Leg Higher

Stocks in the US closed sharply higher on Friday, fueled by a tech sector rebound and significant gains across major indices.

The S&P 500 rose 1%, and the tech-heavy Nasdaq 100 advanced 1.6%, the Dow Jones climbed 0.8%, or 334 points.

Consumer discretionary stocks also outperformed with Amazon up 2.4%.

Sentiments improved on reports of easing inflation pressures and solid earnings from major banks, fueling optimism for potential interest rate cuts.

As Donald Trump prepares for his second presidential term, investors are also watching for policy shifts amid concerns over tariffs and tax changes.

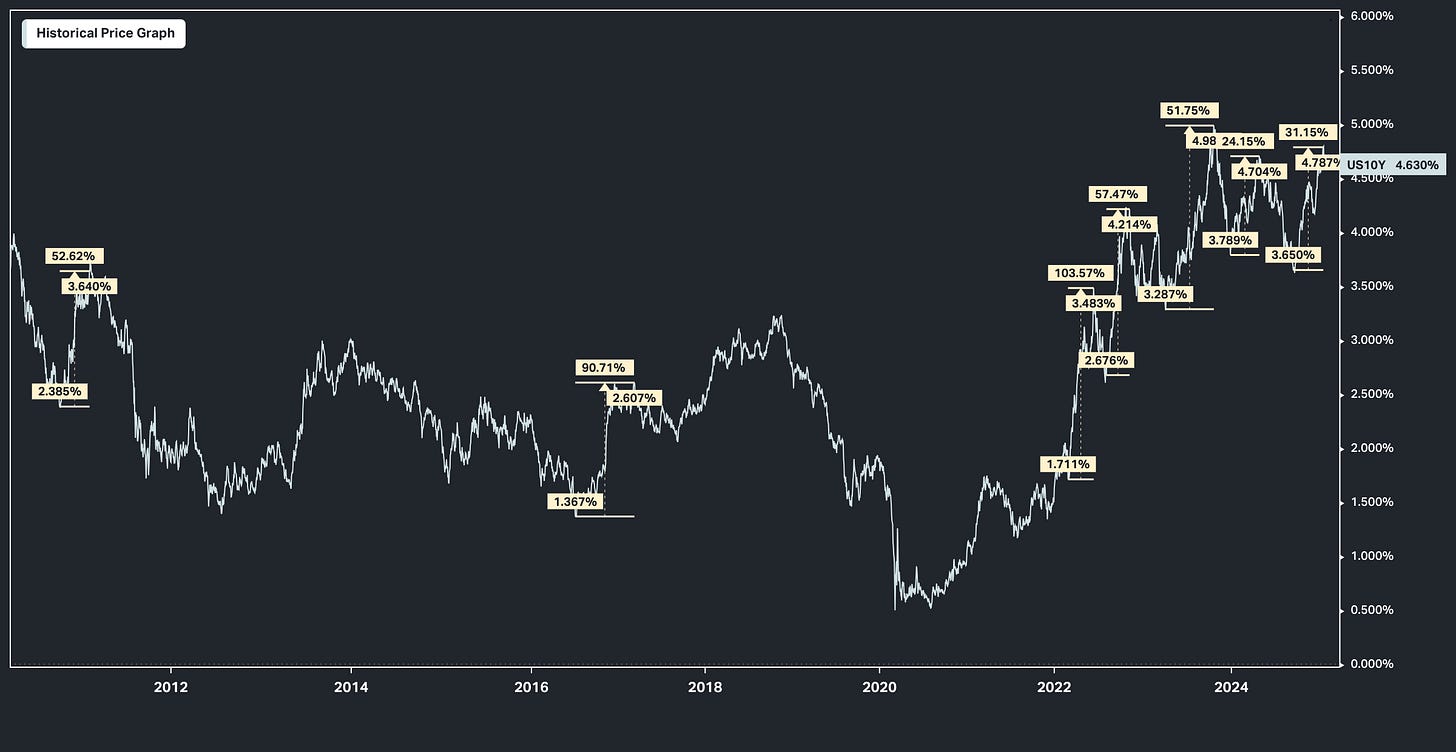

Since reaching a low of about 3.6% in September, the 10-year treasury rate ran up to 4.8% this week. As the rate went higher, high stock valuations and economic growth assumptions were increasingly at risk.

Rates ran higher primarily because inflation and growth measures were reported above expectations over the past several weeks.

There are reasons to believe the 10-year rate rise may be very close to reaching its peak this cycle if it did not do so already this week. Although the core CPI was up 3.2% year-over-year in the report issued Wednesday, this was better than feared, and the 10-year treasury rate retreated from 4.8% to 4.6% in the wake of the report.

From a technical perspective, there have been six periods of sustained 10-year treasury rate rises since 2012. These periods lasted an average of 3.1 months and resulted in an average rise of 1.27%. The current rate rise cycle has extended for 4+ months and the rate is up from low to high by about 1.2%.

Many of the major banks and integrated financial companies reported earnings this week. The reports were better than expected. Citigroup, Wells Fargo, Goldman Sachs, Bank of New York Mellon and Blackrock traded 4%-7% higher on the earnings news.

Taiwan Semi (TSM), the largest semiconductor chip manufacturer in the world, exceeded earnings and revenue estimates and traded up by about 5%. TSM revenue from “AI accelerators” tripled year-over-year.

If earnings continue to surprise to the upside and the 10-year treasury rate were to level-off and subside, the equity market should be able to leg higher.

GRYNING | Quantitative Update

Benchmark SPY: +1.9% with YtD drawdown -2.5%

Six Strategy Ensamble: +0.3% with YtD drawdown -1.4%

Daily Mean Reversion: SPY & QQQ: +4.2% with YtD drawdown -0.8%

Daily Mean Reversion: SPXL & TQQQ: +12.4% with YtD drawdown -2.4%

Futures Trend Following: Nearly flat YtD following +72% in 2024

The Six Strategy Ensamble is available as a quarterly or annual subscription, updated on a weekly basis. The Daily Mean Reversion and Futures Trend Following are two strategies of a ten strategy pack, whose rules are available for purchase.

For more information and to become a member or purchase strategy rules, please click on the button above.