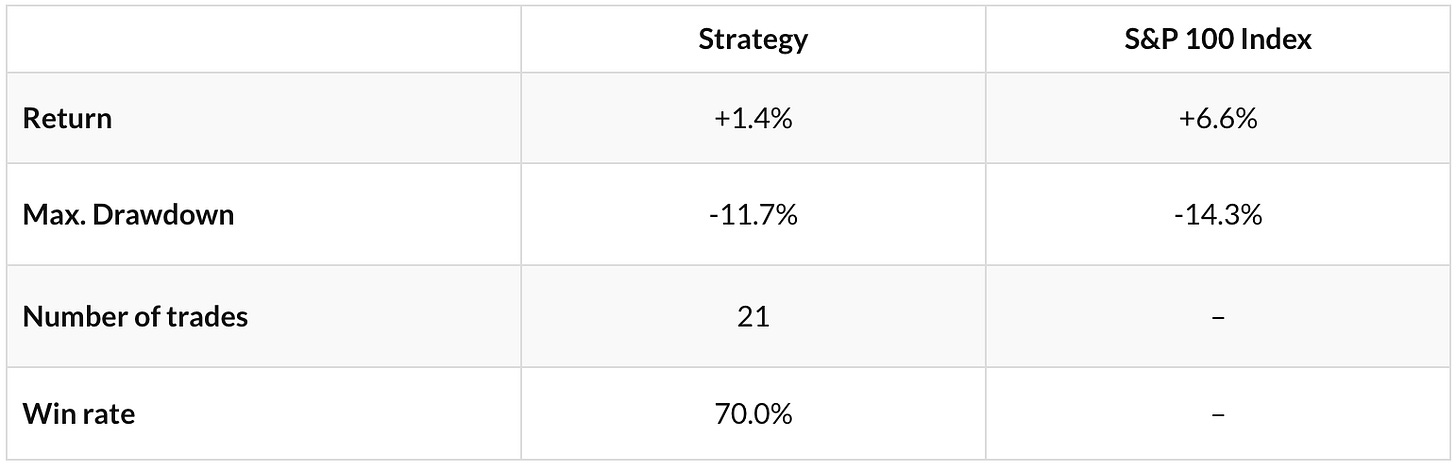

Daily Mean Reversion | Performance with S&P 100 stocks since March 24, 2025

Summary Table | Ten Strategy Pack

The strategies we have developed are based on the following two principles: simplicity and economic value.

Simplicity reduces the probability of overfitting and data-mining bias. Economic value is necessary in the form of reasonable alpha and risk-adjusted returns.

The rules of 10 strategies are available for sale in a bundle. The rules we provide are sufficient for programming the strategies on a trading platform. The strategies are not data-mined and have simple rules.

Delivery: The trading rules are in the form of “private content” sent out via email seven days after payment.

Terms: We make no refunds on any purchase, and all sales are final. No refunds are given for cancellations or under any circumstances, and there is no exception.

Strategy code: We provide the rules in plain English. The customer will need to convert those rules to code before testing them on a backtesting platform.