Less Leeway

Macro Perspectives

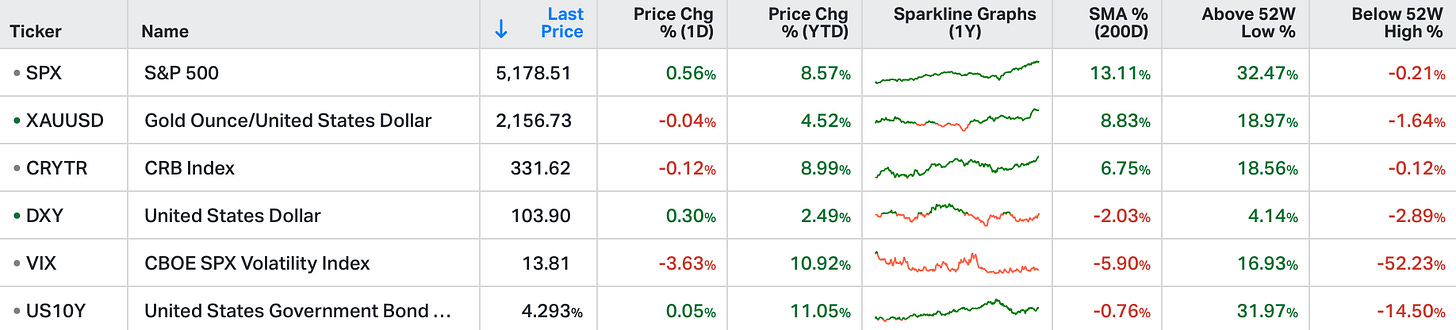

Wall Street’s major averages finished higher on Tuesday, as investors awaited the Federal Open Market Committee's monetary policy decision.

Policymakers are widely anticipated to maintain interest rates at their current levels, attention is turning to the "dot plot" for indications regarding the frequency and timing of potential cuts in the coming months.

Nvidia's stock rebounded, gaining 1% after announcing plans for its new flagship AI processor.

Its CEO also emphasised the potential of the data center market, which he believes could surpass $250 billion.

Etsy saw a 1.1% gain after an earlier 7% surge, while GM added 1.7%.

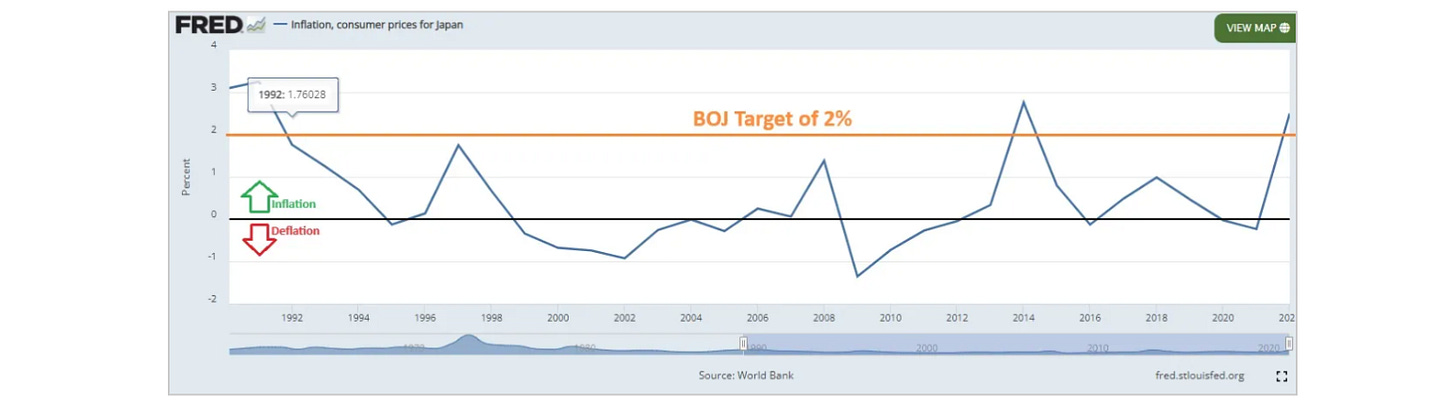

The Bank of Japan declared victory over three decades of deflationary pressures;

They think they will achieve "price stability" (two percent inflation target) toward the end of the year.

They raised rates, ending negative interest rates in Japan.

They ended yield curve control, a seven-year old policy that gave the BOJ a license to do unlimited asset purchases whenever the 10-year government bond yield traded to the high of its stated ceiling.

They ended ETF purchases (exiting the BOJ's explicit involvement in, not just Japanese equity markets but global equity markets - via ETFs).

These are big and bold moves for a central bank that has been the (important) global liquidity provider of the past two years.

The BOJ continuing ultra-easy policy (including QE), as the rest of the world was tightening, was the only way the major central banks around the world were able to raise rates to combat inflation, without losing control of their respective government bond markets (i.e. runaway yields), and runaway government bond yields, at record government debt levels, are a recipe for global debt defaults.

So, the Bank of Japan was (had to be) pumping liquidity, as Western central banks were extracting liquidity. This scrapping of emergency policies by the BOJ comes with risks. We will see how it plays out. For now, the Japanese 10-year yield went down, not up - the yen went down, not up. They stopped buying stocks, and yet Japanese equities went up, not down.

As you can see from this long-term chart of inflation in Japan, the visits to the target 2% area have been brief over the past thirty years. Despite the wage increases in Japan, which they think will underpin inflation, disinflation has been the global trend since the middle of last year. And high productivity rates (at least in the U.S.) have been successfully enabling wage growth, without inflation pressure.

So, a sustainable escape from deflation in Japan is highly questionable.

As we know, the global rate hiking cycle is over for the rest of the world. Global inflation is falling, and most central banks are in restrictive territory, and rate cuts are next.

With the BOJ's move, global central banks (led by the Fed) may now have less leeway to hold rates too high, for too long. With global government debt at record levels, they need to ensure that government bond yields (borrowing rates) continue the path lower.

What was your Twitter handle again?