Looks Like Positioning

Stocks in the US closed sharply lower on Thursday, led by the tech-heavy Nasdaq, as disappointing earnings guidance from Big Tech giants Microsoft and Meta raised concerns about their high AI costs and potential profit pressures.

The S&P 500 lost 1.8%, the Nasdaq 100 tumbled 2.4%, booking their worst day in over a month and the Dow declined 378 points.

Both Meta (-4.1%) and Microsoft (-6%) flagged significant increases in AI-related spending, weighing on investor optimism and hitting shares in other major tech companies, with Nvidia (-4.7%) and Amazon (-3.4%) down as well.

In economic news, the latest PCE index showed core inflation rose 2.7% annually in September, while jobless claims dropped to a five-month low of 216,000.

Apple and Amazon are set to report earnings after the bell, rounding out a challenging week for Big Tech stocks.

We had no surprises in the PCE report - the Fed's favoured inflation gauge has now fallen to a year-over-year rate of 2.1%. That's the lowest since early 2021, prior to the explosion of agenda spending by the Biden administration.

With that, the Fed has turned focus to the employment situation in recent months; we'll get the October jobs report this morning.

As a refresher, Jerome Powell made it clear in their September meeting that a negative surprise in the labour market was the condition to cut rates faster.

Two weeks later, the jobs data delivered a positive surprise. It's unlikely that the Fed would put much weight on today's report given that it will be distorted by the effects of the hurricanes and the port worker strike.

That said, the revisions to last month's numbers will be the spot to watch. As we know, the Biden Bureau of Labour Statistics (BLS) has consistently reported jobs data over the past four years, in a way that has led to very consequential misreads on the health of the economy by policymakers.

Assuming no material change in last month's view of the employment situation, the Fed should be on an easy path to deliver a quarter point cut at its meeting next week, and another quarter point cut in December. That's in line with it's September projections, and in line with market expectations.

And with inflation now very close to the Fed's target (the target headline PCE of 2%) and the effective Fed Funds rate still well above the rate of inflation (at 4.83%) the Fed has a lot of ammunition to respond to any shock risks that may arise from any domestic or geopolitical event (the probability of which is not small).

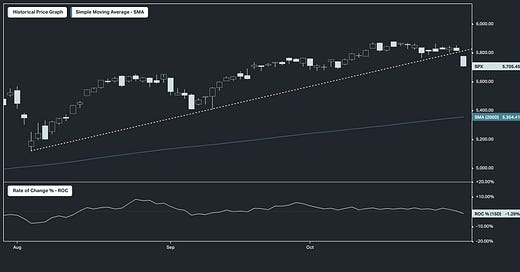

On a related note (to shock risk), we got a bearish technical break in the stock market. In the chart below, you can see the break of the trendline that comes in from the August lows — lows which were induced by the carry trade unwind that shook global markets.

This looks like positioning, ahead of what will likely be a chaotic period around election day on Tuesday. We have a similar line (from the August lows) in German and Japanese stocks, both of which have given way (broken).