A relatively quiet day in the markets yesterday, let's take a look at oil.

Over the past week, the biggest mover in global markets has been oil(+12%, and +23% from the lows of last Monday). This comes as the media's presumed next President has vowed to kill the fossil fuels industry in the U.S., and realign under a global pact to substantially cut the use of fossil fuels around the world.

Most would have thought oil would be heading toward zero.

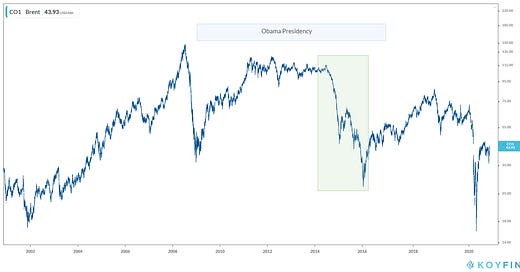

More likely, if Biden gets to inauguration day, oil is going back to Obama-era prices - think $75-$115 oil.

Why? Biden will regulate the U.S. shale industry into extinction, and OPEC will be in charge again.

You can see in the chart below, what oil prices looked like under Obama.

In the green area, that's OPEC manipulating an oil price crash, in an effort to destroy the rising competitive U.S. shale industry (2014-2016). It nearly worked (too well), over 100 shale related companies went bankrupt in that period, but the oil revenue dependent OPEC countries nearly went bankrupt too (near default). So they had to reverse course, and start cutting production to get prices back up. The shale industry survived and has continued to threaten the future of OPEC.

Under Biden, however, OPEC wouldn't have to worry about shale, he would do the job for them. So, until we're all driving Teslas, and the energy grid has been completely "green" transformed, we'll still be using a lot of oil.

We'll just be paying a lot more for it.