Weekly Market Signals

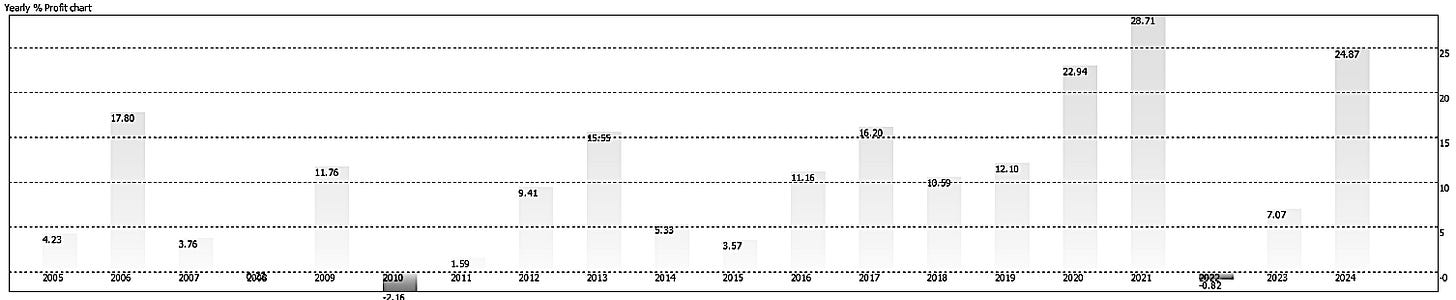

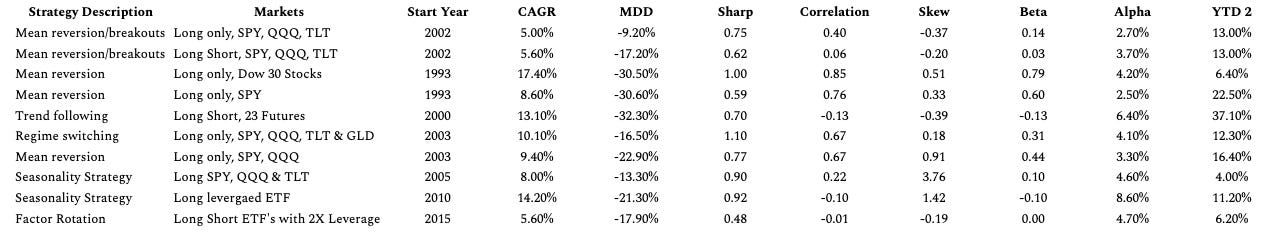

Performance of six trading strategies; Tactical asset allocation, mean reversion, cross-sectional momentum, and equity long-short with weekly and monthly updating.

Performance of the six strategy ensemble and benchmarks

In 2024, the strategy ensemble gained 12% with a 3.4% maximum drawdown.

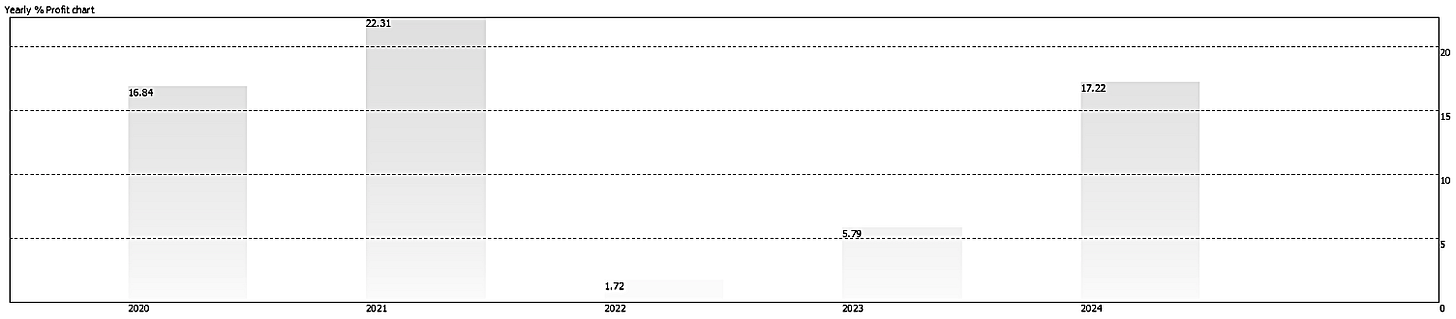

Performance of the monthly dynamic momentum strategy

2024 return: 24.9%. Maximum drawdown in 2024: -4%

Performance of the monthly hybrid asset allocaion strategy

2024 return: 16.7%. Maximum drawdown in 2024: -2.1%

**Signal Summary for Next Week is sent out members every Sunday.

Daily Mean Reversion & Futures Trend Following

Daily Mean Reversion | Performance with SPY and QQQ

The following pairs can also be used in place of SPY and QQQ:

SSO and QLD for 2x leverage.

SPXL and TQQQ for 3x leverage.

Performance with SPXL and TQQQ

* Start date: June 27, 2023. The allocation to the signals of the two ETFs is 50% of closed equity. Performance is indicative only and depends on execution, slippage, and commissions.

Daily Equity Performance

SPY: The mean waiting time between signals has been 6.5 days, and 3-standard deviations are at 23.2 days.

QQQ: The mean waiting time between signals has been 4 days, and the three-standard deviations are 14.3 days.

Furures Trend Following | Performance

The strategy is down 1.7% year-to-date.

The drawdown from equity highs is 5.6%.

There are 13 open positions, 10 long and 3 short.

2024 return: 70.64%.

Daily Mean Reversion and the Futures Trend Following strategies are available as part of the “One Solution, Multiple Benefits” 10 strategy rule pack. For more information, click here.