Less Leeway

In the afternoon session, the S&P 500 and the Nasdaq were up more than 0.2% each, while the Dow Jones was marginally lower.

Investors were digesting cooler-than-expected inflation data alongside tempered rate-cut expectations from the Federal Reserve, while US Treasury yields reached their lowest levels since early April.

As a result, US Treasuries and German bonds rose, while bonds in Southern Europe faced losses due to political turmoil, leading to wider spreads and a decrease in market sentiment.

On the corporate front, Broadcom soared by 12.7% after raising revenue forecasts for AI chips and announcing a stock split, while Nvidia rose 3.5%.

Tesla's shares climbed 3.9% after shareholders approved Elon Musk's $56 billion pay package and announced plans to relocate to Texas.

Think Like a Market Professional: Practical Frameworks for Financial Markets

This self-paced course will equip you with a set of robust and practical frameworks that combine logic, stories, data and more to help you see markets more clearly, make better forecasts, and make more money.

Designed for institutional and individual traders, the course will give you and your team an edge over their peers and in the market - make more rational and intelligent investing decisions.

The report on consumer prices (CPI) showed no inflation in May (zero month-over-month change). The Fed Chair said when we see the inflation report on producer prices (PPI, which was reported yesterday morning), "we'll know more about what PCE will look like."

PCE is personal consumption expenditures. This is the inflation measure they care most about - it's the basis of their 2% inflation target. We'll get the PCE report at the end of the month.

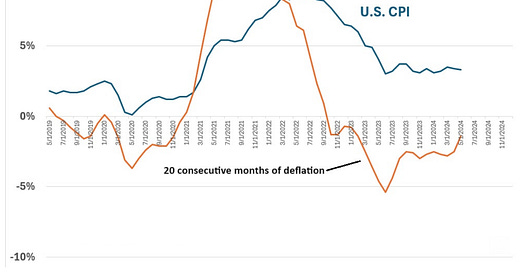

So again, Jerome Powell and his Fed colleagues were looking at this morning's PPI for clues on PCE. What did they learn? The monthly change in core PPI was zero (no inflation). This all aligns with the global inflation picture, which has been tracking Chinese PPI since global inflation peaked.

As we've discussed along the way, this is the equivalent of "running into space / skating to where the puck will be". The price of the products we will be buying in the months ahead, will be determined (in large part) by the inputs into Chinese production.

This year-over-year change in Chinese PPI was at 26-year highs when the Fed was telling us, back in 2021, that there was no inflation. It led on the way up (for global price pressures), and it has led on the way down. Chinese PPI has now been in deflationary territory for 20 consecutive months.

This inflation view aligns with what the third largest global retailer has experienced over recent quarters - Costco said selling prices were flat for the past two quarters.

With this inflation picture, the Fed had the opportunity to signal to the market that they were in highly restrictive territory, and could afford to reduce restriction in the coming months if inflation continued its trajectory - just to maintain the level of restriction as inflation falls.

This is the playbook just executed by the European Central Bank and Bank of Canada in the past week. They laid the groundwork. The Fed missed the opportunity. With that, we hear from the Bank of Japan tonight (I write this on Thursday evening).

Remember, the Bank of Japan played the critical role of global liquidity provider the past two years (the liquidity offset to the Western world's liquidity extraction/tightening policies). But they made the first step toward exiting that role in March;

They raised rates, ending negative interest rates.

They ended yield curve control.

They ended ETF purchases.

And it has been reported in recent days that they may begin the end of bond purchases tonight (i.e. taper QE).

With those moves by the BOJ, in my March 19th note I said, "global central banks (led by the Fed) may now have less leeway to hold rates too high, for too long."

With the BOJ exiting its role as global liquidity provider, Western world central banks have to start paying closer attention to the vulnerabilities in their respective government bond markets (i.e. the risk of higher yields). That's why, no coincidence, two days after the Bank of Japan's move in March, the Swiss National Bank started the easing cycle with a surprise rate cut (adding liquidity). And we've since seen cuts from Sweden, Canada and the euro zone.

Conversely, the Fed seems convinced that they can patiently sit with high real rates, until they manufacture their desired inflation rate. The actions of their central bank counterparts tell a different story. They don't have the luxury - they are all a liquidity crunch away from returning to the business of QE.