Job Openings-to-Job Seekers Ratio

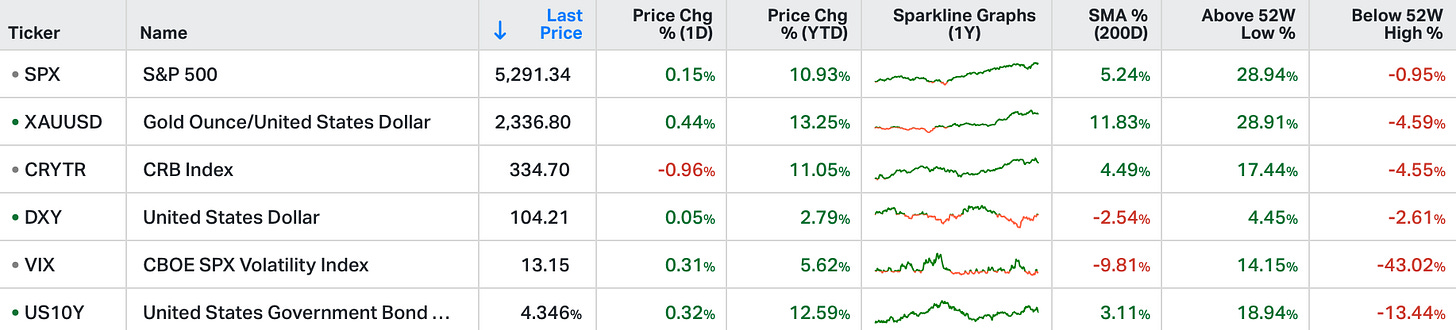

Stocks in the US finished slightly higher on Tuesday, as the S&P 500 and the Nasdaq added 0.1% each, while the Dow rose 140 points.

Investors were digesting fresh data and assessing the health of the US economy and the future path of interest rates.

Meanwhile, factory orders rose slightly more than expected, though the ISM PMI released yesterday showed surprising weakness in the manufacturing sector.

The real estate and consumer staples sectors gained the most, while energy and materials were the biggest laggards.

Shares of Walmart and Costco dropped over 1.1%, while Exxon Mobil and Chevron lost 1.5% and 0.9%, respectively, after oil prices hit a four-month low.

Continuing from our discussion yesterday, the interest rate easing cycle is underway in the advanced economies (excluding Japan) - we should see more evidence of that this week (in Europe, and likely Canada).

As for the Fed, Jerome Powell has told us they are watching the job market "carefully" for "cracks" as a condition to start the easing cycle. This week we get jobs data.

It started yesterday morning with the report on job openings.

If we look back to March 2022, when the Fed started the tightening cycle, they immediately made it known that they wanted to "bring demand down," and the sacrificial lamb would be jobs. Powell incessantly cited the job openings-to-job seekers ratio. At that time, there were two open jobs for every one job seeker. He told us they intended to bring the ratio down one-to-one.

So, what was today's number?

The job openings fell to the lowest level since February of 2021. That brings the ratio down to 1.24 job openings for every one job seeker - it's not one-to-one, but it's the lowest ratio since mid-2021.

More importantly, as you can see in the chart, that's in-line with pre-covid (2018-2019) levels.