The European Central Bank added more fuel to the fire.

They extended their QE program another nine months and added another $600 billion - bringing Europe's total monetary response to the pandemic at $2.2 trillion.

We also have a $2 trillion fiscal stimulus package on the table, originally agreed to in July, but has been held up by opposition from Hungary and Poland. The heavy lifting, to keep the euro zone economy alive, has been left to the ECB - as it was after the wreckage of the Global Financial Crisis.

The question is, will the ECB follow the lead of Japan at some point, and begin outright buying European stocks? Even the Fed has entered the stock market this year, outright buying corporate bond ETFs.

The chart below shows the impact of the BOJ on Japanese stocks. Japan started buying ETFs back in 2013, as part of their QE program. They went on to triple the initial amount, and then double that amount. The Nikkei did this along the way.

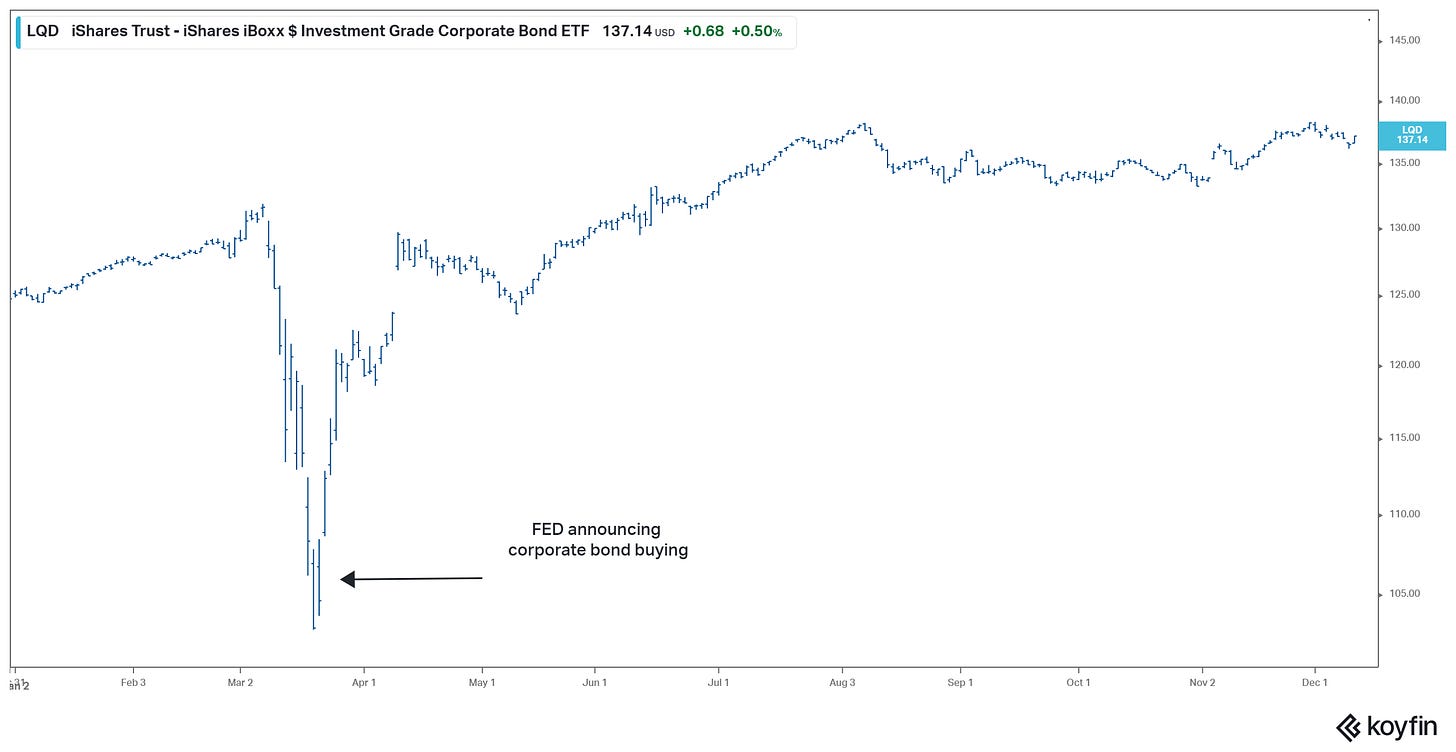

Not coincidentally, when the Fed announced it would become a buyer of bond ETFs on March 23rd, this year, that was the bottom in the broad stock market. Stocks are up 69% since and you can see what the biggest corporate bond market ETF has done…

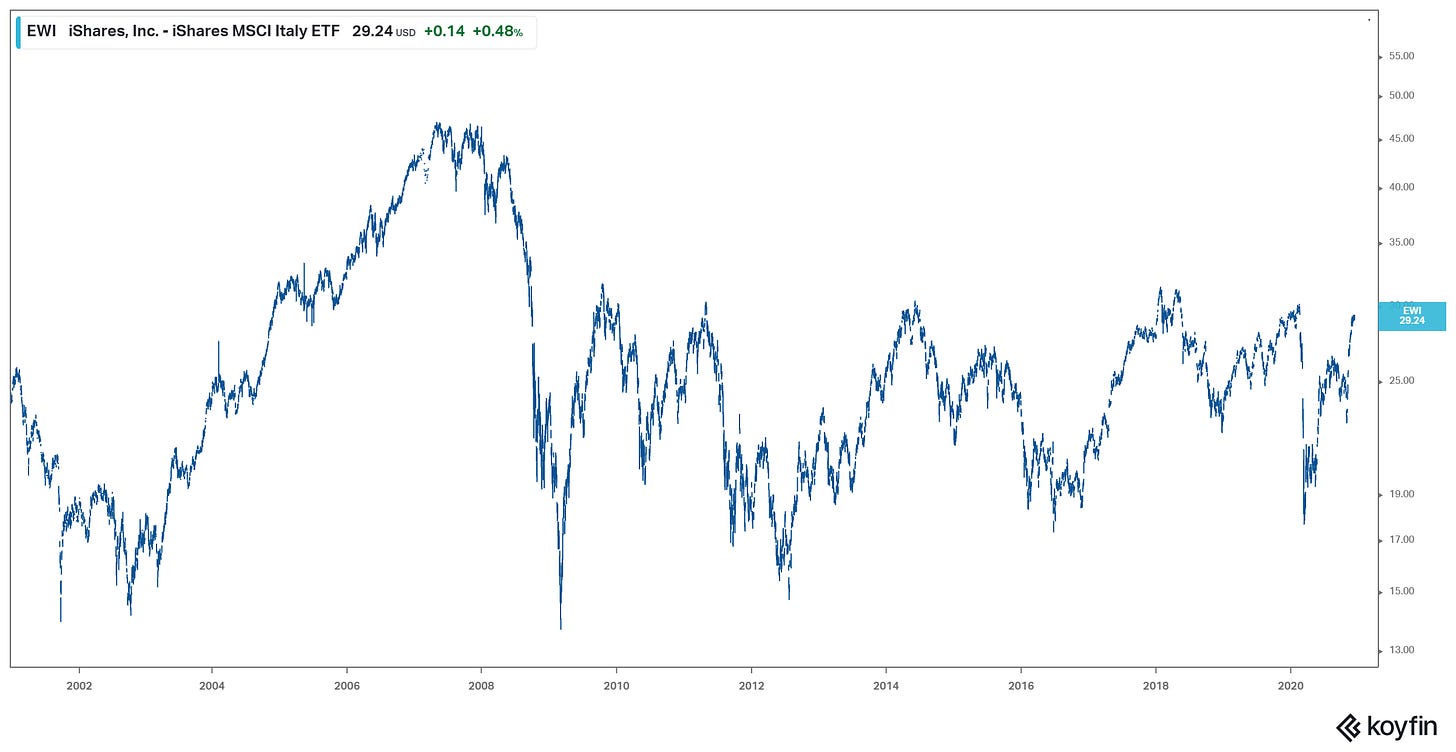

With the above in mind, in a world of inflating stock markets, there remains good value in European stocks. The broad European stock market remains 11% from the record highs. Moreover, if the ECB were to broaden the asset purchase scope to include stocks, they would likely follow the path they have for government debt - the weak spots - the Italian stock market could use some help.