We've talked about the coming inflation tsunami, thanks to the bazooka monetary and fiscal policy response that is proving to abundantly outweigh the economic damage caused by the Pandemic. We've heard along the way, from Jay Powell, that the Fed plans to keep the policy pedal to the metal, in recovery, to let the economy run hot.

He made that official policy yesterday, in his speech at Jackson Hole, announcing formally that the Fed would let inflation run hot.

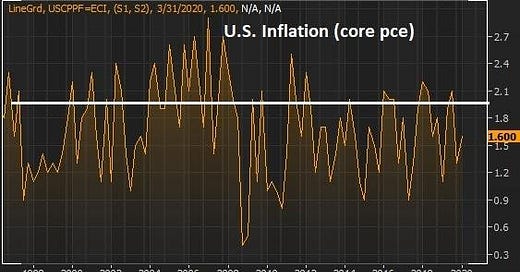

They've talked about this "symmetric" view on inflation for the past few years, telling us that they would allow inflation to run “symmetrically” above their 2% inflation target, to balance against the period of time where inflation ran below their inflation target. This communication has always been about trying to dial UP inflation expectations. It hasn't worked to this point, as you can see in this chart of core pce (the Fed's favored inflation gauge)...

With the large majority of data points residing below the white line (the Fed’s target inflation rate), this chart tells us that we should expect the Fed to happily watch an inflation rate that rises and persists in the 3%+ area for quite some time. In that scenario, they would be very slow to start moving rates higher (as they have explicitly told us), giving the economy plenty of runway to sustain recovery. This is the best-case scenario.

But remember, this will be a recovery juiced by trillions of dollars of excess money from the policy response (well in excess of the damage). That means the Fed will likely have to chase inflation at some point, to contain it, with a rapid succession of rate hikes. But they will still let it run hot, early on. This is still a good scenario. That bad scenario is deflation, due to economic collapse, which means a very bad outcome for all, and unlikely salvageable by even aggressive policy actions.

Let's stick with the optimistic (high probability) outcomes...Guess what will "inflate" along the way in these inflation scenarios: Nominal GDP.

GDP measures the market value of the goods and services. So, price goes up, GDP goes up. If we look back to the inflation spikes of the early 70s and early 80s, nominal GDP grew by an annual rate of better than 10% during those periods. If we had a similar spike, we would regain peak levels of GDP by middle-to end of next year, and we would be on the way to a $30 trillion economy by 2024, which would (by design) go a long way toward repairing, if not resolving, our debt as a percent of GDP problem.