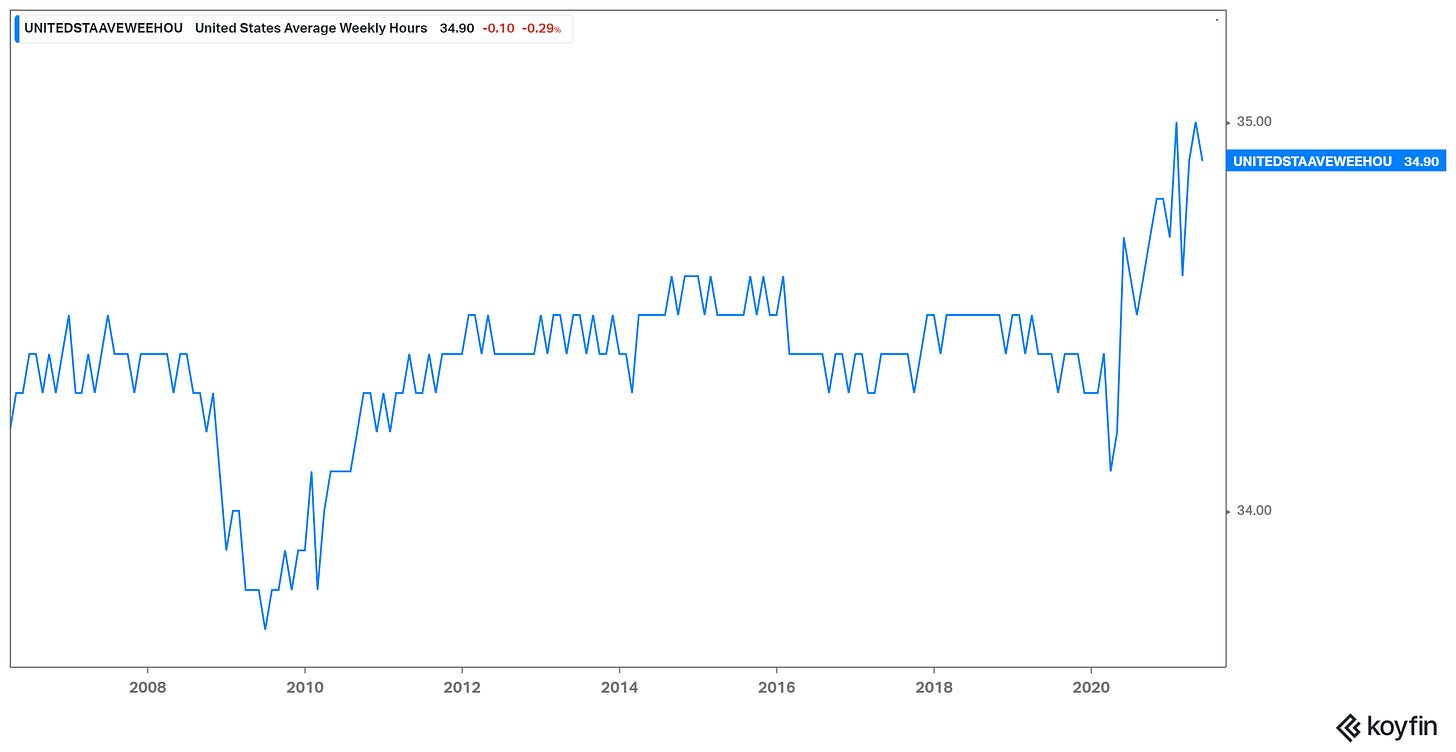

Like last month, the jobs report last Friday morning continued to show a labor shortage, as employers are unable to compete with the wages paid by the Federal government (through the unemployment subsidy). These two charts tell the story...

Existing workers are having to work longer hours in an attempt to satisfy hot demand, especially in the industry that was hardest hit in the pandemic (leisure and hospitality… And its because employers are unable to fill open jobs...

There were about a million more job openings on Friday than there were in February of last year (pre-pandemic), but there are 3.4 million more unemployed.

As about half of the states in the country begin rejecting the additional federal unemployment compensation, we'll see in the months ahead how this shakes out.

For now, markets see the jobs numbers as: 1) giving the Fed justification to continue its aggressive policy, and 2) giving the administration the cover it needs to push through another big spending package.

With that, yields remain tame at 1.55% as we start the week, and stocks are going out this week near record highs again.