The stock market hit another record high to start the week, again proving to be impervious to geopolitical risk.

Why?

Liquidity. There is a ton of liquidity in the system and if there were any shock event, we know exactly how global central banks would respond: "more liquidity."

With that, equity prices continue to march higher, with plenty of tailwind.

Bonds, on the other hand, look like perhaps there is a geopolitical risk story being acknowledged. Yields on the ten-year Treasury note traded back down to 1.21% - from 1.37% just three trading days ago.

The question is: With the quick collapse of the Afghan government, upon the withdrawal of U.S. troops, does it embolden China to act on Taiwan?

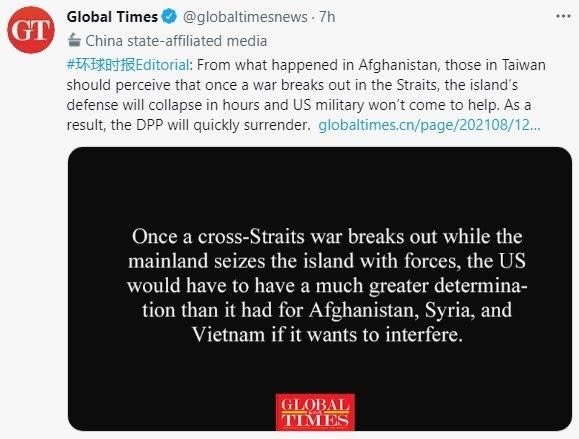

Chinese state-owned media has already planted the seed to question the resolve of the U.S., to defend Taiwan, if China were to invade Taiwan. The fact is, as you can see in the tweet below, the language suggests when, not if "war breaks out in the Straits."

With this, keep in mind, U.S. assets remain the safest and most liquid place to park capital in the world, and, as such, money will continue to flow into the dollar and Treasury market as relative safe havens. What else has had a big bounce back in recent days? Gold.