We revisited the chart of U.S. 10-year yields in my previous note, and the episodes of stress to the global financial system, over the past twelve months, when yields spent some time above 4%.

If we look back to the beginning of the Fed's tightening cycle, we are now in the longest stretch without a stress event (five months), and with yields now sitting near the highest levels since the inception of zero interest and QE policies of the past fifteen years.

That said, the major central banks of the world have been able to successfully exit zero interest rates (and QE) with an historically fast normalization of rates, all in the face of one of the most complicated global financial, economic and political environments in history - and without losing control of the bond markets.

If history (of the past 15 years) is our guide, we have no reason to believe they will lose control this time either.

It's a "managed" normalization. In the post-GFC era of no-rules central banking, they are in the practice of "fixing and manipulating." As long as it's done in cooperation (very important) with their global central bank counterparts, there are no penalties (not to the currency, not to the bond market, not to equity markets, not to foreign investment).

With that in mind, we should expect more rate sensitive vulnerabilities to be revealed in markets and/or the global economy. But we should also expect central banks to continue to do "whatever it takes" to maintain stability. Now, let's take a look at stocks . . .

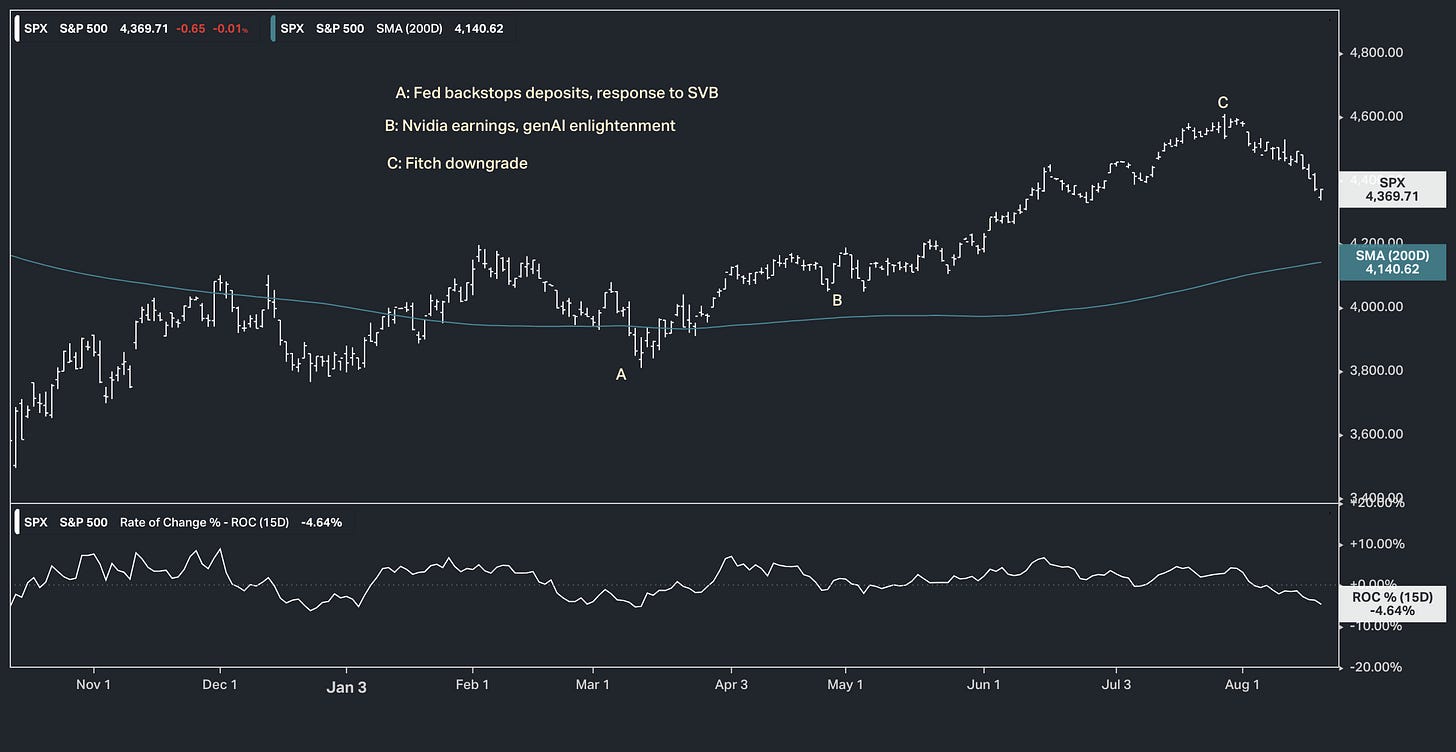

This looks like a modest correction - we're down 5% since Fitch came in after the close of the market on August 1st with a downgrade of U.S. debt.

After a 45% run from the January lows, a 10% correction for the Nasdaq is just two percentage points away.

On that note, we have Nvidia earnings on Wednesday, where they will need to hit the very big guidance upgrade from last quarter. If we look across recent earnings reports from the AI infrastructure stocks, we should expect Nvidia to deliver.

The 10-year yield was under 4% before the Fitch downgrade - it has traded up to 4.32% since - part of the case for the downgrade was their expectation that the Fed will go another 25 basis points in September.

We should get a good view on that Friday morning, when Jerome Powell speaks at Jackson Hole. Contrary to the Fitch view, Powell may signal the end of the tightening cycle.