Last Call & Market Summary

LAST CALL:

Think Like a Market Professional: Practical Frameworks for Financial Markets

This self-paced course will equip you with a set of robust and practical frameworks that combine logic, stories, data and more to help you see markets more clearly, make better forecasts, and make more money.

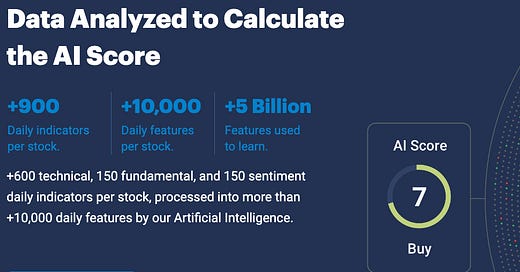

Plus, I’ve added all things Gryning AI to give you AI-Powered Stock Picking - get unique insights, boost your portfolios, and make smart data-driven investment decisions.

If you know any students, traders or investors who may be interested, please send them this post.

Market Summary

In US data, PMIs came out positive, but almost everything else this week was negative. The NY manufacturing index, two housing reports, retail sales, and jobless claims were all negative. The Leading Economic Index was down yet again.

Bad news for Main Street was good news for Wall Street again. Sort of. We got new highs in the S&P 500 and Nasdaq, but not the Dow.

Another week and another record high for the S&P 500. Friday closed out the week with the 31st record high for 2024. 8 of the past 9 weeks have been positive.

The stock market is now in the longest stretch (377 days) without a 2% sell-off since the GFC. There still has not been a drop of 1% or more on the S&P 500 in May or June.

All of this leaves the Atlanta Fed GDPNow Forecast looking like this.

This week also saw Nvidia take over the top spot as the largest company in the S&P 500 - it’s the 12th company to ever be in the top spot.

Thanks for reading and sharing The Gryning Times. Have a great weekend and keep crushing it.