We had a broad bounce back in global markets yesterday; stocks, commodities, currencies and yields.

Thus far, both the virus variant and the U.S. government's response to the variant has been tame - that's good news.

After all, much of the ugly price action in markets over the past two weeks originated from a headline that dropped on Thanksgiving evening about the new variant.

There is however plenty of other noise for markets to interpret: the continued infighting on Capitol Hill, over the debt ceiling and the next massive spending bill. Add to that, U.S./China and U.S./Russia tensions have been bubbling up.

Is this all bad for stocks? We don't have to look too far for the answer. This sounds a lot like 2014 - including the presence of a scary virus (ebola).

What did stocks do in 2014? In the face of all of the worry, stocks rose 11%.

What also happened in 2014? In late October, the Fed finally ended its financial crisis QE response - which set the table for a liftoff of interest rates.

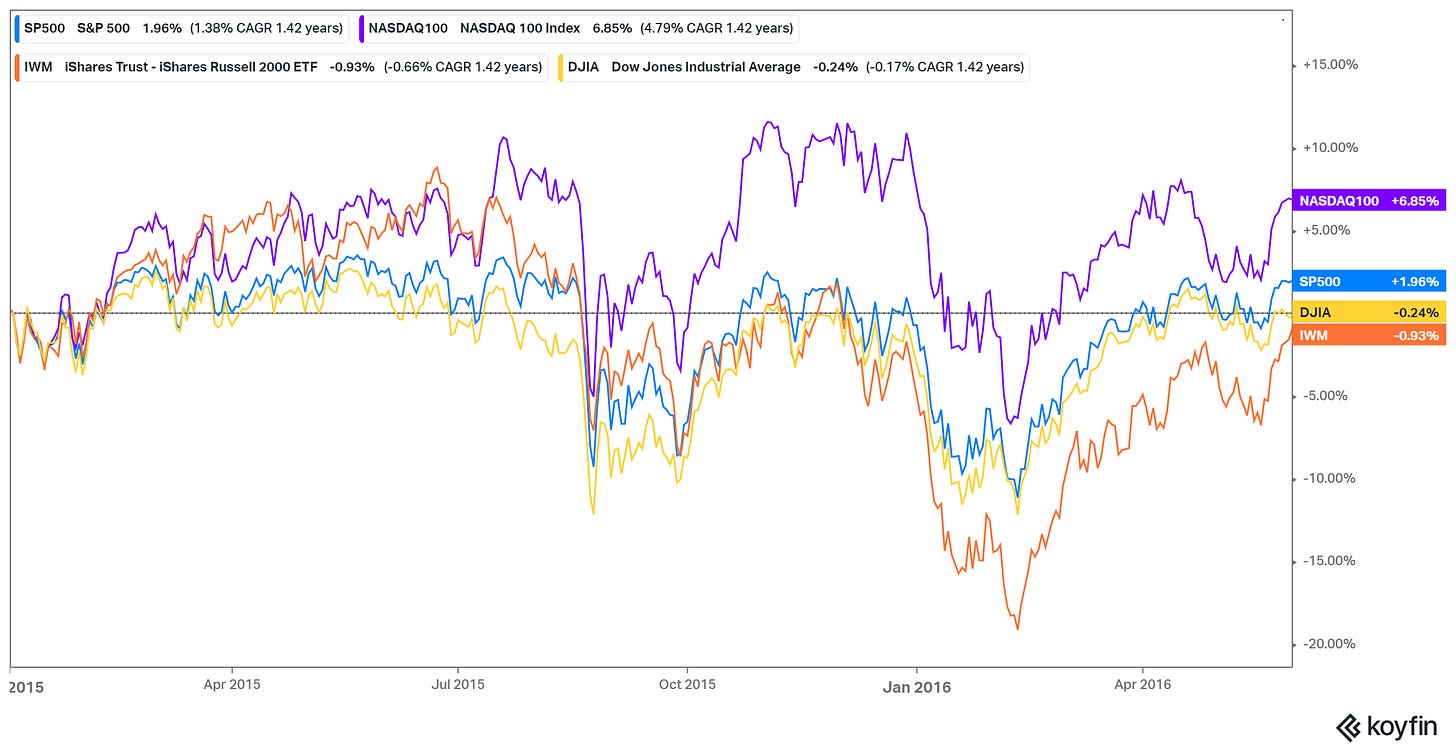

So, what happened in 2015?

With an anticipated tightening cycle coming, stocks went sideways for much of the year (including a 13% correction). The Fed started the liftoff of rates in December - it wasn't welcomed. By late January (2016), they were walking back on their rate path projections (chart below).

Bottom line: In the crisis era (both Great Financial Crisis and Great Health Crisis), where the Fed has crossed the line in the sand, and become directly involved in key asset markets, Fed policy has been, and will continue to be, the dominant catalyst for markets.