Low Volatility

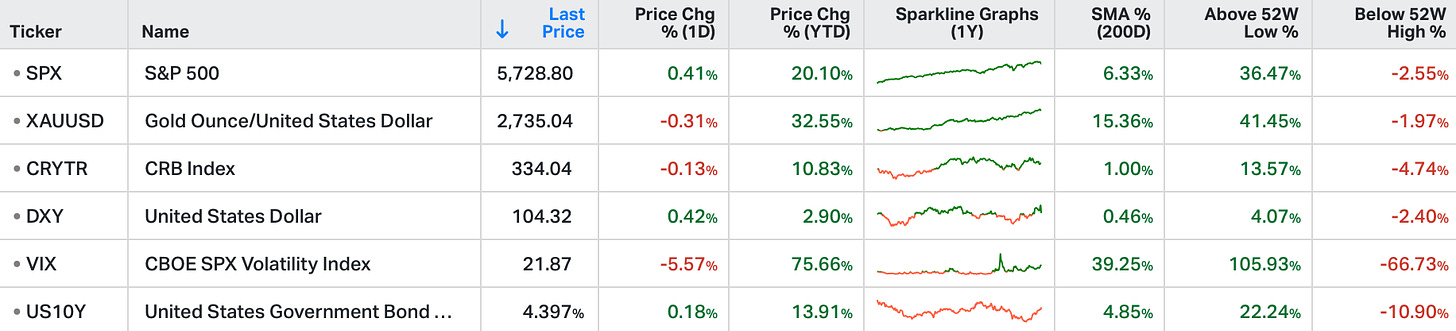

US stocks extended gains on Friday, with the S&P 500 and the Nasdaq rising more than 0.5%, while the Dow jumped by over 200 points.

The ISM Manufacturing PMI came below forecasts and pointed to another considerable contraction in manufacturing.

In addition, traders continue to parse fresh earnings reports.

Amazon surged nearly 7% following better-than-expected Q3 results, bolstered by growth in its cloud and advertising sectors.

Intel also rallied 5.2% on stronger-than-anticipated revenue and an optimistic sales outlook.

Low volatility in the stock market is generally considered bullish.

High volatility is an expression of investor uncertainty. In an uncertain world, the risk premium (discount rate) of stocks goes up because “anything” can happen. When the risk premium rises, stock values decline.

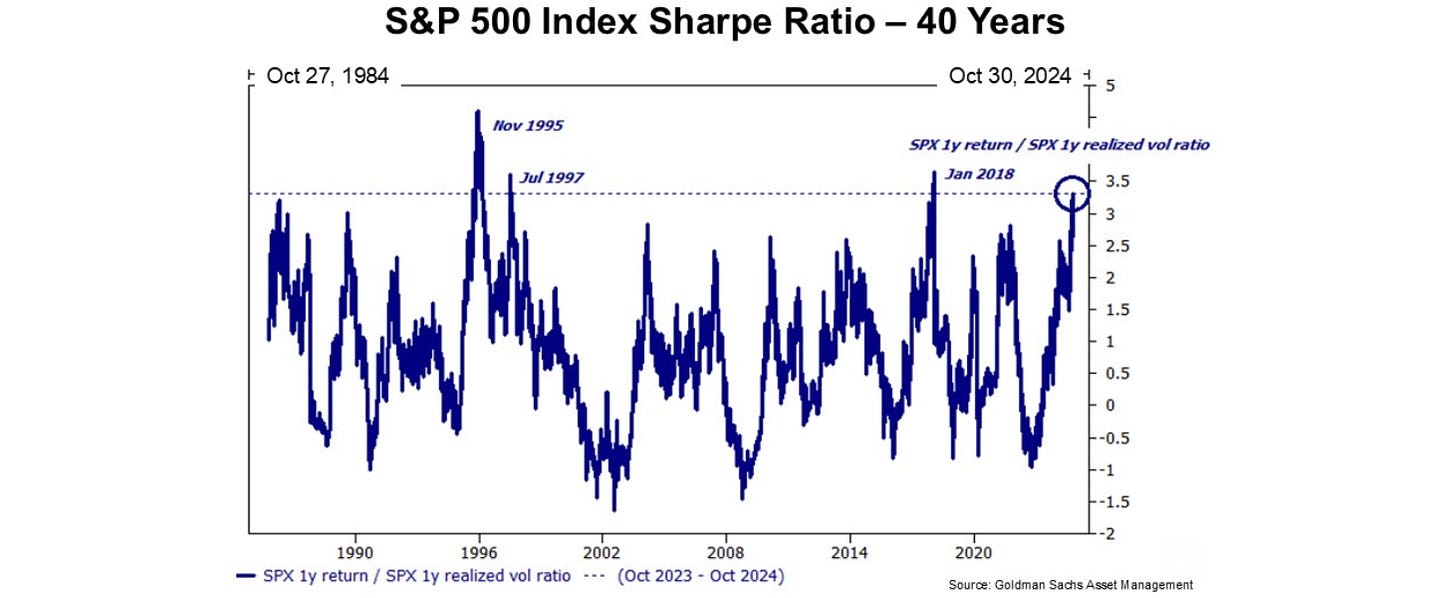

The Sharpe Ratio compares the return of an investment with its risk.

Risk is measured by volatility.

The Ratio divides performance by standard deviation (volatility).

The Sharpe ratio of the S&P 500 over the past calendar year is above 3 (high return with low volatility) - this has only happened four times in the past forty years.

Low-volatility, bullish stock market environments can have staying power;

After the 1995 bullish year, the stock market appreciated by 20% in the next year.

After the 1997 high Sharpe ratio year, the S&P 500 climbed 27% in 1998.

The one negative case was 2018 when the calendar year return was -6%. But, after a steep sell-off in the fourth quarter of 2018, the market completely recovered in the first two months of 2019.

The realised low volatility of the stock market is a surprise given we are in an election year and have expanding geo-political uncertainty in Ukraine/Russia and the Middle East. One third of the S&P 500 reported earnings last week including Apple, Amazon, Microsoft, Meta and Google. The S&P 500 volatility index has been roughly 20 for the past month which normally indicates above average volatility.

The low volatility, high performance nature of the stock market suggests investors have high conviction in strong economic and earnings growth. On average since 1984, the S&P 500 has appreciated 17.6% in the year following election day.

Let the good times roll.